- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Sentinel Resources

District-scale potential in world-class jurisdictions

This Sentinel Resources profile is part of a paid investor education campaign.*

Overview

Sentinel Resources (CSE: SNL,OTC:SNLRF) is a Canadian exploration company targeting high-quality precious metals through the strategic acquisition of resource-rich properties located within world-class mining jurisdictions. The company's projects are currently in Australia, Peru and Canada. Each project benefits significantly from low-cost of entry or acquisition and easy access to infrastructure, minimizing capital and operational costs during explorational periods.

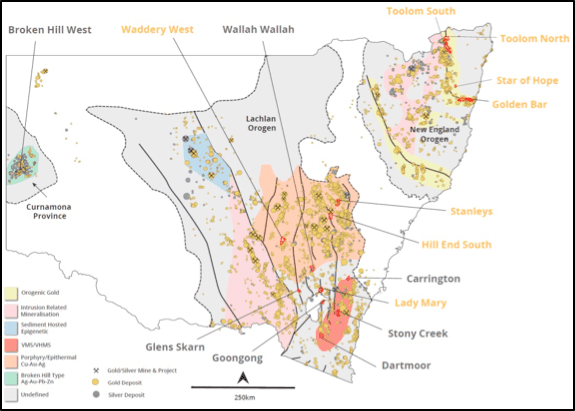

The company's flagship projects, located in New South Wales (NSW), Australia, have district-scale potential. NSW lies on the east coast of Australia and has been established as a prospective state for gold exploration and production since the 1850s. Between 2015 and 2016, NSW produced over 37 tonnes of gold, valued at AU$1.9 billion. Sentinel's property package in NSW includes 94,500 hectares and eight gold projects. At least 198 historic gold mines and gold exploration prospects are present across the NSW property package. Historic production records indicate that gold grades were often multi-ounce.

Sentinel has also acquired, through staking, seven silver-focused exploration concessions totaling 38,600 hectares in NSW. Sentinel's property package includes at least 23 historic silver and three historic gold mines and exploration prospects. Historic production records indicate high-grade silver production that exceeded 1 kg/t. Sentinel's technical team is currently reviewing historic data in order to fast-track reconnaissance follow-up and definition of high-grade, drill-ready targets.

Rob Gamley, president and CEO of Sentinel, commented, “The acquisition of eight strategically located gold projects within the prolifically mineralized Lachlan and New England orogenic belts provides the company with an extremely solid exploration portfolio on which to build. To acquire such a commanding land package, with numerous high-grade historic gold mines and showings, is a remarkable achievement given the large numbers of companies that are now focusing their acquisition and exploration activities in New South Wales. Our highly experienced team continues to review precious metal opportunities worldwide." The company's NSW property package is 100 percent owned with no NSRs, back-in rights, future cash payments or royalties.

Sentinel recently appointed a seasoned technical team with a proven track record of success in exploration. Gamley stated, “We are delighted to announce the appointment of such an experienced exploration and development team, which has over 90 combined years of experience in over 80 countries, across almost all commodities and deposits types, from grass roots through to resource definition and advanced project development. The technical team has significant public market experience and understands the importance of economically focused, results-driven exploration."

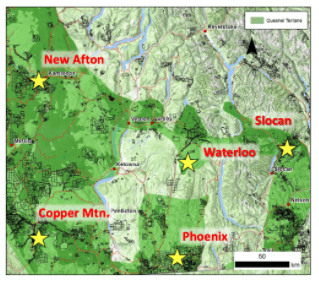

The company's property portfolio also includes the Salama project in Peru and the Waterloo project in British Columbia. The Waterloo property can be found 65 km east of Kelowna, near the historic Lightning Peak, a high-grade gold and silver mining camp. Several high-grade drill targets have been identified on-site. While the area has received attention historically, the Waterloo property has never been systematically drilled — Sentinel intends to capitalize on the significant potential for low-cost, high-grade gold and silver development.

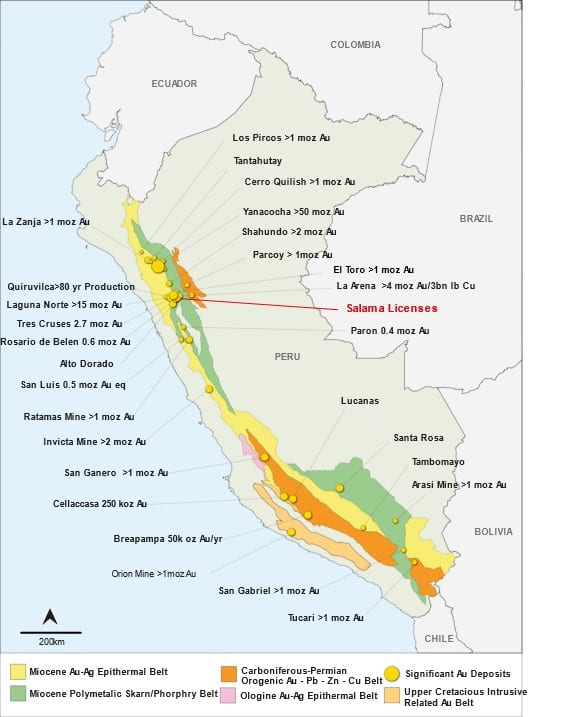

The company's Salama project consists of four gold-focused exploration concessions totaling 2,700 hectares located in the Anta province of Peru. The project is situated within the prolific gold-polymetallic Miocene skarn and porphyry belt. More than 20 million ounces of gold has been produced within a 45 km radius of the Salama concessions from established mines such as the Lagunas Norte, La Virgen, La Arena and others.

Sentinel Resources' Company Highlights

- Projects are located in mining-friendly jurisdictions: Australia, Peru and Canada.

- The eight gold projects and seven silver projects in NSW, Australia, are 100 percent owned.

- The NSW projects have no NSRs, future cash payments, back-in rights or royalties.

- The technical team has a proven track record of success in exploration and development.

- The Waterloo project is located near the historic Lightning Peak, a high-grade gold and silver mining camp.

- The Salama project is located within the prolific gold-polymetallic Miocene skarn and porphyry belt in the Anta province of Peru. The surrounding region has produced more than 20 Moz of gold.Request an Investor Kit:

Sentinel Resources

Sentinel Resources' Key Projects

New South Wales Project (Australia)

Sentinel's current NSW portfolio includes high-grade gold and silver orogenic projects. The portfolio consists of eight gold-focused concessions (Star of Hope, Golden Bar, Alliance Reef, Stanleys, Lady Mary, Waddery West, Wittagoona Reef and Toolom South) and seven silver-focused concessions (Wallah Wallah, Stony Creek, Carrington, Dartmoor, Glens Skarn, Broken Hill West and Goongong). At least 198 historic gold mines and 23 historic silver mines and exploration prospects are present across the entire NSW property package. Historic production records indicate that gold grades were often multi-ounce and that silver grades were generally high-grade and exceeded 1 kg/t Ag in some instances.

Mineralization

Mineralization

Five of Sentinel's eight NSW gold projects are located within the New England orogenic terrane, which hosts an extensive network of alluvial gold fields and, historically, has attracted a significant number of underground gold and silver mines. For instance, Toolom South, one of Sentinel's NSW gold projects, covers 165.5 square kilometers that includes over 60 historic gold mines and high-grade gold showings. Another project, Alliance Reef, traces 12 kilometers of the significantly mineralized Peel-Manning fault system. The Golden Bar covers nearly 200 square kilometers of the historic Orara-Coramba gold field.

Three projects are located within the Lachlan orogenic terrane of New South Wales, Victoria and eastern Tasmania. The Lachlan terrane is similarly prolific when it comes to economically significant mineralization of precious metals. The Stanleys property encompasses 90 square kilometers, and the land has hosted 17 historic gold mines and high-grade showings. Historic records cite production grades of up to 185 g/t gold. The Lady Mary property indicates 15 historic hard-rock mines and prospects. The primary target on the Warraderry West property is a 15 km gold-mineralized dyke swarm.

Six of Sentinel's seven NSW silver projects are located within the Lachlan Orogenic terrane, which comprises a series of well-mineralized accretionary terranes formed during the Ordovician and Early Carboniferous Period, making the exploration potential for silver excellent. For example, the Wallah Wallah covers 99 square kilometers, including 6 historic high-grade silver mines. Historic records indicate several thousand tonnes of material was processed at grades of 950 g/t Ag and 30 percent Pb.

Stoney Creek, another project, is an 81 square kilometer license hosting 7 high-grade historic silver and gold mines and showings. Carrington contains a number of historic mines and workings within gold-silver mineralized gossanous lodes; historic rock chip grab samples of this material assayed up to 85 g/t Au, 6037 g/t Ag, 24.85 Pb and 16.75 percent Sb. In the Curnamona Province, the Broken Hill West project is located 2.5 kilometers west of the Broken Hill mine complex and shares the same geological setting and structure.

Next Steps

The evaluation of all 198 historic mines and prospects in phase one is almost complete. Selection of the top 50 percent ranked targets will be prioritized for phase two and the remaining 50 percent will be considered for joint venture or subsequent development. Phase two of exploration involves geological mapping to estimate maximum depths, strike continuity and other critical details. A combination underground and surface regolith sampling will verify historical sampling grades and extend mineralised surface footprints. Data from phase two will inform geochemical surface sampling and geophysical surveys in phase three, which will focus on identifying robust drill-ready targets.

Salama Project (Peru)

The Salama property totals 2,700 hectares in the Anta province of Peru. The property is situated within the prolific gold-polymetallic Miocene skarn and porphyry belt, one of several metallogenic belts that run parallel to Peru's coast and have hosted the country's most significant deposits. Preliminary reviews reveal an extensive network of quartz veins with localized silicified breccias, which have been the focus of high-grade historic gold mining in the area. Historic production at the nearby La Virgen gold mine totaled 12 Koz gold per annum.

Waterloo Project (BC, Canada)

The Waterloo property covers 3,130 hectares in Kelowna, a mining-friendly jurisdiction located within British Columbia. Historically, the property has hosted a number of high-grade gold and silver operations since the early 1990s. High-grade prospects define a 4 kilometer strike from east to west, underscoring the potential for high-quality resource development that benefits from existing infrastructure.

Sentinel Resources

Sentinel Resources' Management Team

Rob Gamley—President, CEO and Director

Rob Gamley's career spans over 10 years in corporate finance and consulting, providing corporate strategy and communications services to public companies across a broad range of industries including natural resource exploration and development. He has been a board member of several TSXV-listed companies and brings extensive capital markets experience and a considerable network of both retail and institutional contacts. Gamley graduated in 1998 with a Bachelor of Science from the University of British Columbia.

Dr. Peter Pollard—Director and Chief Geologist

Dr. Peter Pollard brings more than 30 years of global research and mineral exploration consulting experience. He is a recognized expert in intrusion-related mineralized systems including copper-gold porphyry (e.g. Grasberg, Escondida Norte, Oyu Tolgoi, Ok Tedi, SarCheshmeh district), tin-tungsten-molybdenum-bismuth-gold (e.g. Herberton, Zaaiplaats, Timbarra, Mongolia), iron-oxide copper-gold-uranium (e.g. Olympic Dam, Carajas, Cloncurry, Chile, Mexico, Mauritania) and gold-silver systems (low-sulphidation, high-sulphidation, mesothermal).

Pollard has presented short courses on ore deposit geology to the industry for more than 25 years. He has been a regular speaker at major conferences and has significant experience presenting to analysts, shareholders and board members. He is a qualified person (NI43-101 and JORC) with strong technical and scientific writing skills. Pollard has been engaged as a reviewer of papers for international journals and has authored, or co-authored, over 70 peer-reviewed scientific publications. Pollard has held a number of board positions in public and private companies.

Danny Marcos—Exploration Manager

Danny is a field-orientated exploration geologist with over 30 years of experience. This included responsibility for the review and prioritisation of precious and base metals projects for both major and junior companies — including the design and management of field mapping and geochemical programs, data compilation/review and target generation. He has a strong focus on delivering results including completion of large drill programs from regional (greenfields) to advanced/resource stage. Marcos has specialist experience with porphyry Cu-Au systems; low, intermediate and high sulphidation Au-Ag epithermal deposits; orogenic Au; and base-metal and nickel mineralization. He was a key member of the WMC technical team that discovered the Tampakan Cu-Au deposit in the Philippines — a resource of 15 Mt Cu and 17.6 Moz Au.

Marcos has proven ability managing multidisciplinary and multi-cultural, high talent teams under diverse cultural and physiographic regimes, having spent considerable time exploring in Australia and Asia-Pacific. Marcos has a strong understanding of deposit models and key controls on mineralization, allowing for robust drill targeting of high priority targets. He has a strong economic focus and is experienced in identifying business development for potential growth opportunities.

Dr. Chris Wilson—Senior Advisor

Dr. Chris Wilson is a commercially driven and innovative exploration geologist with over 30 years of global experience in area selection and prospect generation, target generation and the design and management of large resource definition drilling and pre-feasibility programs. He has worked in over 75 countries, on most commodities and deposit styles. Wilson has extensive project review and target generation experience, with the ability to integrate complex multi-disciplinary datasets and rapidly identify and test high value targets. A strong deposit model knowledge ensures key controls on mineralization are placed within the wider context of a project's geological, structural and hydrothermal evolution. Most recently Wilson has been involved in global project valuation and fatal flaw analysis for high net-worth investors.

Wilson is a Qualified Person for JORC and NI 43-10 compliant reporting and valuation. He has worked for Ivanhoe Mines for 10 years as an exploration manager. At Mongolia, he was responsible for an exploration portfolio of over 11 million hectares. He has extensive public market and public company experience including board of director positions.

*Disclaimer: This profile is sponsored by Sentinel Resources (CSE: SNL,OTC:SNLRF). This profile provides information which was sourced by the Investing News Network (INN) and approved by Sentinel Resources in order to help investors learn more about the company. Sentinel Resources is a client of INN. The company's campaign fees pay for INN to create and update this profile.

INN does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. INN does not endorse or recommend the business, products, services or securities of any company profiled.

The information contained here is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Readers should conduct their own research for all information publicly available concerning the company. Prior to making any investment decision, it is recommended that readers consult directly with Sentinel Resources and seek advice from a qualified investment advisor.

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.