- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

Carbon Done Right

International Graphite

Trident Royalties PLC

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

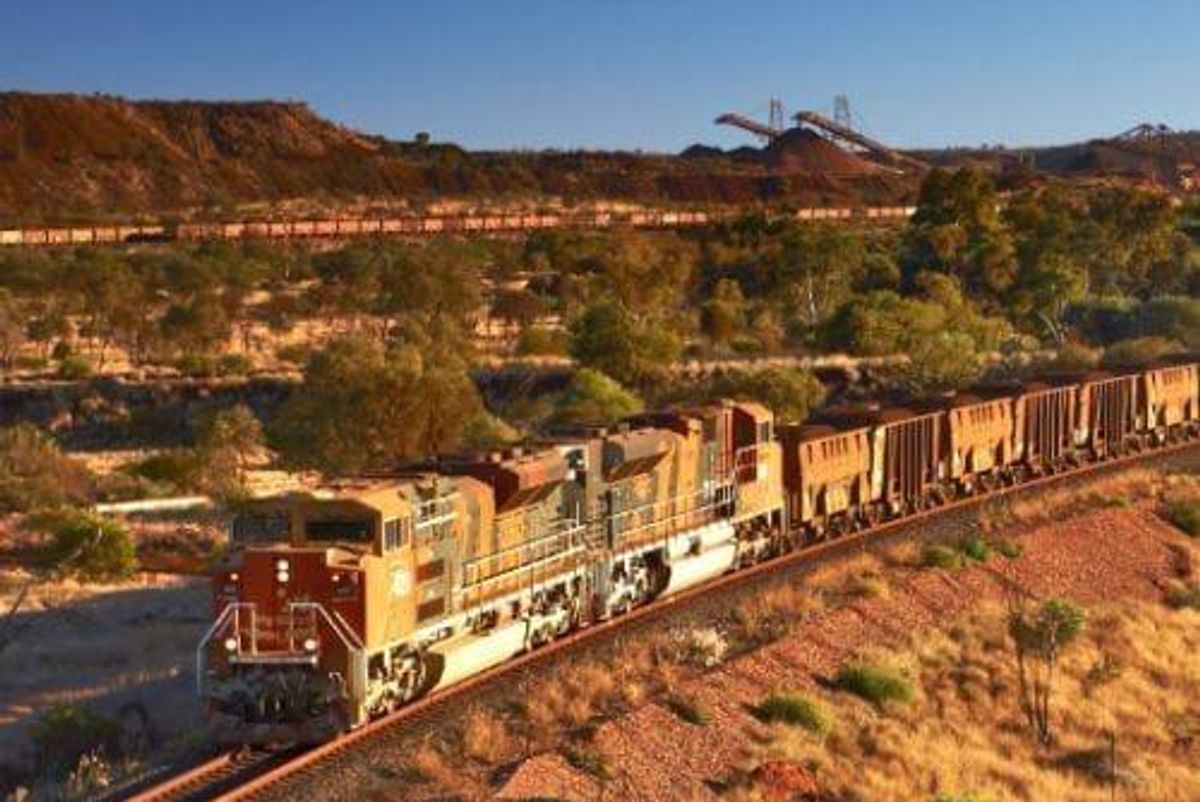

South Flank Iron Ore Project Blasts into Construction Phase

The progress comes three months after owner BHP Billiton gave itself the internal green light to proceed with South Flank.

BHP Billiton (ASX:BHP,NYSE:BHP,LSE:BLT) has made a bang at its South Flank iron mine replacement project, setting off the first blast at the Pilbara site on Tuesday (September 18).

After the turning of the sod ceremony in July, the company has gotten down to business of blowing things up. The birth of the new mine can be seen in a video posted to the company’s LinkedIn account on Wednesday, showing the huge scale of the operation which will eventually create more than 3,000 jobs.

The progress comes three months after BHP gave itself the internal green light to proceed with South Flank, when it announced it would spend AU$2.9 billion on the project to directly replace the aging 80 million tonne per year Yandi mine, also in the Pilbara.

Head of BHP’s operations in Australia, Mike Henry, said at the time that South Flank would create 2,500 construction jobs, more than 600 ongoing operational roles and generate opportunities for Western Australian suppliers while increasing the iron content of BHP iron ore to 62 percent to better suit customer needs in China.

The South Flank project will require the expansion of existing infrastructure at Mining Area C, one of the five mines operated by BHP in the region.

To achieve planned first ore by 2021, BHP needs to build a 80 million tonne per year crushing and screening plant, an overland conveyor system, a stockyard and train-loading facilities. It will also procure a new mining fleet and perform substantial mine development and prestrip work to bring South Flank online.

The company estimates it will operate for 25 years from first production.

The Anglo-Australian miner has an 85-percent stake in the project, with the balance owned by Japanese conglomerates Mitsui (TSE:8031), which controls 7 percent, and ITOCHU (TSE:8001), which controls 8 percent of the project.

South Flank is one of three major iron ore replacement mines in the region, joining Rio Tinto’s (ASX:RIO,NYSE:RIO,LSE:RIO) US$2.2-billion Koodaideri project and Fortescue Metals’ (ASX:FMG) US$1.275-billion Eliwana project.

In other news for the company, BHP posted its 2017-18 end of financial year results at the end of August, showing a 33 percent increase in profits.

It also announced via the ASX that it would be asking shareholders to vote on changing the company’s name to BHP Group, dropping ‘Billiton’ officially—although it has been marketing itself as simply BHP since May 2017 when it spun off South32 (ASX:S32).

On the Australian Securities Exchange, BHP was trading at AU$32.77 as of market close on Thursday (September 20) AEST, up 1.14 percent.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Scott Tibballs, hold no direct investment interest in any company mentioned in this article.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2323.96 | -9.43 | |

| Silver | 27.32 | 0.00 | |

| Copper | 4.45 | -0.01 | |

| Oil | 83.50 | +0.14 | |

| Heating Oil | 2.58 | 0.00 | |

| Natural Gas | 1.83 | +0.02 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.

Scott has a Master's Degree in journalism from the University of Melbourne and reports on the resources industry for INN.

Scott has experience working in regional and small-town newsrooms in Australia. With a background in history and politics, he's interested in international politics and development and how the resources industry plays a role in the future.

Learn about our editorial policies.