- Current drill program expanded by 25,000 meters with three new drill rigs added for a total of five rigs

- Drilling to expand Mineral Resources is proceeding positively and resource updates are expected in Q1 2021

- Infill drilling will target upgrading the Company’s Mineral Resources on the Core property from Inferred to Indicated classification in advance of a Definitive Feasibility Study

Piedmont Lithium Limited ( “Piedmont” or “Company” ) is pleased to announce it has expanded the current drilling campaign by an additional 25,000 meters, with three additional rigs arriving in the field over the coming weeks. The expanded drill program is designed to complete infill drilling on the Core Property with the objective of upgrading the Mineral Resource classification category for select areas from the Inferred category to the Measured and Indicated categories.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201117005343/en/

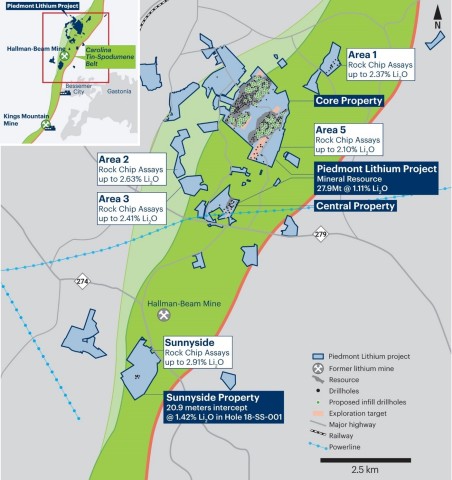

Piedmont Lithium Project Property Map Showing Mineral Resources, Exploration Targets and Proposed Drillholes (Graphic: Business Wire)

The Company plans to publish a Mineral Resource estimate update for the Core Property in Q2 2021 in support of reporting Ore Reserves and completion of a Definitive Feasibility Study in mid-2021.

The expanded drill program will also continue to explore the numerous spodumene pegmatites which have been discovered on the Company’s properties over the past several months. Assays are pending for several of these new discoveries.

The Company also plans an update to the Mineral Resource estimate of the Central Property in early-2021 based on the results of exploration drilling on the property completed in September 2020.

Piedmont expects to complete the expanded drill program in late spring 2021 but acknowledges that the schedule may be impacted by the ongoing COVID-19 pandemic. Field operations at the Piedmont Lithium Project continue under COVID-19 safety protocols, using guidelines and orders established by the State of North Carolina.

Keith D. Phillips, President and Chief Executive Officer, commented: “ We are excited to be aggressively expanding our drill program with five drill rigs soon to be in the field. Our dual objectives are to upgrade the current Inferred Resources within the Core Property to support our upcoming DFS, while also growing the overall scale of our mineral resource tonnage. The Carolina Tin-Spodumene Belt is one of the world’s most prolific lithium belts and we are hopeful that we will ultimately delineate North America’s largest spodumene resource, ideally located in North Carolina to power North America’s clean energy storage and EV revolution. ”

Click here to view the full ASX Announcement.

View source version on businesswire.com: https://www.businesswire.com/news/home/20201117005343/en/

Keith Phillips

President & CEO

+1 973 809 0505

kphillips@piedmontlithium.com

Tim McKenna

Investor and Government Relations

+1 732 331 6457

tmckenna@piedmontlithium.com