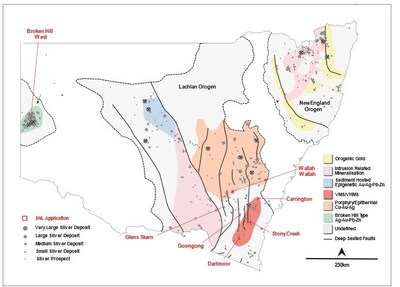

Sentinel Resources Corp. (CSE: SNL) (US OTC PINK: SNLRF) (“Sentinel” or the “Company “) is pleased to announce that its seasoned exploration team of Dr. Peter Pollard director and Chief Geologist of Sentinel, and Dr. Christopher Wilson senior advisor to Sentinel, has provided an initial review of Sentinel’s seven highly prospective, silver-focused exploration licenses located in New South Wales, Australia . The exploration licenses are known as Wallah Wallah, Stony Creek, Carrington, Dartmoor, Glens Skarns, Broken Hill West and Goongong (collectively, the ” Silver Projects “)(Figure 1).

First-pass review of the extensive historic data for the Silver Projects indicates that Wallah Wallah, Stoney Creek and Carrington are high priority projects. All are located in a significantly silver-mineralized part of the southern Lachlan Orogenic Belt. Review of the other Silver Project licenses is ongoing. Once complete Sentinel will provide an update on the planned work program.

Highlights:

Wallah Wallah (ELA 6065)

- A 99 km 2 licence hosting 6 historic silver mines and showings with reported rock-chip grades of over 1,000 g/t Ag.

- The historic Wallah Wallah prospect comprises mineralized lodes which crop out as gossans over a strike length of 2 kilometres.

- Historic records indicate that one lode was exploited to a depth of at least 46 m on four levels. Records indicate several thousand tonnes of material was processed at grades of 950 g/t Ag and 30% Pb 1 .

- The system is relatively unexplored, but the presence of minor tin, topaz and tourmaline with the silver-lead mineralization suggests it forms part of an intrusion-related system possibly related to nearby Devonian granites.

Stoney Creek (ELA 6082)

- An 81 km 2 licence hosting 7 high-grade, historic silver and gold mines and showings. Mineralization is likely of a low-sulphidation epithermal type — characterized by vein-hosted high-grade shoots.

- The Stoney Creek prospect comprises quartz-sulphide veins within an 85 m wide zone of alteration. Historic rock-chip grab samples assayed up to 18 g/t Au and 212 g/t Ag.

- Gundillions Reef is defined by a series of shafts, drives and small open pits that have been worked to a depth of approximately 200 metres. Rock-chip grab samples have returned assays of up to 50 g/t Au.

Carrington (ELA 6080)

- Carrington contains a number of historic mines and workings within gold-silver mineralized gossanous lodes. Gossans form when sulphide mineralization is exposed to surface and “rusts” to an iron oxide residue. Gossans are important vectors to underlying sulphide mineralization.

- Three historic silver-gold mines targeted silver-gold mineralized gossans. Historic rock chip grab samples of this material assayed up to 85 g/t Au, 6037 g/t Ag, 24.85 Pb and 16.75% Sb (antimony).

- Significantly, the NSW government “minview” website states that over 0.5 Mt of iron gossan is present. This is significant given silver-gold mineralization is associated with gossans developed above primary sulphide mineralization. The tonnage cited suggests a robust system.

Additional Silver Projects (ELA 6080)

- Sentinel’s review of Broken Hill West (EAL 6078), Glens Skarns (ELA 6066), Goongong (ELA 6091) and Dartmoor (ELA 6084) is ongoing:

- Broken Hill West is located 2.5 km to the west of the Broken Hill mine complex and shares similar geology and structure. There has been minimal exploration due to an extensive cover of recent alluvium.

- Glens Skarns has four mineralized skarns over a strike length of 7.5 km. The Sentinel team believes these are four priority targets.

- Historic rock chip sampling at Glens Skarns returned results of up to 80 g/t Ag, 5% Cu, 0.28% Pb, 1.26 % Zn, 100 g/t Sn and 1700 g/t W (tungsten).

- Dartmoor hosts Kuroko-style VMS mineralization which can be traced as gossanous outcrops over a strike length of 1.5 km. Small scale historic production records cite silver grades of up to 900 g/t.

- Goongong hosts four historic silver mines and prospects of polymetallic skarn style with anomalous silver, copper, lead, zinc, tin and tungsten.

Rob Gamley , CEO of Sentinel, commented, “We are pleased that we hold seven highly prospective silver exploration licenses in New South Wales , which is well known for its silver-rich deposits. Whilst the review of historic data is ongoing, Sentinel’s technical team has now identified Wallah Wallah, Stoney Creek and Carrington as very high priority exploration licenses. The very large historic dataset available adds significant value to first pass project ranking. The technical team continues to review and model this data in order to prioritize the remaining silver licenses. The huge task of fully assessing this portfolio of assets continues. In addition to high-grade silver mineralization, Stoney Creek and Carrington, also report extremely high gold assays”.

Qualified Person

Christopher Wilson , Ph.D., FAusIMM (CP), FSEG, a Qualified Person, has reviewed and approved the scientific and technical information contained in this news release. The historical information on the exploration licenses was obtained from the New South Wales Department of Planning, Industry and Environment.

About Sentinel Resources

Sentinel Resources is a Canadian-based exploration company focused on the acquisition and exploration of gold and silver projects with world-class potential. Its current portfolio includes high-grade gold and silver orogenic projects in New South Wales, Australia as well as the Salama Gold Project, Peru. Sentinel Resources also has interests in the Waterloo, Pass, and Little Bear projects in British Columbia. The Company’s guiding principles are based on acquiring strategic exploration properties in mining-friendly jurisdictions with historical mining industries, low-cost of entry or acquisition, and easy access to infrastructure to minimize capital and operational costs in explorational periods. For more information, please go to the Company’s website at www.sentinelexp.com .

Sentinel Resources Corp.

“Rob Gamley”

President and Chief Executive Officer

Forward-Looking Statements

Information set forth in this news release contains forward-looking statements that are based on assumptions as of the date of this news release. These statements reflect management’s current estimates, beliefs, intentions and expectations. They are not guarantees of future performance. Sentinel cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond Sentinel’s control. Such factors include, among other things: risks and uncertainties relating to Sentinel’s limited operating history, ability to obtain sufficient financing to carry out its exploration and development objectives on its mineral properties, obtaining the necessary permits to carry out its activities and the need to comply with environmental and governmental regulations. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, Sentinel undertakes no obligation to publicly update or revise forward-looking information.

Neither the Canadian Securities Exchange (“CSE”) nor its Regulation Services Provider (as that term is defined in the policies of the CSE) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE Sentinel Resources Corp.