/ NOT FOR DISSEMINATION OR DISTRIBUTION IN THE UNITED STATES AND NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES. /

OceanaGold Corporation (TSX: OGC) (ASX: OGC) (the “Company”) is pleased to provide an update on Martha Underground (“MUG”), including project development progress and updates to Mineral Resources.

Key Highlights

- First gold produced from Martha Underground.

- 2021 production expected to range between 35,000 to 45,000 ounces of gold.

- Indicated Resource increased 36% to 1.0 million ounces of gold grading 5.2 g/t.

- Extensive 2021 drill program including 27,000 metres targeting resource definition and extensional opportunities.

- Feasibility Study with initial Mineral Reserve expected at the end of the first quarter 2021.

Michael Holmes , President and CEO of OceanaGold said, “We are very pleased with the progress we have made at Martha Underground where we have achieved first gold production and expect steady-state in the second half of the year. We will continue to batch process MUG ore this month ahead of the planned mill shut down to install a new SAG mill shell which remains on schedule for completion in late second quarter. Once completed, we expect underground production to sustain continuous milling.”

“Following our successful 2020 infill drill campaign at MUG, the Company is pleased to announce an increase in the Indicated Resource to one million ounces of gold grading 5.2 g/t; an increase of 36% representing the addition of approximately 260,000 ounces of gold. The increase in Indicated Resource underpins the minimum ten-year mine life targeted for MUG. Importantly, we are also on track to complete the MUG feasibility study that will include our initial Mineral Reserve for the deposit.”

“We continue to be very excited for the future of the Waihi operations. We are a responsible mining company that operates to the highest environmental and social standards. With over 30 years of operational success in New Zealand , we are widely regarded as a valued corporate citizen. We look forward to advancing our exciting growth projects in New Zealand , which we expect will deliver significant socio-economic benefits including an additional 300 new jobs for the local rural communities.”

Martha Underground Development

The Company achieved first gold production from MUG after progressing development by nearly 7.5 kilometres in 2020. Mining of MUG continues to ramp-up with additional production expected in the first quarter ahead of the installation of a new SAG mill shell, which is scheduled completion late in the second quarter as planned. The Company continues to expect Waihi to produce between 35,000 and 45,000 ounces of gold in 2021.

Mining from MUG will continue to ramp-up with ore stockpiled ahead of continuous milling re-commencing late in the second quarter of 2021. The Company expects to complete the first full stope at the end of the first quarter before increasing average mining rates to between 30,000 and 35,000 tonnes a month in the second half of the year. Development continues at MUG as the Company targets a steady-state annual gold production rate of 90,000 to 100,000 ounces gold plus silver. The MUG feasibility study, including the initial Mineral Reserve, is due for completion late in the first quarter.

Exploration Update

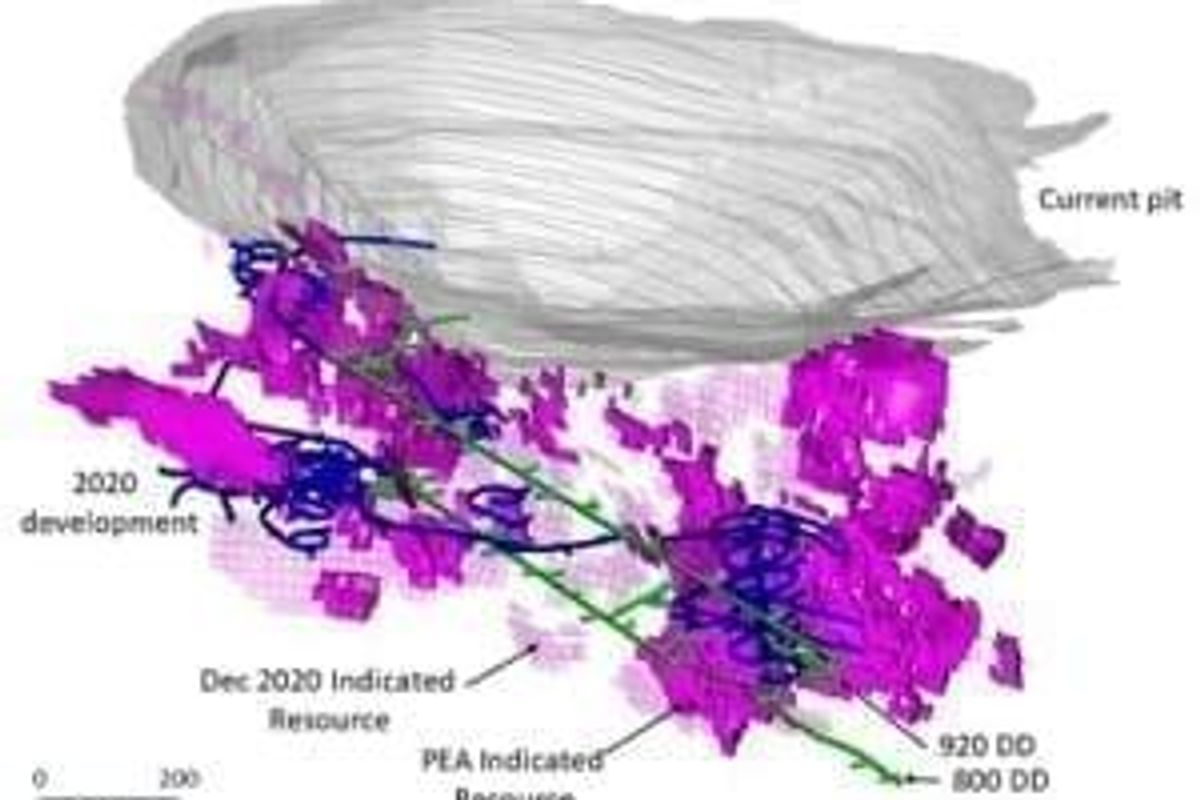

In July 2020 , the Company released the results of a Waihi District Study Preliminary Economic Assessment (“PEA”) that included 4.4 million tonnes of Indicated Resource grading 5.2 g/t for 0.74 million ounces of gold and 3.7 million tonnes of Inferred Resource grading 4.6 g/t for 0.55 million ounces of gold in the Martha Underground Project (Table 1, Figures 1 and 2). Drilling undertaken in 2020 was successful in converting these Inferred Resources as reflected in the reported growth in Indicated Resource of 0.26 million ounces for a total of 1.00 million ounces gold (Table 1, Figures 1 and 2).

Table 1: Updated Martha Underground Indicated & Inferred Resources

INDICATED RESOURCES | |||||

Tonnes | Gold Grade | Silver Grade | Gold Contained | Silver Contained | |

Mt | g/t | g/t | Moz | Moz | |

December 31, 2020 (1)(2) | 6.0 | 5.2 | 16.6 | 1.00 | 3.2 |

June 1, 2020 (PEA) (1)(3) | 4.4 | 5.2 | 17.8 | 0.74 | 2.5 |

INFERRED RESOURCES | |||||

Tonnes | Gold Grade | Silver Grade | Gold Contained | Silver Contained | |

Mt | g/t | g/t | Moz | Moz | |

December 31, 2020 (1)(2) | 2.5 | 4.7 | 15.3 | 0.38 | 2.3 |

June 1, 2020 (PEA) (1)(3) | 3.7 | 4.6 | 16.0 | 0.55 | 2.0 |

Notes: | |

1) | Resources are reported below the conceptual Martha Phase 5 open pit design |

2) | Resources are constrained to within a conceptual underground designed based upon the incremental cut-off grade of 2.2 g/t which is defined at a gold price of NZD$2,394/oz |

3) | Resources are constrained to within a conceptual underground designed based upon the incremental cut-off grade of 2.15 g/t which is defined at a gold price of NZD$2,083/oz |

– | No dilution is included in the reported figures and no allowances have been made for mining recoveries. Tonnages include no allowances for losses resulting from mining methods. |

– | The tabulated resources are estimates of metal contained as troy ounces of gold and do not include allowances for processing |

– | All figures are rounded to reflect the relative accuracy and confidence of the estimates and totals may not add correctly |

– | There is no certainty that Mineral Resources that are not Mineral Reserves will be converted to Mineral Reserves |

Drilling at MUG commenced in 2017 and since that time, the Company has drilled 124 kilometres from both surface and underground. As drilling of MUG has tested a mix of historically mined areas and new or unmined portions of mineralised vein, the initial Mineral Reserve will reflect a conservative approach to the historically mined areas that will, in part, be excluded to allow for further resource definition and geotechnical drilling and studies to further optimise the resource and mine design.

In 2021, the Company expects to drill a further 27,000 metres in MUG with a focus on resource conversion (20,000 metres) and resource extension (7,000 metres). Accompanying the most recent update to the resource at MUG, the Company has revised the Exploration Target which now stands at 5 to 7 million tonnes with a grade of 4.0 to 5.0 g/t gold. It is important to note that the exploration target is exclusive of the reported Mineral Resources and relates to the portion of the deposit that has not yet been adequately drill tested (see cautionary statement below).

Cautionary Statement

The Exploration Target is based on the assessment of surface and underground drill data collected by the Company in addition to the significant amount of historical and archived geological and mine data from over a century of mining activity at Waihi. The Exploration Target is conceptual in nature and insufficient exploration has been undertaken in the areas that the Exploration Target relates to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a Mineral Resource.

All drill data in relation to information presented in this release can be found on the Company’s website at https://oceanagold.com/investor-centre/tsx-asx-filings/ . In line with ASX listing requirements, a summary of material information and JORC Code Table 1 for the Waihi drill results are appended to its ASX Announcement. JORC Table 1 is not required under National Instrument 43-101. Readers are referred to the ASX website at www.asx.com.au or the OceanaGold website at www.oceanagold.com to view JORC Table 1.

Authorised for release to the market by Acting Company Secretary, Chris Hansen

www.oceanagold.com | Twitter: @OceanaGold

About OceanaGold

OceanaGold is a multinational gold producer committed to the highest standards of technical, environmental, and social performance. For 30 years, we have been contributing to excellence in our industry by delivering sustainable environmental and social outcomes for our communities, and strong returns for our shareholders. Our global exploration, development, and operating experience has created an industry-leading pipeline of organic growth opportunities and a portfolio of established operating assets including Didipio Mine in the Philippines ; Macraes and Waihi operations in New Zealand ; and Haile Gold Mine in the United States of America .

Competent/Qualified Person’s Statement

The exploration results were prepared in accordance with the standards set out in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (“JORC Code”) and in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators (“NI 43-101”). The JORC Code is the accepted reporting standard for the Australian Stock Exchange Limited (“ASX”).

Information relating to Waihi Mineral Resource and Exploration Results in this document has been verified by, is based on and fairly represents information compiled by or prepared under the supervision of Mr Peter Church , a Chartered Professional of the Australasian Institute of Mining and Metallurgy and an employee of OceanaGold. Mr Church has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the JORC Code and is Qualified Persons for the purposes of the NI 43 101. Mr Church consents to the inclusion in this public report of the matters based on their information in the form and context in which it appears.

Cautionary Statement for Public Release

Certain information contained in this public release may be deemed “forward-looking” within the meaning of applicable securities laws. Forward-looking statements and information relate to future performance and reflect the Company’s expectations regarding the generation of free cash flow, achievement of guidance, execution of business strategy, future growth, future production, estimated costs, results of operations, business prospects and opportunities of OceanaGold Corporation and its related subsidiaries. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, using words or phrases such as “expects” or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “estimates” or “intends”, or stating that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ materially from those expressed in the forward-looking statements and information. They include, among others, the outbreak of an infectious disease, the accuracy of mineral reserve and resource estimates and related assumptions, inherent operating risks and those risk factors identified in the Company’s most recent Annual Information Form prepared and filed with securities regulators which is available on SEDAR at www.sedar.com under the Company’s name. There are no assurances the Company can fulfil forward-looking statements and information. Such forward looking statements and information are only predictions based on current information available to management as of the date that such predictions are made; actual events or results may differ materially as a result of risks facing the Company, some of which are beyond the Company’s control. Although the Company believes that any forward-looking statements and information contained in this press release is based on reasonable assumptions, readers cannot be assured that actual outcomes or results will be consistent with such statements. Accordingly, readers should not place undue reliance on forward-looking statements and information. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements and information, whether as a result of new information, events or otherwise, except as required by applicable securities laws. The information contained in this release is not investment or financial product advice.

SOURCE OceanaGold Corporation

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2021/16/c4411.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2021/16/c4411.html