- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

Trident Royalties PLC

Impact Minerals Limited

Purpose Bitcoin ETF

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Piedmont Resumes Drilling to Further Increase Mineral Resources in the Carolina Tin-Spodumene Belt

Piedmont Lithium Limited (ASX:PLL,NASDAQ:PLL) (“Piedmont” or “Company”) is pleased to announce the Company has resumed drilling on its properties located within the world-class Carolina Tin-Spodumene Belt (“TSB”) in North Carolina

- Drilling has commenced testing new target areas on the Company’s Core and Central properties

- Drilling will also test previously identified regional drill targets in the prolific Tin-Spodumene Belt

- Piedmont is focused on increasing its Mineral Resources and potential increased production of American sourced lithium

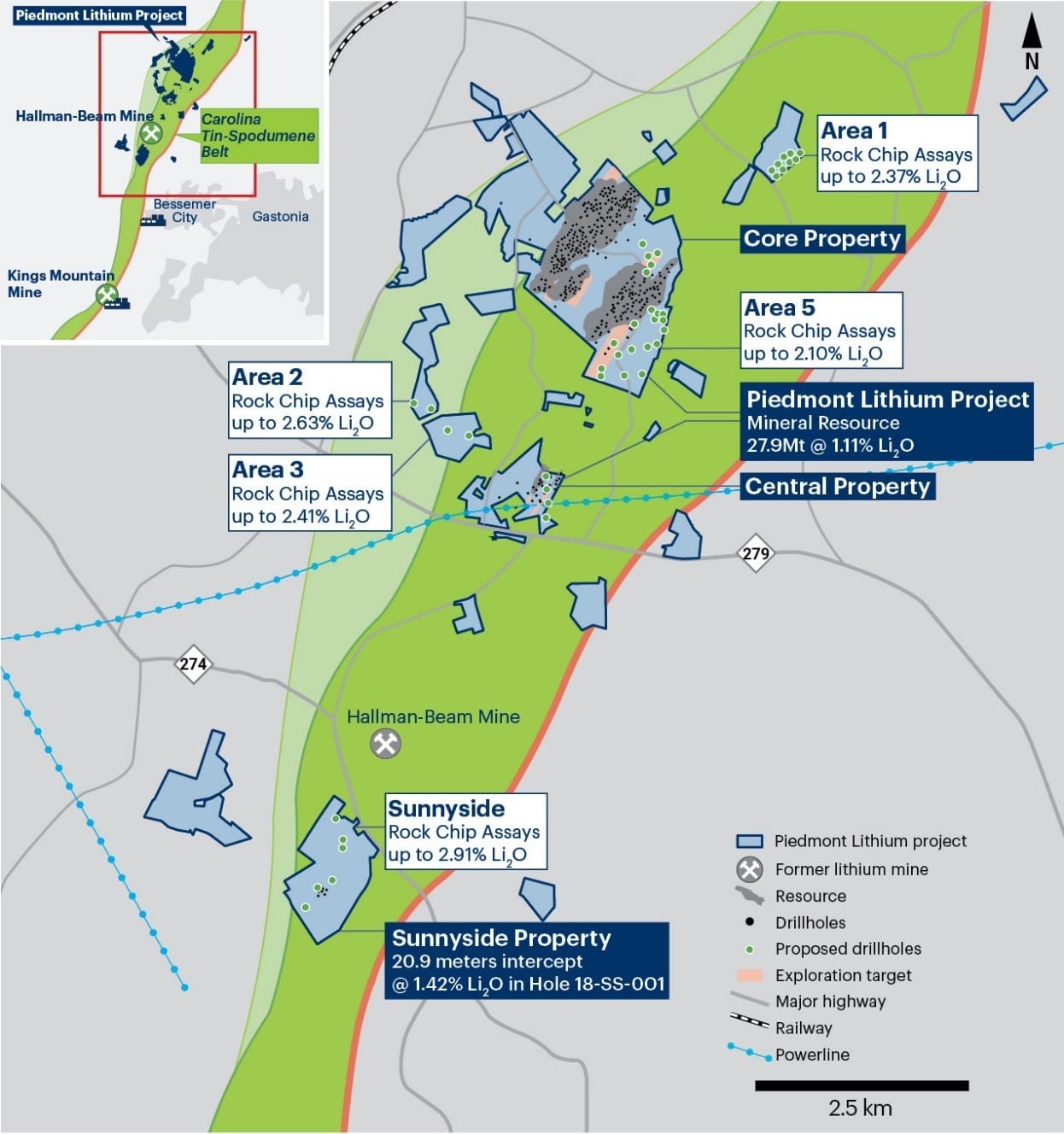

Figure 1 – Piedmont Lithium Project Property Map Showing Mineral Resources, Exploration Targets and Proposed Drillholes

Piedmont Lithium Limited (ASX:PLL,NASDAQ:PLL) (“Piedmont” or “Company”) is pleased to announce the Company has resumed drilling on its properties located within the world-class Carolina Tin-Spodumene Belt (“TSB”) in North Carolina, USA. The drill program will consist of approximately 5,600 meters. The program’s primary objectives are to drill Exploration Target areas on the Core and Central properties, as well as previously untested occurrences of spodumene bearing pegmatite on regional properties (Figure 1).

Core Property

Approximately 50% of the total drill holes are allocated for the eastern portion of the Core property. These drill holes will test two Exploration Target areas previously identified (refer announcement dated June 24, 2019). The Company will additionally explore Area 5 (Figure 1), which is outcropping mineralization with assays up to 2.10% Li2O (refer announcement dated January 27, 2020). Several areas of low mineralization potential will also be tested to determine whether these areas offer additional Resource potential or are better suited for waste rock storage and or mine infrastructure.

Central Property

At the Central property, 5 drill holes are proposed to test the previous Exploration Target (refer announcement dated April 23, 2019), and will build on the Phase 4 drilling results reported in our announcement dated January 27, 2020. Two holes are designed to test to the south and downdip of the intercepts reported in Hole 19-CT-019 (36.0 meters @ 1.11% Li2O and 44.9 meters @ 1.30% Li2O).

Regional Properties

The remainder of the proposed drilling will be distributed on Piedmont’s regional properties. Drilling at Area 1 (Figure 1) will target a large robust soil anomaly along with outcrops of spodumene bearing pegmatite that range up to 2.37% Li2O. Initially, Area 2 and 3 (Figure 1) will receive limited drilling that will target significant soil anomalies and spodumene in outcrop. At Sunnyside, soil anomalies and newly identified spodumene pegmatite occurrences will be targeted as well as potential follow up drilling from the 2018 drilling reported in our announcement dated October 16, 2018 (20.1 meters @1.42% Li2O). Prioritization of drilling will be results based, not all the regional targets may get drilled.

Keith D. Phillips, President and Chief Executive Officer, commented: “We are excited to once again have drill rigs in the field. The Carolina Tin-Spodumene Belt is one of the world’s most significant spodumene occurrences, and there are many high-priority targets remaining on our properties. Spodumene is the dominant feedstock for the fast-growing lithium hydroxide market, and with over 80% of the world’s hydroxide currently being produced in China, this is an opportune time for Piedmont to grow its mineral resources in the United States.”

To view the full ASX release, click here.

Contacts

Keith Phillips

President & CEO

T: +1 973 809 0505

E: kphillips@piedmontlithium.com

Tim McKenna

Investor and Government Relations

T: +1 732 331 6457

E: tmckenna@piedmontlithium.com

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2328.22 | -58.63 | |

| Silver | 27.21 | -1.36 | |

| Copper | 4.51 | -0.01 | |

| Oil | 83.02 | -0.12 | |

| Heating Oil | 2.57 | +0.02 | |

| Natural Gas | 1.79 | +0.04 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.