- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Sensore Secures Barton Gold as New Client in South Australia

SensOre Ltd (SensOre or the Company) (ASX: S3N) has signed a terms sheet with Barton Gold Holdings Limited (ASX: BGD) (Barton Gold) to adapt and refine SensOre’s cutting edge AI and machine learning DPT® technology to a portion of the Gawler Craton in South Australia surrounding Barton Gold’s assets.

The companies will focus on the targeting of gold and copper mineralisation.

The agreement is worth up to $400,000 in co-funding to add data to the Company’s South Australian data cube in the area surrounding Barton Gold’s tenements, with SensOre and Barton Gold operating in exclusive partnership on DPT® targets generated in that area. Barton will also become a SensOre client and, subject to production from new gold and copper targets identified via DPT®, SensOre will also be entitled to additional royalty fees linked to gold ounces produced (or copper equivalent).

Under the contract, Barton Gold will also join SensOre’s South Australian gold and copper prospectivity mapping initiative which includes Hillgrove Resources Pty Ltd, Argonaut Resources NL and Aroha Resources Pty Ltd. The subsequent DPT® engagement includes provision for integrating Barton Gold’s extensive data sets and deploying SensOre’s DPT® in the area.

Successful refinement of tools and methodologies for gold and copper exploration under cover in the Gawler Craton also offer significant potential to extend the outcomes to other regions of interest in Australia and internationally.

SensOre Chief Executive Officer Richard Taylor said: “We are excited to collaborate with Barton Gold who understand the tremendous upside potential that machine learning can bring to exploration and are already trialling machine learning technologies in the area including CSIRO’s machine learning adaptive sampling platform. This partnership is an important milestone in offering Australia-wide prospectivity mapping and AI-enhanced minerals targeting to innovative explorers.”

Barton Gold Managing Director Alexander Scanlon said: “We are pleased to join with SensOre in developing new tools and methodologies with the potential to significantly accelerate the mineral exploration and development cycle. We have closely followed SensOre’s technological progress as we have advanced our R&D pipeline for the central Gawler Craton and view the DPT® technology as a promising and timely complement to our other initiatives.”

SensOre’s engagement with Barton Gold is the latest of several SensOre client engagements that leverage the potential of SensOre’s multidimensional data cube and AI-enhanced targeting technology. SensOre and Barton Gold will now advance the terms sheet to a detailed binding agreement ahead of commencement.

Click here for the full ASX Release

This article includes content from SensOre, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Reddit Prices IPO at US$34 per Share — What to Know as Trading Begins

Reddit, one of the internet’s most popular discussion forums, is poised to make waves with its much-anticipated initial public offering (IPO) and trading debut, set to happen on Thursday (March 21).

The San Francisco-based company intends to list 22 million shares on the stock market at US$34 each, the high end of its anticipated range of US$31 to US$34. Reddit itself will sell 15.28 million shares, while its existing shareholders will sell 6.72 million shares; the company will not receive proceeds from shares sold by existing shareholders.

Reddit will trade on the New York Stock Exchange under the symbol RDDT.

Leading up to the news, reports suggested that Reddit's IPO was four to five times oversubscribed, indicating strong investor interest and positioning the company to reach the US$6.5 billion valuation it was hoping to achieve.

Founded in 2005, Reddit has evolved into a diverse platform hosting myriad discussions across over 100,000 active forums; called "subreddits," each of these niche areas focuses on its own topic. Reddit’s unique approach to community-driven content distinguishes it from traditional social media platforms.

Reddit has deviated from the usual IPO practice by reserving 8 percent of its shares for board members, employees, users and moderators. Only users, or “Redditors,” with established accounts as of January 1, 2024, will qualify, and shares will be allocated based on contributions and engagement metrics. These shares won’t be subject to lockup.

Despite its prominence, Reddit's IPO journey has been marked by deliberation, and the company's delayed entry into the public market has prompted questions about its strategy and long-term vision.

Reddit's association with events like the GameStop (NYSE:GME) short squeeze in January 2021 has also raised speculation about how the company's IPO will fare. Thousands of Redditors in the WallStreetBets subreddit played an integral role in causing GameStop's share price to skyrocket, leaving short sellers with major losses.

WallStreetBets participants have created volatility for other "meme stocks" as well. For now, it remains to be seen whether the company's own shares will be affected by these dynamics after listing.

However, it's worth noting that some Reddit users aren't thrilled about the IPO, or about the company's 2023 move to begin charging for API access. This decision forced the closure of popular third-party apps — some of which offered important accessibility features — and caused mass protests on the platform.

Jordan Zazzara, a moderator of WallStreetBets, plans to observe Reddit's performance before deciding whether to purchase shares of the company. “Not because I’m not generally optimistic about Reddit as a business, but because I’m sure it’s going to be volatile,” Zazzara told Bloomberg in an email.

There are also concerns regarding the viability of the company as a whole. Since its launch in 2005, Reddit has yet to have a profitable year, as per the Associated Press. This is compounded by the fact that user growth has stalled — IPO papers from Reddit state that its 500 million monthly users have not grown for the past three years.

On the flip side, Reddit CEO Steve Huffman remains optimistic about the future. Reddit recently unveiled a US$60 million partnership with Google focused on providing the tech giant with content it can use to train artificial intelligence models.

“I have never been more excited about Reddit’s future than I am right now,” Huffman wrote in the IPO papers. “... As the world becomes increasingly data-driven, we offer solutions that are human and experience-focused. We expect our data advantage and intellectual property to continue to be a key element in the training of future (large language models).”

Don't forget to follow us @INN_Technology for real-time updates!

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.

Should You Invest in the Magnificent 7?

The so-called "Magnificent 7" stocks have been a hot topic of discussion among investors and financial professionals, with their market activity and record-breaking performances being closely monitored.

However, amid this unprecedented rally, concerns about a potential market drop or correction are looming large as investors try to assess whether the current conditions are sustainable or a harbinger of future volatility.

In this article, the Investing News Network (INN) will explore the topic of the Magnificent 7 and its impact on the stock market and the broader economy.

Who are the Magnificent 7?

The term "Magnificent 7" was coined in 2023 by Bank of America analyst Michael Hartnett (although some give credit to Mike O'Rourke of Jones Trading), and refers to the seven large-cap tech stocks that came to dominate the markets in the final weeks of 2023 — namely, Apple, Meta Platforms, Nvidia, Tesla, Amazon, Microsoft and Alphabet, the parent company of Google.

The term is now a common moniker in the financial world. Daily reports on the companies' market activity have become a staple in all major news outlets, with analysts often speculating on what their record-breaking performances could mean for the stock market and the economy as a whole. The Magnificent 7 now serve as bellwethers of the tech sector, with their movements closely monitored by investors and financial professionals alike. Their influence seems to extend beyond their individual stock prices and serves as a signal of broader market trends and the health of the tech industry.

How are the Magnificent 7 performing?

Early on, some analysts expressed doubts about the continued relevance of the Magnificent 7. Indeed, as Nvidia blows past the other contenders and Tesla continues to lag farther behind – Tesla’s market cap now lags behind pharmaceutical giant Novo Nordisk – the diverging performance of individual stocks within the group has prompted some experts to now speak of the Fab Five, or even the Fab Four. These shifts have led O’Rourke to suggest that the era of the Magnificent 7 may be over.

Conversely, other analysts remain optimistic about the future of the Magnificent 7, highlighting their competitive advantages and dominant positions within their respective sectors.

“The Magnificent 7 group of leading technology companies is still a must-own, led by huge beats and stock reactions during the month from Facebook and Nvidia. But underneath the surface there are cracks emerging,” said Greg Taylor, chief investment officer at Purpose Investments, in a note on March 1, referring to the modest performances of Apple, Google and Tesla compared to Microsoft, Nvidia and Meta.

Tesla shares fell when Elon Musk failed to appease investor concerns over discouraging Q4 results in January, and dropped a further 7.2 percent on Monday (March 4) as the company reported its lowest sales in China since December 2022. Tesla has also been moved to reduce the price of its electric vehicles (EVs) in the face of competition from local makers like BYD. These events have led to Tesla's value diminishing in 2024. Last week (March 7), following positive early trial data for a new obesity drug, shares of Novo Nordisk surged upwards of 8 percent, bringing its market value above that of Tesla’s. As of writing, Novo Nordisk’s market cap sits at US$598.68 billion, while Tesla is valued at US$539.76 billion.

Meanwhile, Apple, which lost its title as the world’s most valuable company to Microsoft earlier this year, abandoned plans to create its own EV to focus on artificial intelligence (AI) projects to meet growing demand. While the company has been slow to unveil a product with AI capabilities, it has reportedly been working on generative AI tools to rival ChatGPT and Microsoft’s GitHub Copilot. Apple is also facing antitrust lawsuits in the US and Europe and was hit with a 1.8 billion euro fine by the European Commission on March 4.

On the other hand, Google’s Pixel 8 comes with AI features powered by its Tensor G3 chip, and its language model Gemini was chosen to be included in the Samsung Galaxy S24 series. Shares surged above the company’s all-time high on January 24 but fell a week later after fourth-quarter earnings revealed missed ad revenue expectations. The company also chose to pause Gemini’s image generation feature after it presented inaccurate historical depictions, an event that brought the stock down a further 4.4 percent.

On the other end of the spectrum, Meta issued its first-ever dividend to investors and made stock market history with its US$197 billion surge on February 2, and Microsoft claimed US$3 trillion in market capitalization for the first time in company history in January. The latter company is also rumored to be unveiling its first AI PC sometime in March.

However, Nvidia is leading the pack by a wide margin. The company’s fiscal year results, ending January 28, exceeded expectations by over US$2 billion, reflecting a remarkable 265 percent year-over-year growth. Nvidia’s performance drove a 10 percent increase in stock value, according to some analyses. Reuters reported an additional US$129 billion in stock market value after the results, with Nvidia as well as other hardware makers like Super Micro Computer, Broadcom and Arm Holdings being the biggest winners.

Is a bubble brewing?

The Magnificent 7 has had a significant impact on the overall performances of stock market indexes. The S&P 500 closed at a record high for the first time in two years in January and has notched a total of 15 record closes in 2024, most notably breaking the 5,000 level for the first time in its history in February. The Nasdaq also reached a new record high last week (February 29), beating its November 19, 2021 record close of 16,057.44 by 34.48 points. These gains were attributed to the strong performance of tech stocks, fueled by the growing enthusiasm and potential of AI.

However, when Reuters reported that all three of Wall Street's major indexes had retreated upwards of one percent on Tuesday, weakness in mega-cap growth and the chip sector was given as one of the reasons why. This observation suggests high sensitivity to the Magnificent 7’s performance and raises the question of how a significant downturn in their stock prices could impact the broader market.

“Markets have experienced an incredible rally since the end of October when everyone was convinced that Central Bankers had kept rates too high for too long. But as the data is getting better and the ‘soft landing’ seems more likely (at least in the US), markets have celebrated with a record run,” Taylor wrote in his note.

“However, the rally has not been broadly based, and concentration risk is becoming very real in many markets.”

Marko Kolanovic of JP Morgan recently cautioned clients in a note that the rapid ascent of both tech stocks and Bitcoin could indicate increasing “froth in the market”, a market condition where the price of an asset is uncorrelated from its intrinsic value. However, as Nils Pratley from The Guardian notes, the presence of froth does not necessarily signal an imminent end to current market conditions, especially given the sustained demand. Yahoo! Finance reported that Tom Lee of Fundsrat believes it’s premature to label the AI boom a “bubble peak”. Nvidia’s chips are the essential component to the speculative AI revolution that’s been driving the surge, and its customers have deep pockets. But while its role in the AI revolution and strong customer base suggests a positive outlook, it's important to consider the potential impact of all factors on the company's financial performance. Nvidia faces challenges that could impact its future growth prospects, such as political influence affecting sales in China. Further, many of its clients are seeking ways to reduce their reliance on Nvidia’s business, such as by developing their own chips.

While Nvidia's performance is emblematic of the broader success of the Magnificent 7, Yahoo! Finance executive editor Brian Sozzi points out that the connection between Nvidia's technology and the immediate financial success of its clients may not be as straightforward as it seems. “Just because Meta owns and uses some new Nvidia chips, how is that going to positively impact (Meta’s) earnings and cash flow over the next four quarters? Will it at all?” He alludes to economist and former Federal Reserve Chairman Alan Greenspan's term “irrational exuberance”, to describe investors indiscriminately increasing the stock prices of related companies as something that “makes sense until it doesn’t”.

He also argues against Solita Marcelli’s justification of Nvidia’s high price-to-earnings (P/E) ratio when compared against the S&P 500. Sozzi points out that Nvidia's stock price already reflects very optimistic assumptions about the company's future earnings growth, which leaves it with no room for anything other than absolute perfection. Therefore, Nvidia’s P/E may not be as "compelling" a value as the analyst suggests.

Past patterns or a new paradigm?

The current market rally is inviting parallels with the Dot-com Bubble of 2001 and a resurgence of investor optimism seen in 2021. In both 1999 and today, stock markets experienced robust bullish trends driven by investor optimism and excitement about technological advancements. Today, more than half of traders at Charles Schwab report a bullish outlook reminiscent of the sentiment seen in 1999, when the Nasdaq Composite Index, which is heavily influenced by tech stocks, saw significant gains.

However, there are important differences to consider between the economic landscapes of 1999 and today. One notable distinction is the inflationary environment. In 1999, inflation was relatively low and stable. Today’s economy faces higher inflation, which has become a significant concern for investors and policymakers alike.

The January 2024 Consumer Price Index (CPI) Report released on February 13 revealed a higher-than-expected inflation rate, reinforcing the Federal Reserve’s stance on maintaining current interest rates, pushing back estimates of potential rate cuts to June or July instead of March, as some optimistic analysts had previously anticipated. The market reacted with a drop in both stocks and bonds, a far cry from the “wide boost” deVere CEO Nigel Green, who advises against investing exclusively in the Magnificent 7, predicted the week prior. In an address to the House Financial Services Committee on March 6, US Federal Reserve Chair Jerome Powell told lawmakers that rate cuts wouldn’t be merited until further evidence of falling inflation was observed. The March 12 release of the February CPI also revealed that inflation remained relatively high, but the market reaction was considerably more muted.

Beyond inflation, another critical aspect to consider when comparing the market conditions of the past to today is the role of market concentration, as David Kostin of Goldman Sachs pointed out in a note. Further, he emphasized that the investment landscape has evolved since 2021. “In contrast with 2021, the cost of capital is much higher today and investors are focused on margins rather than “growth at any cost.” These tech giants have exhibited robust revenue growth and high-profit margins and are backed with large cash reserves and strong balance sheets, fundamentals that support the continued climb in stocks. And unlike the speculative nature of the crypto boom, for example, the AI boom is built around tangible products like GPUs, which have already demonstrated real-world utility and economic value in gaming, data centers and AI.

Is now a good time to invest?

As the market rally continues to forge ahead, some big tech bosses are seizing the opportunity to cash out while the market is hot. Amazon’s Jeff Bezos recently offloaded a staggering US$8.5 billion worth of shares, while Meta CEO Mark Zuckerberg has sold US$661 million shares of company stock in 2024. Nvidia insiders also sold off US$80 million in stocks soon after the company’s Q4 earnings report. While such moves might raise concerns about a potential market correction, finance analysts like Tobi Opeyemi Amure argue that these executives are simply capitalizing on their gains. "These founders and CEOs often wait until shares hit all-time highs before locking in profits or diversifying their wealth," said Amure in correspondence obtained by INN.

Moreover, the current rally is not limited to tech stocks; other assets such as gold are also on the rise. There are indications that the bullish sentiment is being felt globally, with stock markets in countries like Japan and Germany experiencing similar upward trends.

However, it’s important to recognize the potential challenges and risks that may arise. Tim Bray alludes to the macroeconomic factors that could eventually cause the bubble to pop, ranging from the environmental cost to the massive expense of data centers that power it. There is also the risk that AI might not live up to its hype for years, and progress in the field could stall as humans grapple with the challenges of regulating and implementing it at scale.

Furthermore, over-concentration in a few high-performing stocks, as highlighted by Orbis in their report “The Magnificent Middle” can increase the risk of a market correction. The authors advocate diversification and stress that midcap stocks should not be so quickly overlooked.

Taylor agrees. “The dream for investors would be a pause in the large-cap technology names and a catch-up rally for the lagging sectors. Presently, the rally is only held up by a few names, and the risk of a correction increases,” he said.

As the Magnificent 7's individual performances continue to fluctuate, their influence on the tech sector and the stock market as a whole remains a topic of interest for investors and analysts alike.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Meagen Seatter, hold no direct investment interest in any company mentioned in this article.

How to Invest in Technology (Updated 2024)

The evolution of technology has undoubtedly grabbed the interest of the general public and investors alike as innovation in diverse categories continues to move forward at a remarkable speed.

Overall, the technology sector has come a long way in the last two decades. In March 2000, the S&P 500's (INDEXSP:.INX) technology index hit its peak of 988.49 points, rising by almost 500 points in the five years leading up to the dotcom bubble. Similarly, the NASDAQ reached an all-time high of 5,000 points during this milestone period.

As of March 2024, the S&P 500's technology index had grown by more than 500 percent, while the NASDAQ had more than tripled. The tech market is now dominated by large players, with companies like Meta Platforms (NASDAQ:META), Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN), Netflix (NASDAQ:NFLX) and Alphabet (NASDAQ:GOOGL) creating vast monopolies.

With so much growth in the technology sector over the last two decades, tech developments are disrupting and shaping our cultural fabric at unprecedented speeds. Industries such as finance, real estate, transportation and healthcare are transforming with current technological advancements. Here's a breakdown of why investors should pay attention.

What should investors know about the tech market?

The past decade or so has seen the evolution of countless tech-related industries.

Take, for example, the cable industry, which has been transformed by video streaming. As of Q4 2023, Netflix (NASDAQ:NFLX) had expanded to over 190 countries worldwide with a subscriber base of 260 million. The streaming service giant generated US$33.7 billion revenue in 2023, a 6.6 percent increase on the previous year. Amazon Prime Video has also exploded in recent years, with over 230 million subscribers and revenues of US$40.2 billion in 2023.

Apple's Apple TV Plus and Disney's (NYSE:DIS) Disney Plus have joined the ranks of video-streaming service companies as well. While Apple has withheld the number of users it has garnered since launching in 2019, estimates put at upwards of 25 million for 2023. Disney Plus, which debuted the same year, had amassed more than 150 million subscribers as of February 2024.

Gaming is another industry benefiting from advancements in streaming technology. The mobile gaming market is growing faster than any other gaming segment in the world, according to market intelligence firm Precedence Research, which estimates that the segment brought in US$184.4 billion in 2022, equivalent to about half of global gaming revenue. In the years ahead, growth in global smartphone sales, cloud gaming, 5G and mobile infrastructure are expected to sustain growth in the mobile gaming sector.

The "fourth industrial revolution" has been tied to various disruptive technologies, including artificial intelligence (AI), 3D printing, and blockchain. The global AI market was worth US$196.63 billion in 2023, according to a Grand View Research report, with research and innovation spurring activity in verticals like the automotive, healthcare and finance industries. These segments are adopting solutions like machine learning, robotics, neurolinguistic programming and querying methods.

3D printing, valued at US$20.37 billion in 2023, may be a niche market, but it's growing rapidly based on a number of factors including the technology’s variety of benefits, such as mass customization, the production of complex parts and the ability to improve efficiencies in the manufacturing process.

Blockchain has, of course, also garnered interest in the tech sector; the size of the global market hit US$17.46 billion in 2023. Within this tech space, Grand View Research highlights “DeFi as an emerging financial technology based on blockchain, which reduces the control banks have on financial services and money.”

Which tech sectors have the most potential?

When looking at the technology market worldwide, its reach is almost untouchable — the 10 largest tech firms have a massive combined market capitalization of more than US$27 trillion.

Deloitte posits that the drive by enterprises to embrace digital transformation is pushing the growth of emerging technologies such as cloud computing, artificial intelligence and cybersecurity. “Analysts estimate that public cloud spending will grow by more than 20%, and they foresee stronger demand for cybersecurity. AI investment (not specifically generative AI) is also seen as contributing to overall spending growth. Economists have projected that AI-related investments could reach $200 billion globally by 2025, led by the United States,” Deloitte notes in its technology industry outlook.

With exciting and profound advancements in natural language processing and prediction, AI adoption is beginning to pick up, particularly with the advent of OpenAI's ChatGPT. The evolution of AI is projected to influence and shape society, and analysts estimate that revenues from AI will grow at a CAGR of 37.3 percent to reach more than US$1.81 trillion in 2030.

The mobile gaming market will also see growth in the years ahead, rising at a CAGR of 10.39 percent to reach an estimated US$164.81 billion by 2029. “The development of mobile games has resulted in scalability for the gaming industry. Platforms like Facebook and Instagram have also started to develop innovative mobile games to ensure high product differentiation and benefit from engaging games to enhance their advertisement strategies," states Mordor Intelligence in a recent report on the industry.

As for the future of 3D printing, Grand View Research projects a CAGR of 23.5 percent, which would create a market worth US$88.28 billion by 2030. According to the firm, that growth will be driven by increasing prototyping applications from industries like healthcare, aerospace and defense, as well as "aggressive research and development" on 3D printing.

Blockchain is another of the most promising sectors in the future of the tech space. Grand View Research is forecasting a CAGR of 87.7 percent between 2023 and 2030 to reach a market value of more than US$1.43 trillion. Blockchain's use for the healthcare sector is expected to experience the fastest growth during the period mentioned, driven by the demand for digitization in the industry and an increasing number of regulations aimed at protecting patient data.

How to invest in the tech industry?

Within the broad scope and magnitude of the tech industry, there are countless ways investors can gain exposure to transformative and disruptive technologies.

Exchange-traded funds (ETFs) provide exposure to a basket of securities and are a popular and often inexpensive method for investing. Here’s a brief overview of a few technology ETFs for consideration:

- iShares US Technology ETF (ARCA:IYW): This ETF began on November 12, 2001, and has 138 holdings. It covers big tech names such as Microsoft (NASDAQ:MSFT), Apple, Meta Platforms and Alphabet.

- Technology Select Sector SPDR (ARCA:XLK): This fund has 66 holdings and was started on December 16, 1998. It also holds major names, including NVIDIA (NASDAQ:NVDA), Broadcom (NASDAQ:AVGO) and Cisco (NASDAQ:CSCO), along with Apple, Microsoft and Alphabet.

- iShares Global Tech ETF (ARCA:IXN): Unlike the iShares US Technology ETF, this iShares fund focuses on technology companies from around the world. Founded in 2001, it provides exposure to Japan, Korea, Taiwan and Germany, but also offers a percentage of exposure to US companies. Its international holdings include Samsung Electronics (KRX:005930) and Taiwan Semiconductor Manufacturing Company (NYSE:TSM,TPE:2330).

More advanced investors or those willing to do their research may want to look at stocks in the tech space. Large-cap technology stocks are a good place to start, but it's possible to get specific as well — AI, robotics, esports, virtual reality and blockchain are just a few niche sectors those interested in tech may want to look into.

This is an updated version of an article originally published by the Investing News Network in 2016.

Don't forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

5 Biggest ASX Technology ETFs in 2024

It's indisputable that we're in an era of technology and our technological capabilities are exponentially increasing.

If you aren't reading this on a personal computer or laptop — unthinkable in 1970 — you're probably using a smartphone, and phones that can access the internet have only been around since 1996. For a further example, Apple's (NASDAQ:AAPL) meteoric rise is just as well known and needs no elaboration. The fact of the matter is that technology is integral to our life and advancements in the industry are shaping the future.

For any investor, the tech sector may be a desirable investment opportunity, and ETFs can be a safer way to get into an industry. For those unfamiliar, an ETF, or exchange-traded fund, is a basket of securities that is traded like a stock on an exchange and comes in many different types — market ETFs, foreign market ETFs, commodity ETFs and so on. Advantages include lower expense ratios, diversification and fewer broker commissions. One disadvantage is a low level of liquidity.

Here the Investing News Network looks at ASX technology ETFs for those interested in investing in the digital future.

How to invest in ASX technology ETFs?

ETFs, by their nature, are diverse or somewhat diverse options for investors. As mentioned, they’re a basket of securities, which means they can hold multiple stocks in a sector or may even cover more than one industry.

Fast-growing and already robust, Australia's tech sector is worth 8.5 percent of the country’s total GDP, or AU$167 billion. Furthermore, as of 2022, Australia ranked 16th in the world for digital competitiveness. Given the scale of the tech market in Australia and globally, ETFs can be a good choice for investors.

Beyond diversity, one of the main advantages of an ETF is the ability to buy and sell at any time during the trading day. That's in contrast to mutual funds, which trade at the end of the day.

One thing to watch for with ETFs is portfolio duplication. If your portfolio is diverse, make sure you aren't going to create a redundancy with an ETF — you can do this by checking your total exposure in a given sector, not just the exposure given by the ETF.

What are the biggest ASX technology ETFs?

Below, we’ll list some of the biggest ETFs in the Australian tech sector. The funds are listed in order of market capitalisation, with data gathered using TradingView’s stock screener on February 29, 2024.

1. Betashares NASDAQ 100 ETF

Market cap: AU$4.3 billion; year-to-date gain: 11.45 percent; current share price: AU$41.59

The Betashares NASDAQ 100 ETF (ASX:NDQ) devotes 50.4 percent of its holdings to technology, with the next-highest category, communication services, ranking at 15.5 percent.

2. Betashares Global Cybersecurity ETF

Market cap: AU$936.17 million; year-to-date gain: 11.19 percent; current share price: AU$12.12

The Betashares Global Cybersecurity ETF (ASX:HACK) specialises in cybersecurity, a market that protects and enhances other tech companies' offerings. The ETF's holdings are almost fully in the tech sector, with about 89 percent falling under that umbrella; about half of those are focused on systems software. As technologies advance, so do threats, making these services necessary for businesses and individuals.

3. Betashares Asia Technology Tigers

Market cap: AU$465.59 million; year-to-date gain: 6.05 percent; current share price: AU$8.06

The Betashares Asia Technology Tigers (ASX:ASIA) has is wholly focused on technology companies in Asia ex Japan, with 25 percent being in semiconductor companies. As for countries, China and Taiwan both make up about 35 percent of the ETF's holdings, with South Korea and India making up the majority of the remainder. Of course, this makes it not as globally representative as the other ETFs on this list.

4. Morningstar Global Technology ETF

Market cap: AU$362.21 million; year-to-date gain: 9.8 percent; current share price: AU$107.81

As its name implies, all of the holdings of the Morningstar Global Technology ETF (ASX:TECH) are in the tech sector. Although it does have holdings in several countries, the lion's share come from the US at around 67.2 percent.

5. Global X ROBO Global Robotics & Automation ETF

Market cap: AU$245.92 million; year-to-date gain: 4.26 percent; current share price: AU$76.58

The Global X ROBO Global Robotics & Automation ETF (ASX:ROBO) invests in robotics and automation stocks from around the world. Its portfolio includes companies that create these technologies and those that utilise them, such as companies involved in artificial intelligence, autonomous vehicles, industrial robots and more.

This is an updated version of an article first published by the Investing News Network in 2022.

Don’t forget to follow us @INN_Australia for real-time news updates!

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

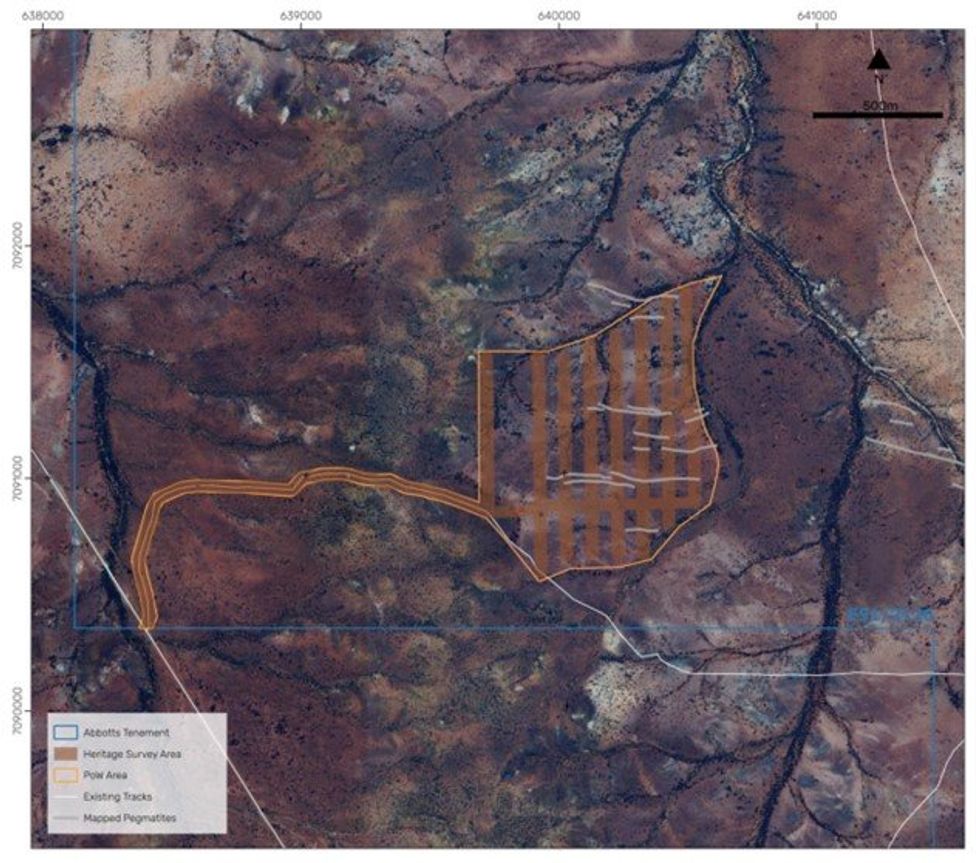

Heritage Clearances Received for Priority Drill Targets at Abbotts North

Premier1 Lithium (ASX:PLC) (“Premier1” or the “Company”) is pleased to announce that heritage clearances have been received for the first stage of the exploration drilling program at the Company’s Abbotts North Project located 35km north of Meekatharra, Western Australia.

HIGHLIGHTS

- Heritage clearances have been received for areas covering priority lithium pegmatite targets at the Abbotts North Project.

- Main Buttamiah Prospect now accessible for the February RC program

- Track and drill pad establishment has commenced and RC drilling rig is mobilising to site.

“With the receipt of the heritage survey report and the recent approval of the Programme of Work applications by the Department of Mines, Industry Regulation and Safety, we now have in place all the environmental and heritage approvals required for the first drilling program at Abbotts North. I thank the traditional owners of Abbotts North, the Ngoonooru Wajarri, for their advice and involvement in the process.

With site mobilisation having commenced and the RC rig already on its way, this is an important and exciting phase for Premier1.”

Priority Targets

The survey area covers the main Buttamiah Prospect where several parallel lithium bearing pegmatites have been mapped and sampled. The pegmatites strike approximately east west and single pegmatites can be traced in strike over an extended area. The RC program has been designed to test the depth and extent of the mineralised pegmatite field.

There remain further priority targets at the Abbotts North Project based on the latest completion of the first phase of field mapping, rock chip sampling and soil geochemistry in December 2023. The results from the soil survey highlighted areas of interest with anomalous responses comparable to the geochemical signature over the main Buttamiah Prospect (ASX 22 January 2024). Further follow up fieldwork will be conducted to assess these new priority targets and plan for further heritage clearance surveys.

Heritage Survey

The first heritage clearance survey at Abbotts North was completed by Archaeological Excavations Pty Ltd in conjunction with the Ngoonooru Wajarri people, who are the traditional owners of the lands and waters. The survey was conducted over several days, with participants from Archaelogical Excavations, the traditional owners and Premier1.

Programme of Work (“PoW”) approvals have been received from the Department of Mines, Industry Regulations and Safety (“DMIRS”) for 4.92ha of land within Exploration Licence E51/2126 (Table 1).

Premier1 Lithium now has in place sufficient PoW and heritage clearances to conduct RC drilling over the main target areas at the Abbotts North Project. The first drilling program is planned for approximately 2,000m. The focus is to define the continuity and extent of lithium mineralisation evident in rock chip samples taken from surface within the main Buttamiah Prospect.

Click here for the full ASX Release

This article includes content from SensOre, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Quarterly Activities Report to 31 December 2023

SensOre Limited (ASX: S3N or the Company), soon to be renamed Premier1 Lithium (ASX:P1L), is focused on tapping into the potential of Western Australia’s renowned lithium reserves. Its strategic exploration approach in this world-class mining jurisdiction is driven by a commitment to uncover valuable resources efficiently and effectively.

Highlights

- Capital Raising - $3m placement to new and existing institutions and sophisticated investors

- Demerger of technology business unit via in-specie distribution which took effect January 2024 Exploration gathering momentum:

- Abbotts North – Soil results at Abbotts North expanded the potential area of prospectivity

- Heritage survey successfully completed in December 2024 at Abbotts North

- Contract for RC drilling signed with Precision Exploration Drilling Pty Ltd

- Yalgoo – Tenure added with new farm-n signed with Firetail Resources

- Other Li Projects – Advanced data analysis and field programs on all projects Corporate – the SensOre board was reconstituted on 25 January 2024

- Abbotts North – Soil results at Abbotts North expanded the potential area of prospectivity

- Cash balance at 31 December 2023 $0.53m prior to proceeds of $3m raise received January 2024

Exploration

SensOre is working on a pipeline of promising lithium projects with Abbotts North being the premier exploration project hosting outcropping lithium bearing pegmatites.

Safety and Environment

SensOre conducted field exploration activity with no reportable ESG related incidents in the quarter.

Abbotts North Project

All heritage and environmental approvals are on track to facilitate first pass drilling in February 2024 with site mobilisation scheduled for 29 January 2024. Drilling will be undertaken by Precision Drilling Pty Ltd. The RC program is designed to drill test a series of outcropping lithium bearing pegmatite units along ~500-600m of strike length within the main Buttamiah Prospect area. The pegmatites show previously reported grades of up to 1.25% Li2O at surface. Approximately 2,000m of RC drilling is planned to test for lithium mineralisation continuity at depth and assess pegmatite scale, geometry and mineralogy.

Abbotts North Lithium Project

SensOre has also completed the first pass lithium targeted soil geochemistry program at the Abbotts North project for a total of 600 samples. Factor analysis (FA) was employed at Abbotts North with the purpose of identifying multielement signatures within the soil assay samples which may be indicative of Li mineralisation. The work was successful in identifying spatial and geochemical associations between lithium mineralisation and mapped geology. The results from the soil survey highlighted new areas of interest with anomalous responses comparable to the geochemical signature over the main lithium bearing pegmatite field. The soil anomalism also correlates with prominent structural contacts and corridors.

Click here for the full ASX Release

This article includes content from SensOre, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.