Supports Piedmont’s Plan to Become America’s #1 Producer of Lithium Hydroxide

- PLL to acquire 9.47% of IronRidge Resources (“IRR”) and a 50% interest in IRR’s Ghana-based lithium portfolio

- $15mm equity placement and 50% project interest to be earned through staged investments over 3-4 years

- Binding supply agreement for 50% of IRR’s planned Ghanaian spodumene concentrate (“SC6”) production

- The IRR Ghana SC6 supply will support staged growth in Piedmont’s lithium hydroxide production

- Feasibility Study of Carolina Lithium’s integrated 30,000 t/y LiOH on track for September 2021

- 30,000 t/y integrated LiOH project in Quebec to be evaluated jointly with Sayona Mining

- IRR SC6 supply provides optionality for incremental 30,000 t/y LiOH capacity at a site to be determined

- Hydroxide capacity to be developed in stages to minimize execution and funding risks

Piedmont Lithium Inc. (Nasdaq: PLL, ASX: PLL) is pleased to announce that it has entered into definitive agreements (the “Agreements”) to establish a strategic partnership with IronRidge Resources (“IRR”) (AIM: IRR) through the purchase of an equity stake in IRR, staged project investments to earn a 50% interest in IRR’s Ghana-based lithium portfolio (“IRR Ghana”), and a binding supply agreement for 50% of IRR Ghana’s planned spodumene concentrate (“SC6”) production.

IRR Ghana has an impressive portfolio of spodumene prospects, anchored by the highly promising Ewoyaa Project (the “Ewoyaa Project”). The Ewoyaa Project has a current Mineral Resource of 14.5Mt @ 1.31% Li 2 O with vast exploration potential. 1 The Ewoyaa Project has the potential to be a large, low-cost spodumene concentrate (“SC6”) producer.

In January 2021, IRR published a scoping study for the Ewoyaa Project forecasting an average of 295,000 t/y of planned SC6 production, a $345 million after-tax net present value and an after-tax internal rate of return of 125%, for initial capital investment of $70 million. 2 The Ewoyaa Project capitalizes on its excellent location less than one mile from a major national highway and only 70 miles to the major port of Takoradi. The site is also directly adjacent to high voltage power and is expected to have a low environmental impact due to reliance on solar and hydroelectric generating capacity to power the facility. Piedmont conducted extensive due diligence over the past several months, including through site visits to Ghana, and believes that IRR Ghana has significant upside potential.

Piedmont will invest approximately $15 million (£10.8mm) to acquire a 9.47% equity interest in IRR (the “Subscription”) and will appoint one director to IRR’s Board of Directors. Piedmont will also have the opportunity to earn a 50% stake in IRR Ghana by investing (i) $17 million to fund ongoing exploration and a definitive feasibility study over the next 24 months to earn an initial 22.5% project interest, and (ii) a further $70 million in 2023-2025 to fund the construction of the Ewoyaa Project to earn an additional 27.5% project interest, which would bring the total to 50% ownership in IRR Ghana (together, the “Project Investment”). Piedmont and IRR have also entered into a binding SC6 supply agreement (the “Supply Agreement”), conditioned on Piedmont completing its earn-in obligations, pursuant to which IRR will supply Piedmont 50% of IRR Ghana’s planned SC6 production (currently estimated to be 147,500 t/y) at market prices on a life-of-mine basis.

The Subscription is expected to close in August 2021 subject to satisfaction of conditions precedent with the Project Investment expected to be staged over a three-to-four-year period leading to initial production in 2025. . Summary of Transaction Terms are available on the company website.

Keith D. Phillips, President and Chief Executive Officer, commented: “We are very pleased to announce a partnership with IronRidge Resources to jointly develop their outstanding spodumene project portfolio in Ghana. We consider IRR’s Ewoyaa Project to be among the world’s most promising spodumene projects. The high-grade mineral resource is currently modest in scale but offers substantial exploration potential, and the project is very well-located, being only 70 miles from a major port. Ewoyaa builds on Piedmont’s strategic commitment to be a large-scale and low-cost producer of lithium hydroxide from spodumene concentrate sourced from diverse sustainable resources in favorable jurisdictions.

“Ghana is one of Africa’s most successful nations, with a strong mining tradition and an increasingly diverse economic base. In naming Ghana as the headquarters for its entire African business earlier this year, Twitter described Ghana as a ‘Champion for Democracy’. Euler-Hermes regularly rates Ghana among the lowest-risk jurisdictions in the region, and Transparency International rates Ghana ahead of other lithium-rich countries such as Argentina, China, Brazil, Mexico, Bolivia, Mali, and the DRC in its annual corruption perception rankings.

“2021 has been a transformative year for Piedmont. We have built the world’s premier lithium development leadership team, significantly expanded our world-class Carolina Lithium Project, and become a multi-asset company through strategic investments in Quebec and in Ghana. We raised sufficient capital in March 2021 to comfortably fund these strategic initiatives as well as our definitive feasibility study in North Carolina and should end 2021 with a robust cash balance. We will now evaluate plans to capitalize on our expanded spodumene resource base to become a larger producer of the battery-quality lithium hydroxide that America will require to power the ongoing transition to electric vehicles. Lithium has been called ‘the irreplaceable element of the electric era,’ and we will bring large-scale production of lithium hydroxide to America.”

Click here to view the complete release.

1 Refer to IRR announcement dated January 28, 2020. |

2 Refer to IRR announcement dated January 19, 2021. |

View source version on businesswire.com: https://www.businesswire.com/news/home/20210701005269/en/

For further information:

Keith Phillips

President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

Brian Risinger

VP – Investor Relations and Corporate Communications

T: +1 704 910 9688

E: brisinger@piedmontlithium.com

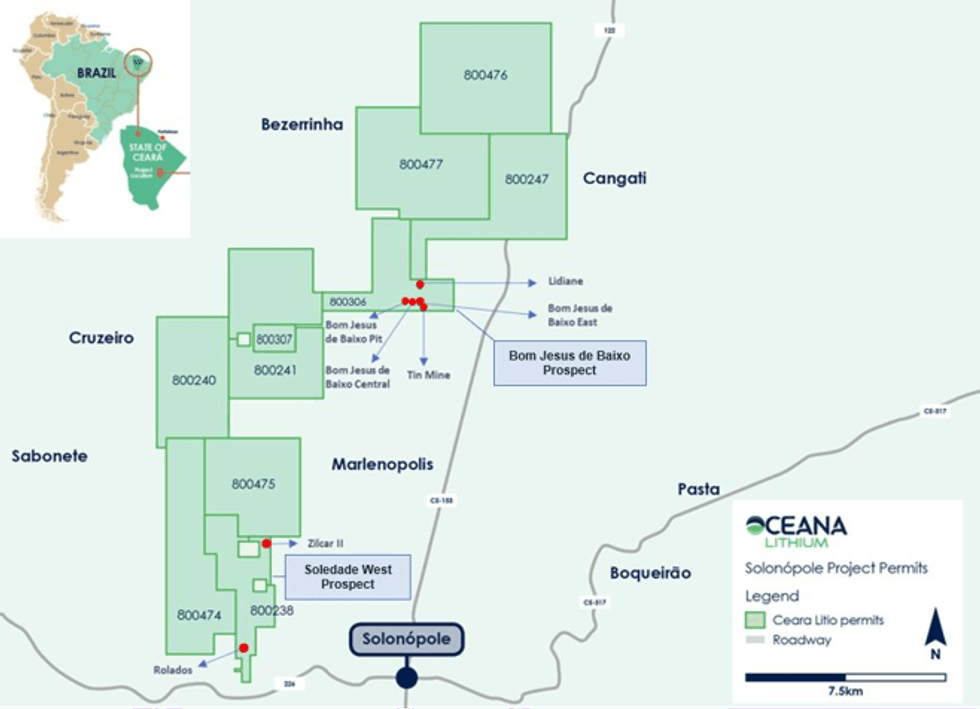

Figure 1: Solonópole Project permits and targets drilled in May – June 2023 (red dots)

Figure 1: Solonópole Project permits and targets drilled in May – June 2023 (red dots)

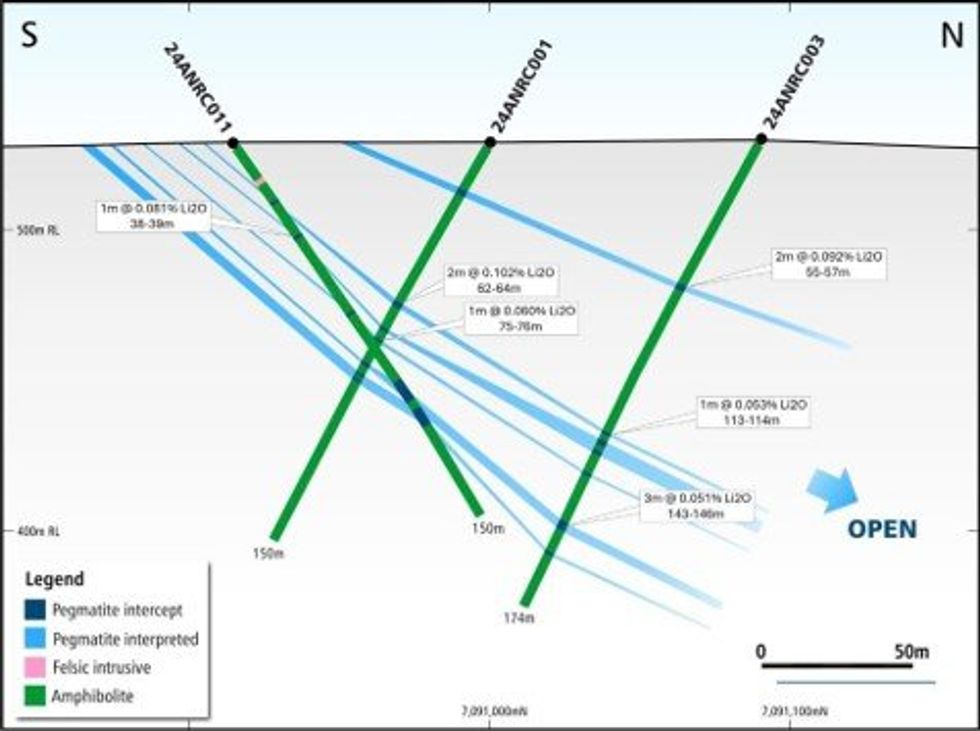

Figure 1: Cross-section of intercepted pegmatites showing significant results >0.05% Li2O.

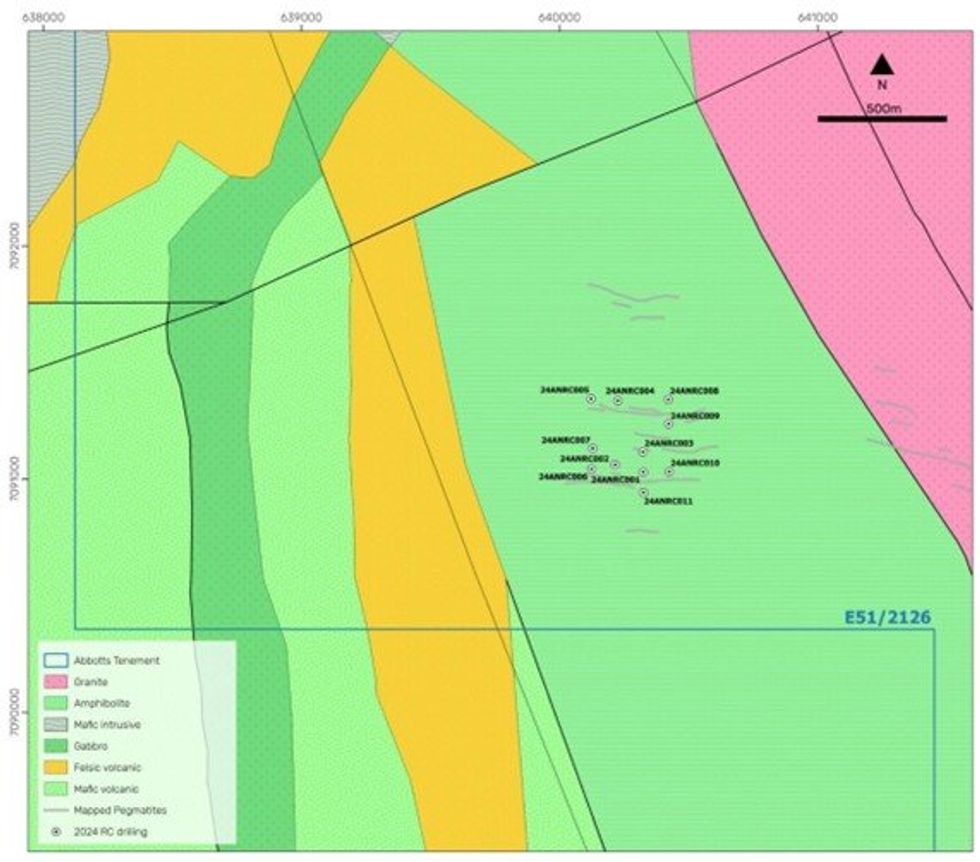

Figure 1: Cross-section of intercepted pegmatites showing significant results >0.05% Li2O. Figure 2: Geological map of the Buttamiah Prospect with collar locations of completed RC drilling.

Figure 2: Geological map of the Buttamiah Prospect with collar locations of completed RC drilling.