- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

International Graphite

Cardiex Limited

CVD Equipment Corporation

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

UPDATE: PharmaCielo’s Deal for Creso Pharma Gets Scrapped

A deal that would have seen Creso Pharma taken over by PharmaCielo has now been cancelled after an independent review called the terms of the acquisition into question.

An Australian cannabis company and a Colombia-based producer have elected to scrap their acquisition deal after an independent business review called the agreement into question.

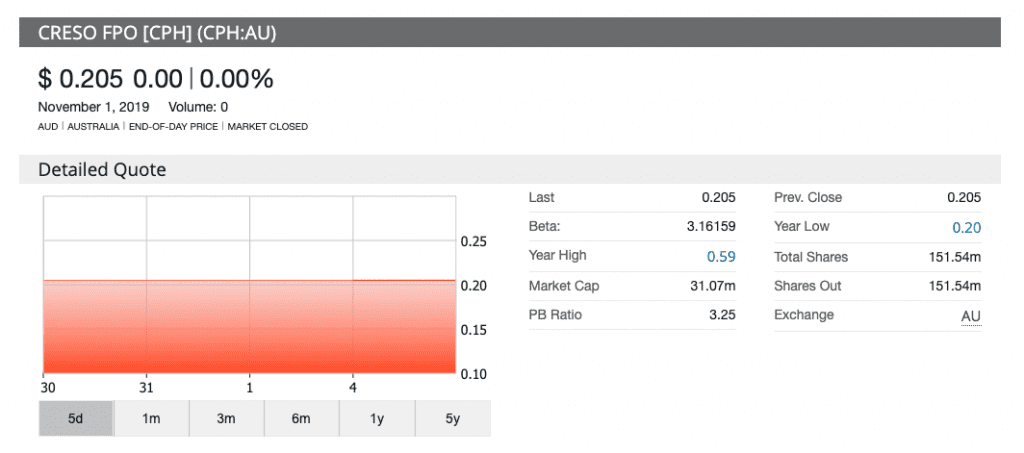

PharmaCielo (TSXV:PCLO) confirmed on Tuesday (November 5) that the deal has been cancelled because the board of directors for Creso Pharma (ASX:CPH) cannot support the original agreement,

Creso Pharma’s decision comes after a BDO Corporate Finance review indicated the transaction was “neither fair nor reasonable and is not in the best interests of shareholders of Creso Pharma.”

David Attard, CEO of PharmaCielo, said the company is disappointed about the way things ended between the two firms, but still managed to find a positive message.

“(W)e have appreciated the interactions between our teams over the past several months and wish them much success in their future endeavours,” he said.

The original agreement did not include a break fee for any party, PharmaCielo indicated. The only remaining item is an AU$3.8 million secured bridge loan paid to Creso Pharma carrying a 15 percent interest rate per year. This payment, according to the Colombian firm, matures at the end of November.

The purchase deal first started falling through, officially, last Friday (November 1), when PharmaCielo confirmed it needed to make sure the BDO report did not affect the thinking of Creso Pharma.

Both companies had their shares halted after the first signs of a slowdown in the deal. As of the time of this writing, both companies remained halted from trading.

Back in October, Creso Pharma said that its board of directors unanimously recommended the approval of the deal by shareholders of the company.

PharmaCielo previously indicated it was unwilling to increase its offer.

The original agreement laid out a plan for PharmaCielo to acquire all of the issued and outstanding shares and listed options of Creso Pharma by way of a deal estimated at approximately AU$122 million.

In terms of the perks of the transaction, Miri Halperin Wernli, co-founder and CEO of Creso Pharma, said earlier this year, “This arrangement with PharmaCielo is an incredible opportunity for Creso Pharma shareholders to benefit from being part of a best in class and well-capitalized global medicinal cannabis company.”

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Bryan Mc Govern, hold no direct investment interest in any company mentioned in this article.

Outlook Reports

Featured Australia Cannabis Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2325.28 | +8.98 | |

| Silver | 27.39 | +0.21 | |

| Copper | 4.56 | +0.07 | |

| Oil | 83.20 | +0.39 | |

| Heating Oil | 2.58 | +0.02 | |

| Natural Gas | 1.63 | -0.03 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

Bryan is a Senior Editor with INN. After graduating from the Langara journalism program he did some freelance reporting with community newspapers in British Columbia. He initially wrote about the life science space for INN and now spends his time covering the marijuana market, from Canadian LPs to US-based companies, and the impact of this sector on investors.

Learn about our editorial policies.