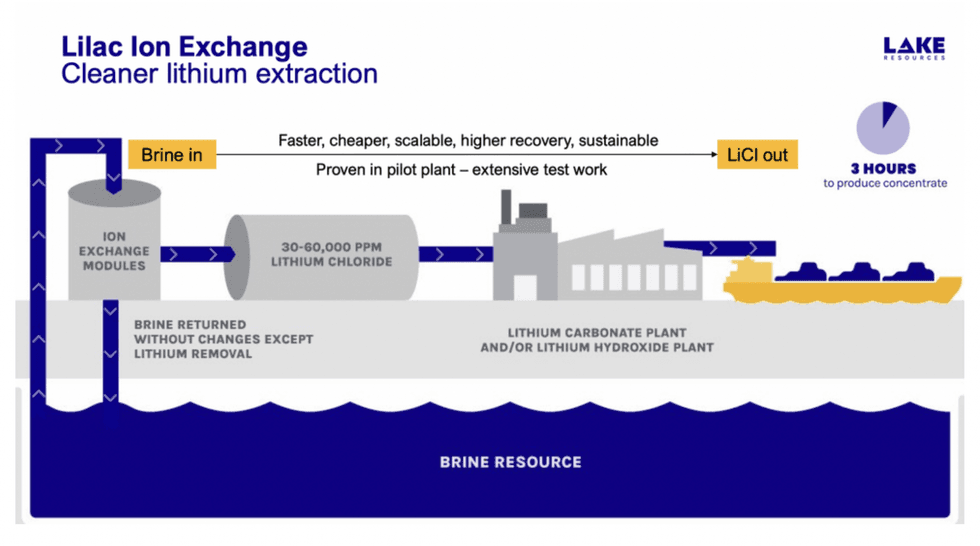

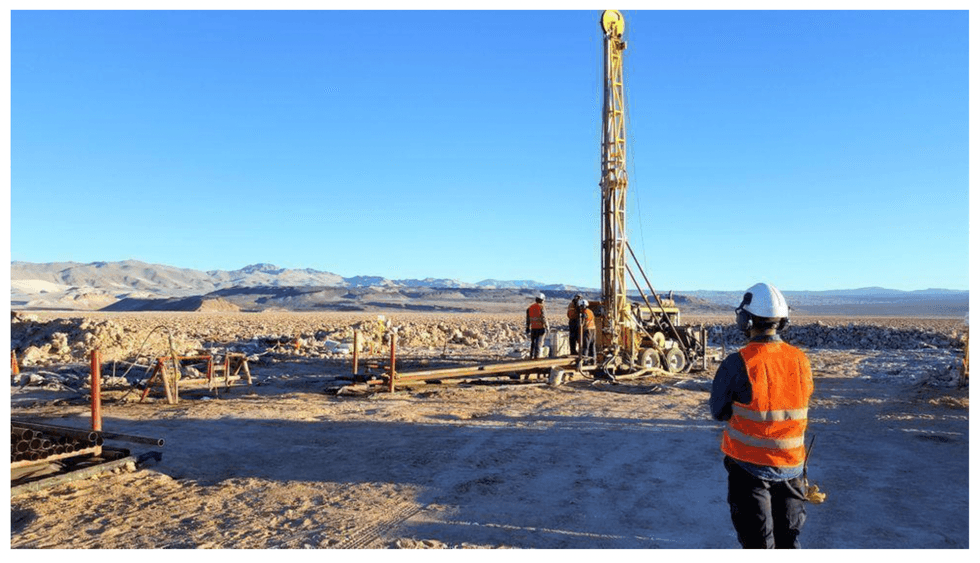

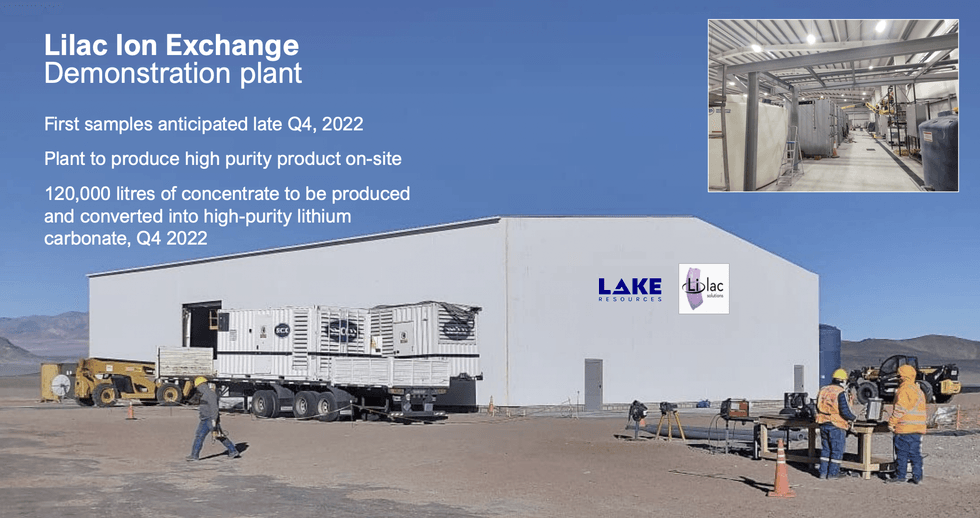

Lake Resources has partnered with Lilac Solutions to build a direct extraction pilot plant at the Kachi project. Lilac Solutions has developed a proprietary ion-exchange technology for the extraction of lithium from brine resources. It’s capable of achieving high recoveries, at minimal cost, with rapid processing times, all while providing numerous environmental benefits — particularly water preservation. Katchi aims to provide the world’s cleanest lithium using its unique procedure.

The modular demonstration plant, designed and built by the engineering team at Lilac Solutions, was dispatched to the Kachi Project in Argentina in March 2022, after which Lilac began operating the demonstration plant for several months to produce lithium chloride (eluate) representing 2.5 tonnes of lithium carbonate.

As of December 31, 2022, Lilac has successfully operated the demonstration plant for 1,000 consecutive hours and produced 40,000 liters of lithium chloride eluate, meeting all key testing milestones outlined in Lake Resources' agreement with Lilac. The lithium chloride eluate produced by Lilac will be converted to lithium carbonate, after which it will be independently tested for purity.

Project Kachi is on track to move from its pilot phase into commercial-scale development after Lake Resources and Lilac Solutions announced the production of 2,500 kilograms of lithium carbonate equivalents (LCE). This successful result led Lilac to increase its ownership of the Kachi Project from 10 percent to 20 percent. The 2,500 kilograms of LCEs were extracted at Kachi with 80 percent lithium recovery, 90 percent plant uptime, 1,000 times less land compared with evaporation ponds, and 10 times less water compared with conventional aluminum-based absorbents.

Lilac has successfully operated the demonstration plant for 1,000 consecutive hours and produced 40,000 liters of lithium chloride eluate, which was then shipped to Saltworks to be converted to lithium carbonate. The lithium carbonate will then be independently tested for purity.

Pre-feasibility Study

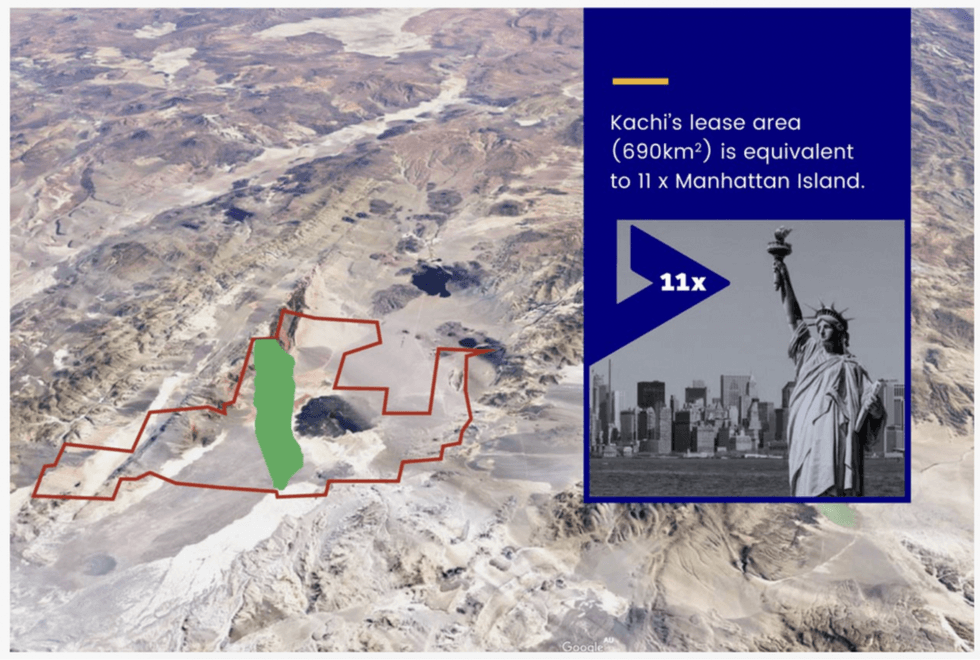

In May 2020 Lake Resources released a PFS on the Kachi property with a target of producing 25,500 tonnes of battery-grade lithium carbonate equivalent (LCE), using Lilac's direct extraction technology at an operating cost of US$4,178 per tonne. The study was based on an indicated resource of 1.01 million tonnes LCE at 290 mg/L lithium. Lake is currently working towards a definitive feasibility study on the Kachi property.

Upcoming Milestones:

Lilac’s ion exchange is proven through extensive testing at the demonstration plant, allowing faster-to-market, high-recovery solutions that are environmentally sustainable. The company expects to report in the next several weeks on the test results of the 40,000 liters of lithium chloride that were shipped to Saltworks for conversion to lithium carbonate, and then further tested for purity levels.

Additionally, the company expects to provide an operational update on the Kachi Project in the second quarter. Completion of the DFS is expected mid-2023, followed by the completion and submission of the Environmental Impact Assessment by the fourth quarter of 2023.

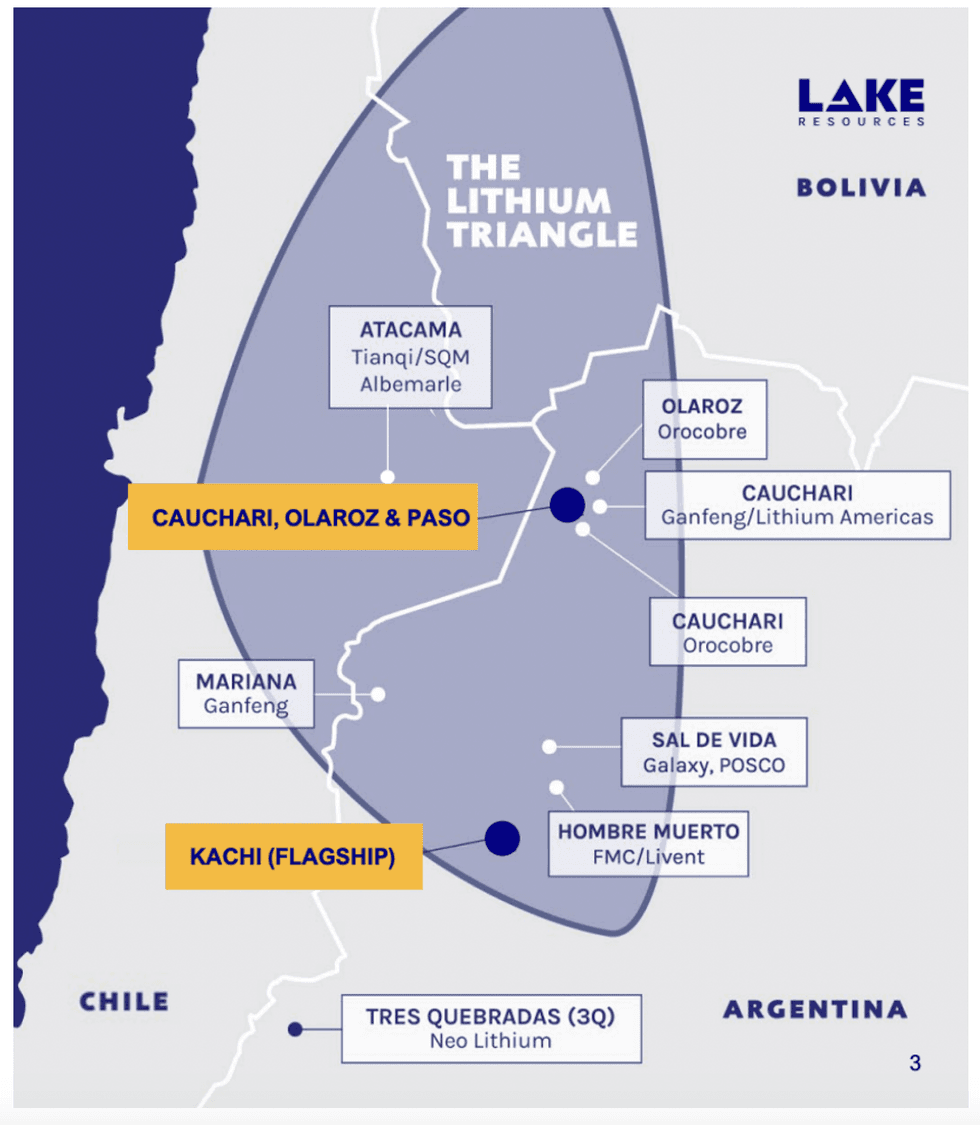

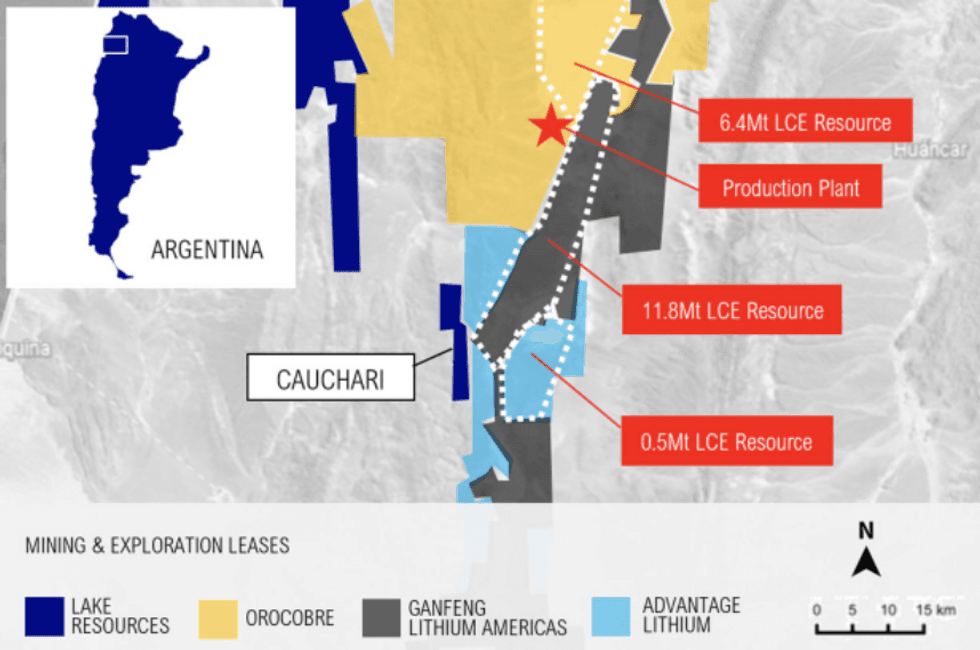

Cauchari-Olaroz-Paso Lithium Brine Projects

The wholly owned Cauchari, Olaroz and Paso lithium brine projects are adjacent to one another and surrounded by significant players in Jujuy province in Argentina. The projects are adjacent to Orocobre's Olaroz lithium brine operations and projects under development by Lithium Americas (

ICX:LAC), SQM (

NYSE:SQM), Ganfeng Lithium and Advantage Lithium.

Management Team

David Dickson - CEO and Managing Director

With more than 30 years' experience in process technology, engineering, construction, and engineering, procurement and construction (EPC) cost management across the energy sector, David Dickson has a proven track record in successfully delivering multibillion dollar resource projects. He is currently a senior advisor to private equity firm Quantum Energy Partners, a global provider of private capital to the responsibly sourced energy and energy transition and decarbonization sectors, and an executive strategic advisor at investment firm The Chatterjee Group. He is the former CEO of global engineering and construction firm McDermott International, where, through his seven-year tenure he built a strong leadership team that steered the company into profitable new markets, oversaw McDermott's merger with CB&I, and ultimately grew the business to more than 30,000 employees across 54 international markets.

Prior to McDermott, Dickson was previously president of Technip USA, overseeing marketing and operations in North, Central and South America. He was also appointed to the board of the US National Safety Council and a member of the World Hydrogen Council.

Stuart Crow - Non-executive Chairman

Stuart Crow has global experience in financial services, corporate finance, investor relations, international markets, salary packaging, and stockbroking. He is passionate about assisting emerging and listed companies in attracting investors and capital. Crow has gained significant experience by owning and operating his own businesses.

Dr. Robert Trzebski - Non-executive Director

Dr. Robert Trzebski is currently chief operating officer of Austmine and holds a degree in geology, a master’s degree in project management, a PhD in geophysics, and has more than 30 years of professional experience in project management and mining services. He holds considerable operating and commercial experience in Argentina and Chile, as a non-executive director of Austral Gold since 2007, listed on the ASX and TSXV. He is chairman of the audit and risk committee at Austral Gold. His role with Austmine has allowed him to develop considerable contacts across the operating and technology space of the global resources industry. Trzebski is also a fellow of the Australian Institute of Mining and Metallurgy and is also fluent in Spanish, German and English.

Amalia Sáenz - Vice-president, Argentina Corporate Affairs

Amalia Sáenz was appointed a non-executive director in July 2021. An experienced energy and natural resources lawyer based in Buenos Aires, Sáenz is assisting Lake Resources and its local team in Argentina to engage with local stakeholders and prepare for the development of clean lithium in Argentina. She is a partner at the law firm, Zang, Bergel & Viñes in Buenos Aires, where she leads the firm’s energy and natural resources practice. A leading member of the Association of International Petroleum Negotiators, Sáenz has extensive experience in energy and resources, including mergers and acquisitions, financing, joint ventures and operating agreements in Argentina. She has also worked in Central Asia and the United Kingdom, gaining experience in exploration and production development across international borders and cultures.

Karen Greene – Senior Vice President of Investor Relations and Communications

Karen Greene is an accomplished investor relations executive with over 25 years’ experience in leading US companies.

Her investor relations leadership experience includes senior vice-president, global client experience and corporate communications, member of senior leadership team at Q4 Inc, Toronto; managing director, investor relations at Hamilton Lane Corp and managing director of investor relations and communications at Actua Corporation in the US.

Greene has an MBA, Boston University and Temple University, Dean’s List; and BA Political Science, Dean’s List, University of Rochester and the Universite de Sorbonne, Paris, France.

Scott Munro - Senior Vice-president, Technology, Strategy and Risk

Scott Munro has significant experience and skills in strategic partnerships, corporate strategic planning, and technology development. He has experience in creating new business units and growing them rapidly to deliver large-scale industrial developments. Munro has overseen the successful delivery of large-scale industrial projects in international markets and has broad experience including general management, strategic planning, partnership development and overseeing technology development. His prior roles included corporate development officer at McDermott International with responsibility for Strategy Development following a period as business unit leader for the company's Americas, Europe, and Africa (AEA) Business Unit and overseeing its re-entry into these geographical areas.

Peter Neilsen - Chief Financial Officer

Peter Neilsen is a chartered accountant with more than 20 years’ experience in all facets of financial management, asset management, and leadership. He has served in a range of positions including as CFO, company secretary, finance manager, and other senior executive positions for a number of listed and unlisted companies in the energy and natural resources sector. Among the companies Neilson has worked with are Barrick, Xstrata and Round Oak. He has been involved in reducing operating expenses up to AU$100M through cost analysis, performance improvements and contract negotiations, acquisitions of up to $80M and managed revenues in excess of AU$5 billion.

John Freeman - Chief Legal Officer and General Counsel

John Freeman is a highly accomplished legal executive with over 30 years of experience in leading global companies. His extensive leadership experience includes serving as chief legal officer, executive vice-president and corporate secretary for McDermott International; general counsel and executive vice-president for Technip S.A.; global ethics and compliance director for Baker Hughes, in addition to other legal and compliance positions within that organization. Freeman has also served as prosecuting attorney for the US Office of Special Counsel and special assistant US attorney for the District of Columbia.

Gentry Brann - Chief People and Administration Officer

Gentry Brann has over 25 years of experience leading HR and communications functions. She joins Lake from McDermott, where she led the company's strategic focus on inclusion and diversity, as well as human resources, communications and marketing, real estate and facilities, and global travel. Brann joined McDermott from CB&I in 2018, where she served as senior vice-president of communications and brand management. Prior to CB&I's acquisition of The Shaw Group, she served as vice-president of investor relations and corporate communications for Shaw. Brann holds an MBA from Duke University's Fuqua School of Business and a bachelor's degree from Louisiana State University. She is also a graduate of the Advanced Leadership Program at Rice University's Jones School of Business.

Mark Anning - Head of Legal, Australia, and Company Secretary

Mark Anning has practiced at partner level in private practice, and in-house at CEO and chair direct-report levels for several ASX and NASDAQ listed companies. With 30 years of legal and corporate practice experience, Anning has specialized in corporate and commercial law, dispute resolution, risk management and corporate governance. Anning is a chartered secretary and holds a Bachelor of Commerce and LLB (Hons) from the University of Queensland and a graduate diploma in applied corporate governance. He is a fellow of the Governance Institute of Australia and is admitted to practice in all Commonwealth Courts and the Supreme Courts of Queensland and Victoria.

Sean Miller - Corporate Development Officer

Sean Miller has significant experience and skills in project execution, supply chains, contracts and procurement, and project optimisation. He has overseen the successful delivery of multibillion dollar projects in Australia and in international markets. He has broad experience including general management, strategic planning, supply chain, finance, legal, information technology, sustainable development and human resources in both greenfield projects and brownfield sites. His prior roles include being head of commercial operations for The Carmichael Rail Project in Queensland; commercial development director at the Kamoto Copper Company Copper and Cobalt mine in Katanga province of the Democratic Republic of Congo; manager - contracts & procurement for Glencore's North Queensland Metals; and superintendent metal handling at Rio Tinto's Boyne Smelters Ltd.

Howard Atkins - Non-executive Director

Howard Atkins brings deep financial management, capital markets, transaction, foreign exchange, and public company experience to the Lake Resources Board. He has over 30 years of financial leadership experience, including 20 years serving as a CFO for organizations including Wells Fargo, New York Life Insurance Company, and Midlantic Bank Corporation. Atkins previously held senior roles at Chase Manhattan Bank, including as head of Foreign Exchange and Markets Businesses for Europe, the Middle East and Africa, and head of the bank's worldwide interest rate derivatives trading business. He has served on the boards of Occidental Petroleum and Ingram Micro.

Dr. Cheemin Bo-Linn - Non-executive Director

Dr. Cheemin Bo-Linn is an accomplished CEO, former Fortune 100 operations executive, and board director with over 25 years of governance expertise at private organizations and public companies across the Americas and Europe. Her board leadership experience at public companies includes her appointment as lead independent director, chair of every major committee (audit, compensation, nomination/governance), chair of sustainability/ESG, and chair of the technology and cybersecurity committees. Her related current board service includes Flux Power, a leading developer and manufacturer of advanced sustainable lithium-ion energy storage solutions for industrial mobility fleets.

Ana Gomez Chapman - Non-executive Director

Ana Gomez Chapman is a financial services executive and board director with over 25 years of investment management, capital markets and business leadership experience. She has worked and lived across the US, Europe, Latin America and Asia Pacific. Chapman previously served on the board of directors of MP Materials, a US-based sustainable rare earth production and refining company where she steered the company through an operational turn-around that led to a New York Stock Exchange listing. She has also served on the advisory board of investment software company Backstop Solutions Group. She is a capital markets expert who has held senior roles at institutional investment firms including Hamilton Lane, where she currently serves as a managing director. She previously was senior relationship manager and alternatives lead at Allianz Global Investors, president of JHL Capital Group LLC, and vice-president at Goldman Sachs in their Latin American, Asian and US equities businesses.

![]() View original content to download multimedia: https://www.prnewswire.com/news-releases/albemarle-donates-1-million-to-cleveland-community-college-to-further-support-workforce-development-programs-302119194.html

View original content to download multimedia: https://www.prnewswire.com/news-releases/albemarle-donates-1-million-to-cleveland-community-college-to-further-support-workforce-development-programs-302119194.html