The decision to take full ownership of the Licences, details of which were contained in the Company's AIM Admission Document dated 11 March 2022, in the Directors' opinion, enhances the potential future returns to shareholders, while reducing risk, given the asset's now relatively advanced stage. The Company has also been advised that taking full ownership of the Licenses clears the path for the planned dual-listing on the Australian Securities Exchange ("ASX").

The Company has also issued convertible loan notes ("CLNS") to raise gross proceeds of £1 million for the Company on what the Directors believe are advantageous terms. Further details of the CLNs are set out below.

Highlights:

- CTL enters into a sale and purchase agreement ("SPA"), now taking full ownership of Licences that were previously held by way of an option agreement

- The SPA caps payments to the vendors of the Licences ("Vendors"), enhancing potential future returns to CTL shareholders and reduces the potentially unlimited shareholder dilution risk under the previous option terms

- CTL has been advised that taking full ownership of the Licences, under the SPA, clears the path for the ASX listing

- Staged payments to the Vendors under the SPA will be budgeted in the normal course of business over a period of up to 10 years, with the first payment having been funded through an un-secured, three-year £1m convertible loan notes on attractive terms

- The later contingent staged payments will be funded either as a very small part (~1%) of the construction finance for Laguna Verde or from sales revenues after sales of 10,000 tonnes and 35,000 tonnes of lithium carbonate equivalent (LCE) have been achieved from Laguna Verde production (estimated at approximately 2-3% of revenues from those sales volumes)

- The new commercial arrangements for the Licences provide clarity on the timing and amounts payable for the Licences and no longer include a subjective mechanism for calculating the amounts due to the Vendors or involve any payments in CTL ordinary shares.

- With CTL now owning 100% of all the 108 licences covering the Laguna Verde Project, this will support CTL's CEOL applications and further clear the path to production.

Steve Kesler, Chairman and Interim Chief Executive Officer, CleanTech Lithium PLC, said:

"Acquiring the 23 Laguna Verde licences under new commercial arrangements, so the Company has full ownership as well as control, is a prudent decision, which will support potential long-term returns to investors. The Company has also been advised that gaining full ownership of the licences will clear the path for the dual-listing on the ASX. While the timing of this decision has been driven by the ASX listing requirements, it was always planned to make these changes for commercial reasons and to provide our shareholders and potential strategic parties with clarity on the ownership position and amounts payable over time. The Board is pleased to have reached agreement with the Vendors on this matter and thanks them for their flexibility over the course of the past few months.

"Having been offered attractive terms by a third party to fund the first staged payment through a convertible loan facility, the Board felt it was prudent to take up this offer, allowing us to continue to focus our existing resources on our ongoing and planned work programmes. We are grateful to the new convertible loan note holder who has demonstrated real confidence in our plans.

"I would also like to recognise and thank our previous CEO, Aldo Boitano, for his crucial role in bringing both these agreements to a successful conclusion.

"Now that these changes have been made, we will look to dual-list on the ASX, with the relevant documentation on this now being under way. We will update our shareholders on this in due course when the application has been made."

Summary:

The original option agreement, entered into with the Vendors of the Licences in April 2021, gave CTL the exclusive right to acquire 100% of the Licences within a 5-year period. As detailed in the Company's AIM Admission Document dated 11 March 2022, this agreement also gave the Company complete control of the Laguna Verde project area as it owned and controlled all other licences comprising the project.

The option agreement that was established is a standard commercial structure within the mining industry and, given the Vendors already owned the 23 licences at that time, it represented an effective mechanism for the Company to gain full control of the Laguna Verde asset in 2021.

The option agreement fully complies with Chilean law and is in-line with UK listing requirements. CTL was, however, advised by the ASX authorities that such an agreement does not conform to current ASX listing rules as it does not provide ownership of at least 51% of all licences on a company's "flagship assets". The timing of this change from an option agreement to a mining licence SPA is being driven by the need to comply with ASX listing rules.

The Board has consistently believed, however, that it would be advantageous to replace the option agreement with full ownership prior to seeking strategic investors and construction finance for Laguna Verde. As such, the timing of this change is not materially different to that planned.

The Board believes this change is in the best interests of the Company and its shareholders as it represents an effective transfer of potential long-term value to shareholders at a time that minimises risk, given the progress made at Laguna Verde and the now evident potential value of that asset as detailed in the Scoping Study released in January 2023.

Under the option agreement, CTL was required to pay the Vendors a percentage of the commercially extractable lithium reserves value from the Licences, on or before maturity in March 2026, with determination of this value being undertaken by an independent expert. This approach reduced upfront risk during the asset's early stages of development but potentially opened the Company to a balloon payment on maturity, of which 80% was to be made in CTL ordinary shares. This represented future financial and dilution risk and negotiations in relation to reserve valuation exposed CTL to potentially protracted discussions and legal debate.

The replacement of the option agreement with the SPA provides clarity on future payments to the Vendors of Licences, capped at a total value of US$35.0 million, with staged payments as detailed below, and the two largest payments being payable out of production revenue. Under the SPA, the last contingent payment should be made within 5 years of the previous contingent payment, with all payments having been made within 10 years from the date of the execution of the SPA (i.e. by 19 April 2034). CTL has been advised it also clears the path for the ASX listing given the Company now has full ownership of the Laguna Verde licence area rather than control through an option agreement.

The initial staged payment of US$1.25m has been settled through £1m unsecured convertible loan notes, with subsequent staged payments already budgeted for as part of the Company's business plans. Based on the cashflow model, as outlined in the Laguna Verde Scoping Study, the two largest production-based payments are expected to account for between 2-3% of production revenue from those specific sales of 10,000 tonnes LCE and then 35,000 tonnes LCE.

The CLNs are on favourable terms, reflecting confidence in the Company's future returns profile, with the conversion price being the lower of a 50% premium to the 30-day Volume Weighted Average Price ("VWAP") of the ordinary shares prior to the conversion notice, or 30 pence per ordinary share. The interest rate is the Sterling Overnight Index Average rate, administered and published by the Bank of England, plus three (3) per cent. The CLN also allows the Company to focus its current cash resources on its operational and technical work programmes, rather than using them to make staged payments under the SPA.

An interview with Gordon Stein, CFO, explaining the new arrangements will be made available soon.

Background Details:

Laguna Verde is the Company's flagship and most advanced project located in Chile. The project comprises 108 licences with a JORC compliant resource of 1.8 million tonnes of LCE, with a Measured & Indicated resource of 1.1 million tonnes. The Licences subject to the SPA are carried in the Company's books in its unaudited interim statement as of 30 June 2023 at £11.0 million under "exploration and evaluation assets" representing the Company's expenditure on these assets to that date.

The Company's wholly owned subsidiary in Chile, Atacama Salt Lakes SpA ("ASL"), holds in its name 85 licences over the Laguna Verde project as well as being party to the option agreement relating to the further 23 mining licences covering the Laguna Verde Project (see details of the Option Agreement in Schedule 1).

The nature of option agreements in Chile means that the option-holder had the exclusive right to acquire 100% of the relevant mining licences within a defined period of time by making certain payments, as detailed in the option agreement, normally based on achieving certain milestones or performance criteria.

ASL has met all payments due to date on the option agreement and had until April 2026 to exercise the option and make the due payments, which would have involved a mixture of cash payments and ordinary shares in the Company at that time. Details of what those payments would have involved are outlined in Schedule 1.

The Licences under option agreement were deemed by the ASX to be a key part of the Laguna Verde Project, which it considered to be the Company's "flagship asset", hence the need for ASL to own at least 51% of the Licences at the time of the listing.

ASX confirmed to the Company's Australian lawyers in Q1 2024 that the proposed new terms under the SPA should meet the requirements of the ASX listing, to own more than 51% of all the licences at all times, and that the payment of the first instalment to the Vendors should immediately address these requirements, enabling the Company to proceed with its planned dual-listing on the ASX.

SPA summary:

- The option agreement relating to the 23 licences has been terminated and replaced with a new SPA executed on 19 April 2024 to acquire 100% of these Licences. The Licences will be held under the Company's new wholly owned subsidiary in Chile, CleanTech Laguna Verde SpA ("CLV"). CLV will only hold the Licences and not the Laguna Verde project.

- First staged payment of US$1.25 million was made to the Vendors upon execution of the SPA and a further five fixed payments will be made on a defined time basis, between 6 - 60 months after the SPA execution date, totalling a further US$9.25 million.

- Only after commencement of sales of lithium carbonate equivalent ("LCE") from Laguna Verde, two further contingent payments will become payable to the Vendors (the "Contingent Payments"): (i) US$6.5 million once sales totalling 10,000 tonnes LCE have been made and (ii) US$18 million once cumulative sales totalling 35,000 tonnes LCE have been made. At this point, these payments are expected to equate to around 2-3% of the sales values of those volumes of LCE at the time, assuming a long-term LCE sales price of around US$22,500/tonne.

- Schedule of staged payments:

Milestone | Amount (US$) | Event of Default Reversion Interest |

Fixed Payments: | | |

Upon SPA execution and transfer of the Licences to CLV - already paid | 1,250,000 | 0% |

6 months after SPA execution | 1,250,000 | 49% |

18 months after SPA execution | 1,000,000 | 49% |

30 months after SPA execution | 1,000,000 | 49% |

42 months after SPA execution | 1,000,000 | 49% |

60 months after SPA execution or within 60 days of commencing the start of construction of the plant facilities at Laguna Verde - whichever comes first | 5,000,000 | 49% |

Total Fixed Payments | 10,500,000 | |

Contingent Payments: | | |

Within 60 days of cumulative sales of 10,000 tonnes LCE from Laguna Verde having been achieved (which would be equivalent to sales revenues for ASL of US$225 million at a LCE sales price of US$22,500/tonne LCE) (1) | 6,500,000 | 40% |

Within 60 days of cumulative sales of 35,000 tonnes LCE from Laguna Verde having been achieved (which would be equivalent to sales revenues for ASL of US$787.5 million at a LCE sales price of US$22,500/tonne LCE) (1). This payment to be made no more than 5 years after the previous contingent payment and all payments must be made within 10 years of the date of the SPA. | 18,000,000 | 30% |

Total Contingent Payments | 24,500,000 | |

Total Payments | 35,000,000 | |

Note (1): US$22,500 was the long-term LCE price included in the Laguna Verde Scoping Study and is still consistent with current long-term analyst price data.

- CLV will be managed and governed by Directors appointed by CTL, in-line with practices for wholly owned subsidiaries and as long as ASL continues to meet the staged payments to the Vendors on time, with no Event of Default occurring, ASL will retain 100% ownership of CLV and the Vendors will not be involved in the management or operations of CLV.

- In the event ASL should default on any staged payments, within 30 days of a default remedy period, ASL will be required to issue shares of up to 49% in CLV and establish a governance framework for CLV which comprises standardised elements for jointly operated entities including a shareholder agreement, Board of Directors, etc., which will protect the interests of the parties.

- In the Event of Default, a clawback mechanism will be in place to allow CTL to acquire back the shares without penalty by paying the default amount due including accrued interest. The shares held by the Vendors in CLV will then be acquired back by ASL.

Convertible Loan Notes ("CLNS" or "Convertible Notes"):

On 19 April 2024, the Company has issued the CLNS to a high-net-worth investor ("Noteholder") to raise gross proceeds of £1 million for the Company on what the Directors believe are advantageous terms.

Further details of the CLNS are set out below:

- The Noteholder has the right at any time to convert each Convertible Note, subject to a minimum denomination value of GBP £50,000, into ordinary shares in the Company by giving the Company 10 business day's written notice of its intention to convert ("Conversion Notice").

- The CLNS can be converted at any time into ordinary shares in the Company at the conversion price ("Conversion Price"), which is the lower of:

- a 50% premium to the 30-day Volume Weighted Average Price (as reported by Bloomberg) of the Shares ("VWAP") prior to a conversion notice; or

- £0.30 per ordinary share.

- The CLNS have a maturity date of 19 April 2027 ("Maturity Date").

- Interest will accrue daily and be calculated on the Denomination of the Convertible Notes outstanding. It will not include, and therefore not compound, any accrued interest. The interest rate is the Sterling Overnight Index Average rate, administered and published by the Bank of England, plus three (3) per cent.

- The Noteholder will have the option to have interest settled in cash on a semi-annual basis. Any interest not cash settled will be accrued and added to the balance owing to the Lender at the maturity date or at the time of any conversion.

- The Company may choose to early repay the outstanding balance of the CLNS at any time up to Maturity Date by providing at least 30 days' written notice to the Noteholder(s) ("Early Repayment Notice"). The settlement amount for early repayment will equal the amount of the CLNS outstanding, plus any accrued and unpaid interest at the date of the Early Repayment Notice, plus any interest which would have accrued on the outstanding CLNS outstanding up to the Maturity Date had the early repayment not occurred.

The information communicated within this announcement is deemed to constitute inside information as stipulated under the Market Abuse Regulations (EU) No 596/2014 which is part of UK law by virtue of the European Union (Withdrawal) Act 2018. Upon publication of this announcement, this inside information is now considered to be in the public domain. The person who arranged for the release of this announcement on behalf of the Company was Gordon Stein, Director and CFO.

For further information contact: |

| | |

CleanTech Lithium PLC | | |

Steve Kesler/Gordon Stein/Nick Baxter | Jersey office: +44 (0) 1534 668 321 Chile office: +562-32239222 | |

| Or via Celicourt | |

Celicourt Communications | +44 (0) 20 8434 2754 | |

Felicity Winkles/Philip Dennis | cleantech@celicourt.uk | |

Beaumont Cornish Limited (Nominated Adviser) Roland Cornish / Asia Szusciak | +44 (0) 207 628 3396 | |

Canaccord Genuity (Joint Broker) James Asensio | +44 (0) 207 523 4680 | |

|

| |

Fox-Davies Capital Limited (Joint Broker) | +44 (0) 20 3884 8450 | |

Daniel Fox-Davies | daniel@fox-davies.com | |

Beaumont Cornish Limited ("Beaumont Cornish") is the Company's Nominated Adviser and is authorised and regulated by the FCA. Beaumont Cornish's responsibilities as the Company's Nominated Adviser, including a responsibility to advise and guide the Company on its responsibilities under the AIM Rules for Companies and AIM Rules for Nominated Advisers, are owed solely to the London Stock Exchange. Beaumont Cornish is not acting for and will not be responsible to any other persons for providing protections afforded to customers of Beaumont Cornish nor for advising them in relation to the proposed arrangements described in this announcement or any matter referred to in it.

Notes

CleanTech Lithium (AIM:CTL, Frankfurt:T2N, OTCQX:CTLHF) is an exploration and development company advancing sustainable lithium projects in Chile for the clean energy transition. Committed to net-zero, CleanTech Lithium's mission is to produce material quantities of sustainable battery grade lithium products using Direct Lithium Extraction technology powered by renewable energy. The Company plans to be a leading supplier of 'green' lithium to the EV and battery manufacturing market.

CleanTech Lithium has two key lithium projects, Laguna Verde and Francisco Basin, and holds licences in Llamara and Salar de Atacama, located in the lithium triangle, a leading centre for battery grade lithium production. The two major projects: Laguna Verde and Francisco Basin are situated within basins controlled by the Company, which affords significant potential development and operational advantages. All four projects have direct access to existing infrastructure and renewable power.

CleanTech Lithium is committed to using renewable power for processing and reducing the environmental impact of its lithium production by utilising Direct Lithium Extraction with reinjection of spent brine. Direct Lithium Extraction is a transformative technology which removes lithium from brine, with higher recoveries than conventional processes. The method offers short development lead times with no extensive site construction or evaporation pond development so there is minimal water depletion from the aquifer. www.ctlithium.com

Source

Click here to connect with CleanTech Lithium PLC (AIM:CTL, OTCQX:CTLHF, Frankfurt:T2N), to receive an Investor Presentation

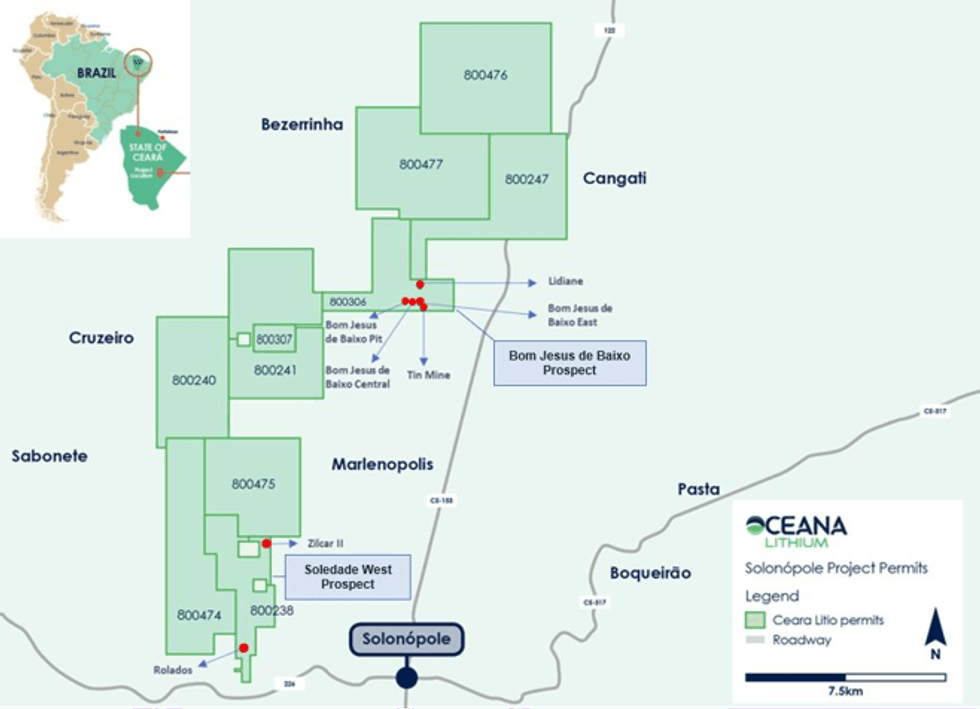

Figure 1: Solonópole Project permits and targets drilled in May – June 2023 (red dots)

Figure 1: Solonópole Project permits and targets drilled in May – June 2023 (red dots)

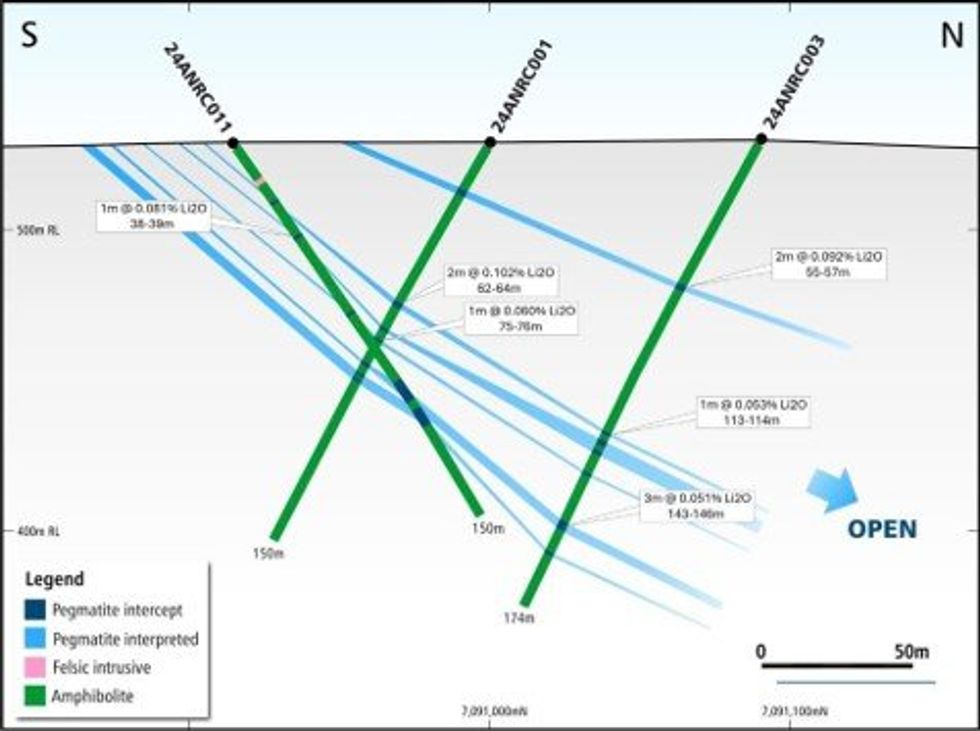

Figure 1: Cross-section of intercepted pegmatites showing significant results >0.05% Li2O.

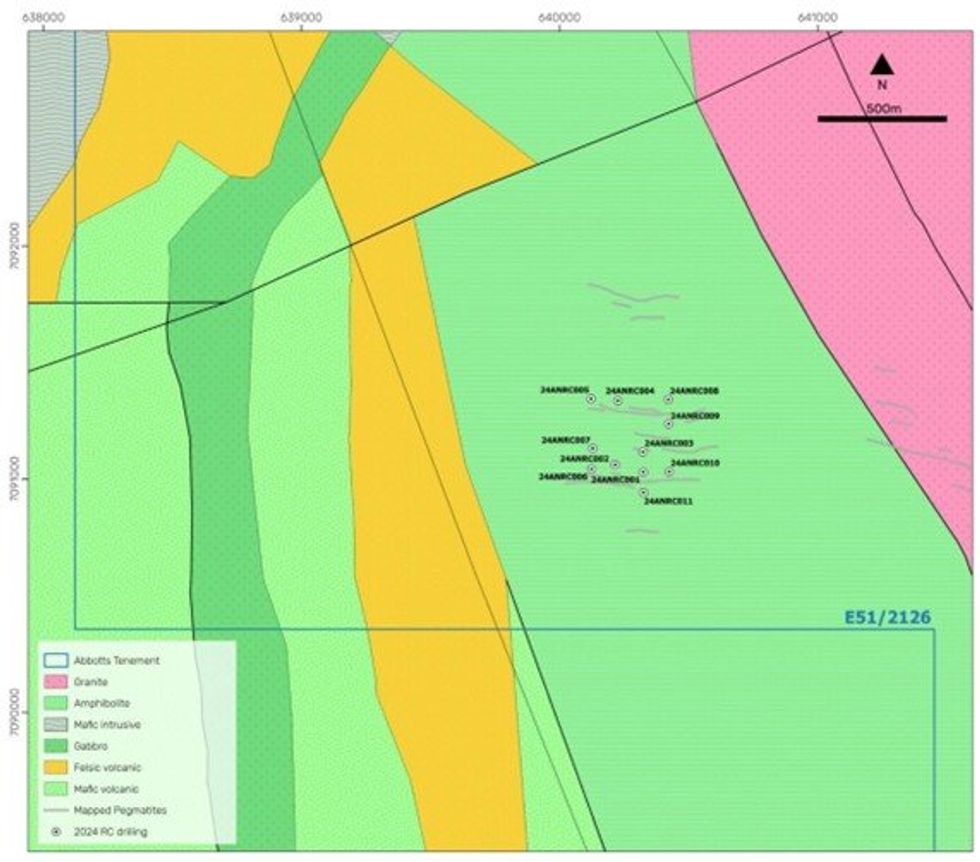

Figure 1: Cross-section of intercepted pegmatites showing significant results >0.05% Li2O. Figure 2: Geological map of the Buttamiah Prospect with collar locations of completed RC drilling.

Figure 2: Geological map of the Buttamiah Prospect with collar locations of completed RC drilling.