Overview

The world of business technology has evolved. Driven by the shift towards distributed work and cloud application delivery, enterprise infrastructure is undergoing a transformation. Legacy infrastructure is rapidly giving way to hybrid cloud data center models, and businesses are increasingly embracing cloud microservices in lieu of monolithic software platforms.

For the uninitiated, microservices represent a unique approach to application development and design. Rather than being inextricable parts of a unified whole, microservices architecture reimagines an application's various functions as a collection of independent, loosely-coupled services supported by application programming interfaces — definitions and protocols through which software components can communicate with one another.

Owing to their agility, flexibility and ease of deployment, microservices are quickly eclipsing monolithic applications. As a result, the microservices architecture market is projected to reach US$21.61 billion by 2030 at a compounded annual growth rate of 18.6 percent.

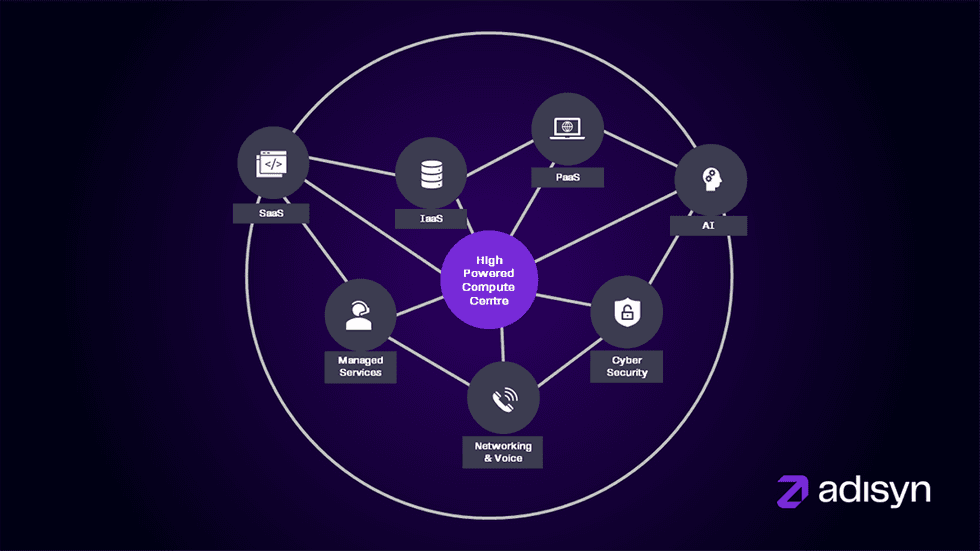

Adisyn Ltd. (ASX:AI1) intends to take full advantage of this growth, leveraging its team of experienced technology specialists and engineers. Originally offering a suite of vertically integrated services covering every aspect of data center and cloud technologies, the company has pivoted its business strategy, focusing on the development of advanced, AI-powered microservices.

Through strategic acquisitions, Adisyn will allow customers to capitalize on a fast-evolving market and access advanced software and IT capabilities — all without the need for in-house developers. With a fully configurable platform, the company also empowers customers to build their ideal software solutions.

Adisyn has charted out an extensive growth strategy consisting of multiple phases. The first phase, completed in 2022, included its ASX listing, the establishment and design accreditation of its advanced Tier III Bibra Lake Data Centre, and ISO 27001 certification for data security. The company is currently in its second phase, expected to conclude in 2025.

Adisyn has completed two acquisitions, acquiring managed services provider Attained and Cyber security company, Thomas Cyber. From here, it plans to seek out further complementary acquisitions and partnerships in the microservices tech space while expanding across Australia and Asia-Pacific (APAC). Another key focus in this phase is to leverage its existing assets to grow revenue as it continues a broader technological restructuring.

Its third and final phase, set to commence from 2025 to 2027, will see the company target global expansion and establish itself as a key player in the microservices space through the development of a unique end-to-end enterprise offering.

Company Highlights

- Hybrid cloud is transforming enterprise infrastructure and driving investment decisions, including around the development of microservices.

- The microservices architecture market is expected to reach US$21.6 billion by 2030, driven by the need for digital transformation, the shift to microservices infrastructure and the growing prominence of artificial intelligence.

- Adisyn, an Australian technology company specializing in microservices powered by AI, is positioned to become the only ASX-listed company focused primarily on the design and delivery of vertically integrated end-to-end microservices.

- A world-class cloud and managed service provider, Adisyn is leveraging a state-of-the-art data center to provide next-gen microservices architecture powered by artificial intelligence.

- The company’s ISO-27001 certification ensures that all its services are protected with industry-leading cybersecurity standards.

- Adisyn's growth strategy will focus on strategic mergers and acquisitions that align with its goals to:

- Expand its intellectual property, technology and expertise

- Improve customer experiences and offer new services

- Acquire new clients

- Improve efficiency and reduce operational costs

- Expand its geographic reach across Australia and the Asia-Pacific region

- The company's December 2022 acquisition of managed service provider Attained fits well with its new business strategy, which prioritizes direct and collaborative client relationships.

Key Assets and Technologies

Attained Group

Acquired by Adisyn in December 2022, Attained is one of Australia's premier providers of managed services. Based in Perth, the company writes, implements and manages a range of IT solutions, including cybersecurity, cloud services, network management and voice solutions. More recently, the company has shifted its focus to the delivery of microservices for which it is internally developing AI capabilities.

Highlights:

- Highly Profitable: Attained has been operational for over 15 years and provides services for over a hundred business clients. From 2020 to 2023, it averaged $3 million in unaudited annual revenue.

- Experienced Management: Several members of Attained's leadership have since joined Adisyn, including veteran COO Paul Arch and expert technologist Liam Gale.

- A Strategic Cornerstone: Attained is a critical pillar of Adisyn's current plan to build a multi-layered, end-to-end microservices offering. The acquisition has also provided Adisyn with financial, technology and management benefits for its next phase of growth.

Thomas Cyber

Acquired by Adisyn in July 2023, Thomas Cyber operates an established cyber security business, catering to a diverse client base that includes ASX-listed companies, government organizations, and private entities across Australia and internationally.

Operating as Adisyn Cyber, a division of Adisyn Ltd, the team delivers enhanced cybersecurity services ensuring the protection and integrity of digital assets in an evolving landscape.

Highlights:

- The acquisition of Thomas Cyber is aligned with Adisyn’s strategy to acquire technology and attract talented individuals, enhance capabilities and market position to drive continued organic growth.

- Through this transaction, Adisyn achieves an additional milestone in its strategy to create an end-to-end market offering in the broader cloud microservices sector.

Core Infrastructure

Adisyn's focus was originally on physical infrastructure and cloud services. Over the years, it has created world-class capabilities in the cloud space, stemming from its managed cloud services. Although the company has now pivoted to microservices, its existing technology and technical expertise will serve it incredibly well in supporting the coming market shift.

Highlights:

- State-of-the-art Data Centre: Adisyn's robust data center is designed with both power and reliability front-of-mind, built to accommodate a wide range of customer requirements. They will form the backbone of its new microservices architecture.

- Cloud Environments: The company operates its own ISO 27001 cloud platform in both Perth and Darwin, and regularly creates and maintains hybrid clouds for its clientele.

Leadership Team

Shane Wee - Non-executive Chairman

Shane Wee has extensive ASX experience and has worked in the financial services industry for the past 30 years. He was a founding director of Alto Capital, until his retirement in June 2021, where he held multiple corporate and advisor roles with various ASX entities and built a network of contacts across Australia and South East Asia.

Blake Burton - Managing Director

Blake Burton has served as managing director of Adisyn since July 2022. He has extensive experience in the IT industry, having founded his own web hosting company which he took to a successful trade sale to Australia’s largest privately owned web host.

Paul Arch - Chief Operating Officer

Paul Arch has an extensive background in emerging technologies and leadership. He has brought several successful opportunities to the Australian technology space. Arch served as founder of Datamate Backups Services and Adisyn West data center in Perth and also played a key role in the founding of Attained Group.

Jesper Sentow - Chief Financial Officer

Jesper Sentow has more than 25 years’ experience as a chief financial officer, company secretary of public and private Australian and international companies across Europe, India, and Southeast Asia. Sentow specialises in corporate financial management and strategic planning, corporate governance and commercial improvement.

Liam Gale - Chief Information Officer

Liam Gale is a highly skilled and experienced technical leader with a strong background in managed IT services. He has served as managing director of specialist IT solutions provider Aviso IT and more recently as CTO of Attained Group.

Justin Thomas - Chief Technology Officer and Director

Justin Thomas has over 20 years experience in the IT Industry. Prior to Adisyn, in 2007 he successfully established and sold a real estate software business to RP Data. In 2012, he built and sold a data center to Amcom (now known as Vocus).

Thomas Jreige - Chief Security Officer

With more than 20 years of experience, Thomas Jreige is a trusted cybersecurity consultant and advisor. His expertise covers various sectors, including national security, health, finance and resources. As the chief security officer at Adisyn, Jreige brings a wealth of knowledge from his previous roles in management consultancy and principal advisory.