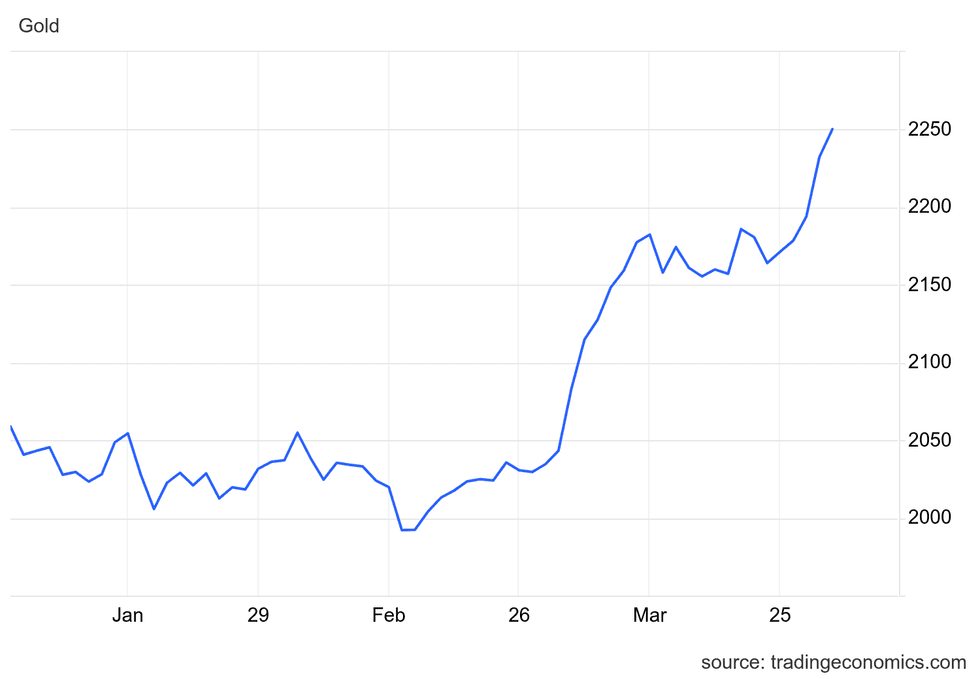

The average market price for gold in Q1 was $2,070 per ounce while the average market price for copper in Q1 was $3.83 per pound.

As planned, preliminary Q1 gold production was lower than Q4 2023 mainly as a result of planned maintenance at Nevada Gold Mines and mine sequencing at various sites. In line with our plans, as a result of the lower production, Q1 gold cost of sales per ounce 1 is expected to be 4% to 6% higher, total cash costs per ounce 2 are expected to be 6% to 8% higher, and all-in sustaining costs per ounce 2 are expected to be 7% to 9% higher compared to Q4 2023. Costs are expected to drop in the successive quarters of the year as production ramps up.

Preliminary Q1 copper production was lower than Q4 2023, driven primarily by lower grades mined at Lumwana in accordance with the mine plan. Compared to Q4 2023, driven by the lower production and in line with plans, Q1 copper cost of sales per pound 1 is expected to be 9% to 11% higher, C1 cash costs per pound 2 are expected to be 10% to 12% higher, while all-in sustaining costs per pound 2 are expected to be 14% to 16% higher. Costs are expected to drop in the successive quarters of the year as production ramps up.

Barrick will provide additional discussion and analysis regarding its first quarter 2024 production and sales when the Company reports its quarterly results before North American markets open on May 1, 2024.

The following table includes preliminary gold and copper production and sales results from Barrick's operations:

| Three months ended |

| March 31, 2024 |

| Production | Sales |

| Gold (attributable ounces (000)) |

| Carlin (61.5%) | 205 | 207 |

| Cortez (61.5%) | 119 | 121 |

| Turquoise Ridge (61.5%) | 62 | 62 |

| Phoenix (61.5%) | 34 | 34 |

| Nevada Gold Mines (61.5%) | 420 | 424 |

| Loulo-Gounkoto (80%) | 141 | 140 |

| Pueblo Viejo (60%) | 81 | 82 |

| Kibali (45%) | 76 | 72 |

| Veladero (50%) | 57 | 33 |

| North Mara (84%) | 46 | 46 |

| Bulyanhulu (84%) | 42 | 40 |

| Hemlo | 37 | 38 |

| Tongon (89.7%) | 36 | 35 |

| Porgera (24.5%) | 4 | 0 |

| Total Gold | 940 | 910 |

| | |

| | |

| Copper (attributable tonnes (000)) |

| Lumwana | 22 | 22 |

| Zaldívar (50%) | 9 | 9 |

| Jabal Sayid (50%) | 9 | 8 |

| Total Copper | 40 | 39 |

First Quarter 2024 Results

Barrick will release its Q1 2024 results before market open on May 1, 2024. President and CEO Mark Bristow will host a live presentation of the results that day at 11:00 EDT, with an interactive webinar linked to a conference call. Participants will be able to ask questions.

Go to the webinar

US and Canada (toll-free) 1 844 763 8274

UK (toll) +44 20 3795 9972

International (toll) +1 647 484 8814

The Q1 2024 presentation materials will be available on Barrick's website at www.barrick.com.

The webinar will remain on the website for later viewing, and the conference call will be available for replay by telephone at 1 855 669 9658 (US and Canada toll-free) and +1 604 674 8052 (international toll), access code 0799#.

Enquiries:

Kathy du Plessis

Investor and Media Relations

+44 20 7557 7738

barrick@dpapr.com

Website: www.barrick.com

Technical Information

The scientific and technical information contained in this news release has been reviewed and approved by: Craig Fiddes, SME-RM, Lead, Resource Modeling, Nevada Gold Mines; Simon Bottoms, CGeol, MGeol, FGS, FAusIMM, Mineral Resource Management and Evaluation Executive (in this capacity, Mr. Bottoms is responsible on an interim basis for scientific and technical information relating to the Latin America and Asia Pacific region); and Richard Peattie, MPhil, FAusIMM, Mineral Resources Manager: Africa and Middle East; – each a "Qualified Person" as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects .

Endnote 1

Gold cost of sales per ounce is calculated as cost of sales across our gold operations (excluding sites in care and maintenance) divided by ounces sold (both on an attributable basis based on Barrick's ownership share). Copper cost of sales per pound is calculated as cost of sales across our copper operations divided by pounds sold (both on an attributable basis based on Barrick's ownership share).

References to attributable basis means our 100% share of Hemlo and Lumwana, our 89.7% share of Tongon, our 84% share of North Mara and Bulyanhulu, our 80% share of Loulo-Gounkoto, our 61.5% share of Nevada Gold Mines, our 60% share of Pueblo Viejo, our 50% share of Veladero, Zaldívar and Jabal Sayid and our 45% share of Kibali.

Endnote 2

Total cash costs per ounce and all-in sustaining costs per ounce are non-GAAP financial measures which are calculated based on the definition published by the World Gold Council ("WGC") (a market development organization for the gold industry comprised of and funded by gold mining companies from around the world, including Barrick). The WGC is not a regulatory organization. Management uses these measures to monitor the performance of our gold mining operations and its ability to generate positive cash flow, both on an individual site basis and an overall company basis.

Total cash costs start with our cost of sales related to gold production and removes depreciation, the non-controlling interest of cost of sales and includes by-product credits. All-in sustaining costs start with total cash costs and include sustaining capital expenditures, sustaining leases, general and administrative costs, minesite exploration and evaluation costs and reclamation cost accretion and amortization. These additional costs reflect the expenditures made to maintain current production levels.

We believe that our use of total cash costs and all-in sustaining costs will assist analysts, investors and other stakeholders of Barrick in understanding the costs associated with producing gold, understanding the economics of gold mining, assessing our operating performance and also our ability to generate free cash flow from current operations and to generate free cash flow on an overall company basis. Due to the capital-intensive nature of the industry and the long useful lives over which these items are depreciated, there can be a significant timing difference between net earnings calculated in accordance with IFRS and the amount of free cash flow that is being generated by a mine and therefore we believe these measures are useful non-GAAP operating metrics and supplement our IFRS disclosures. These measures are not representative of all of our cash expenditures as they do not include income tax payments, interest costs or dividend payments. These measures do not include depreciation or amortization.

Total cash costs per ounce and all-in sustaining costs per ounce are intended to provide additional information only and do not have standardized definitions under IFRS and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS. These measures are not equivalent to net income or cash flow from operations as determined under IFRS. Although the WGC has published a standardized definition, other companies may calculate these measures differently.

C1 cash costs per pound and all-in sustaining costs per pound are non-GAAP financial measures related to our copper mine operations. We believe that C1 cash costs per pound enables investors to better understand the performance of our copper operations in comparison to other copper producers who present results on a similar basis. C1 cash costs per pound excludes royalties and production taxes and non-routine charges as they are not direct production costs. All-in sustaining costs per pound is similar to the gold all-in sustaining costs metric and management uses this to better evaluate the costs of copper production. We believe this measure enables investors to better understand the operating performance of our copper mines as this measure reflects all of the sustaining expenditures incurred in order to produce copper. All-in sustaining costs per pound includes C1 cash costs, sustaining capital expenditures, sustaining leases, general and administrative costs, minesite exploration and evaluation costs, royalties and production taxes, reclamation cost accretion and amortization and write-downs taken on inventory to net realizable value.

Barrick will provide a full reconciliation of these non-GAAP financial measures when the Company reports its quarterly results on May 1, 2024.

Cautionary Statements Regarding Preliminary First Quarter Production, Sales and Costs for 2024, and Forward-Looking Information

Barrick cautions that, whether or not expressly stated, all first quarter figures contained in this press release including, without limitation, production levels, sales and associated costs are preliminary, and reflect our expected first quarter results as of the date of this press release. Actual reported first quarter production levels, sales and associated costs are subject to management's final review, as well as review by the Company's independent accounting firm, and may vary significantly from those expectations because of a number of factors, including, without limitation, additional or revised information, and changes in accounting standards or policies, or in how those standards are applied. Barrick will provide additional discussion and analysis and other important information about its first quarter production levels, sales and associated costs when it reports actual results on May 1, 2024. For a complete picture of the Company's financial performance, it will be necessary to review all of the information in the Company's first quarter financial report and related MD&A. Accordingly, readers are cautioned not to rely solely on the information contained herein.

Finally, Barrick cautions that this press release contains forward-looking statements with respect to: (i) Barrick's production and full year gold and copper guidance; and (ii) costs per ounce for gold and per pound for copper.

Forward-looking statements are necessarily based upon a number of estimates and assumptions including material estimates and assumptions related to the factors set forth below that, while considered reasonable by the Company as at the date of this press release in light of management's experience and perception of current conditions and expected developments, are inherently subject to significant business, economic, and competitive uncertainties and contingencies. Known or unknown factors could cause actual results to differ materially from those projected in the forward-looking statements, and undue reliance should not be placed on such statements and information.

Such factors include, but are not limited to: fluctuations in the spot and forward price of gold, copper, or certain other commodities (such as silver, diesel fuel, natural gas, and electricity); the speculative nature of mineral exploration and development; changes in mineral production performance, exploitation, and exploration successes; the resumption of operations at the Porgera mine and expected ramp up of mining and processing in 2024; risks associated with projects in the early stages of evaluation, and for which additional engineering and other analysis is required; disruption of supply routes which may cause delays in construction and mining activities, including disruptions in the supply of key mining inputs due to the invasion of Ukraine by Russia and conflicts in the Middle East; whether benefits expected from recent transactions are realized; quantities or grades of reserves will be diminished, and that resources may not be converted to reserves; increased costs, delays, suspensions and technical challenges associated with the construction of capital projects; operating or technical difficulties in connection with mining or development activities, including geotechnical challenges, tailings dam and storage facilities failures, and disruptions in the maintenance or provision of required infrastructure and information technology systems; risks that exploration data may be incomplete and considerable additional work may be required to complete further evaluation, including but not limited to drilling, engineering and socioeconomic studies and investment; failure to comply with environmental and health and safety laws and regulations; increased costs and physical risks, including extreme weather events and resource shortages, related to climate change; timing of, receipt of, or failure to comply with, necessary permits and approvals; non-renewal of key licenses by governmental authorities; uncertainty whether some or all of targeted investments and projects will meet the Company's capital allocation objectives and internal hurdle rate; the impact of inflation, including global inflationary pressures driven by supply chain disruptions, global energy cost increases following the invasion of Ukraine by Russia and country-specific political and economic factors in Argentina; the impact of global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future cash flows; fluctuations in the currency markets; changes in national and local government legislation, taxation, controls or regulations and/or changes in the administration of laws, policies and practices; expropriation or nationalization of property and political or economic developments in Canada, the United States, and other jurisdictions in which the Company or its affiliates do or may carry on business in the future; lack of certainty with respect to foreign legal systems, corruption and other factors that are inconsistent with the rule of law; damage to the Company's reputation due to the actual or perceived occurrence of any number of events, including negative publicity with respect to the Company's handling of environmental matters or dealings with community groups, whether true or not; the possibility that future exploration results will not be consistent with the Company's expectations; risk of loss due to acts of war, terrorism, sabotage and civil disturbances; risks associated with artisanal and illegal mining; risks associated with diseases, epidemics and pandemics, including the effects and potential effects of the global Covid-19 pandemic; litigation and legal and administrative proceedings; contests over title to properties, particularly title to undeveloped properties, or over access to water, power and other required infrastructure; business opportunities that may be presented to, or pursued by, the Company; our ability to successfully integrate acquisitions or complete divestitures; risks associated with working with partners in jointly controlled assets; employee relations including loss of key employees; and availability and increased costs associated with mining inputs and labor. In addition, there are risks and hazards associated with the business of mineral exploration, development and mining, including environmental hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion, copper cathode or gold or copper concentrate losses (and the risk of inadequate insurance, or inability to obtain insurance, to cover these risks).

Many of these uncertainties and contingencies can affect our actual results and could cause actual results to differ materially from those expressed or implied in any forward-looking statements made by, or on behalf of, us. Readers are cautioned that forward-looking statements are not guarantees of future performance. All of the forward-looking statements made in this press release are qualified by these cautionary statements. Specific reference is made to the most recent Form 40-F/Annual Information Form on file with the SEC and Canadian provincial securities regulatory authorities for a more detailed discussion of some of the factors underlying forward-looking statements and the risks that may affect Barrick's ability to achieve the expectations set forth in the forward-looking statements contained in this press release.

Barrick disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except as required by applicable law.

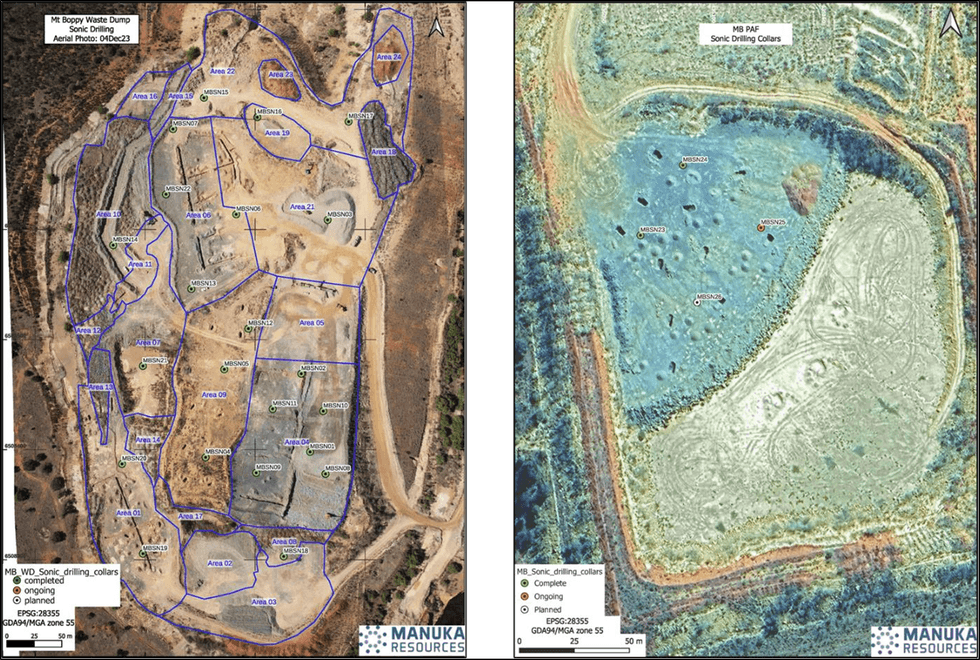

Figure 1: Location Sonic drilling collars over Mt Boppy Rock Dump (left) and TSF3 PAF (right)

Figure 1: Location Sonic drilling collars over Mt Boppy Rock Dump (left) and TSF3 PAF (right)

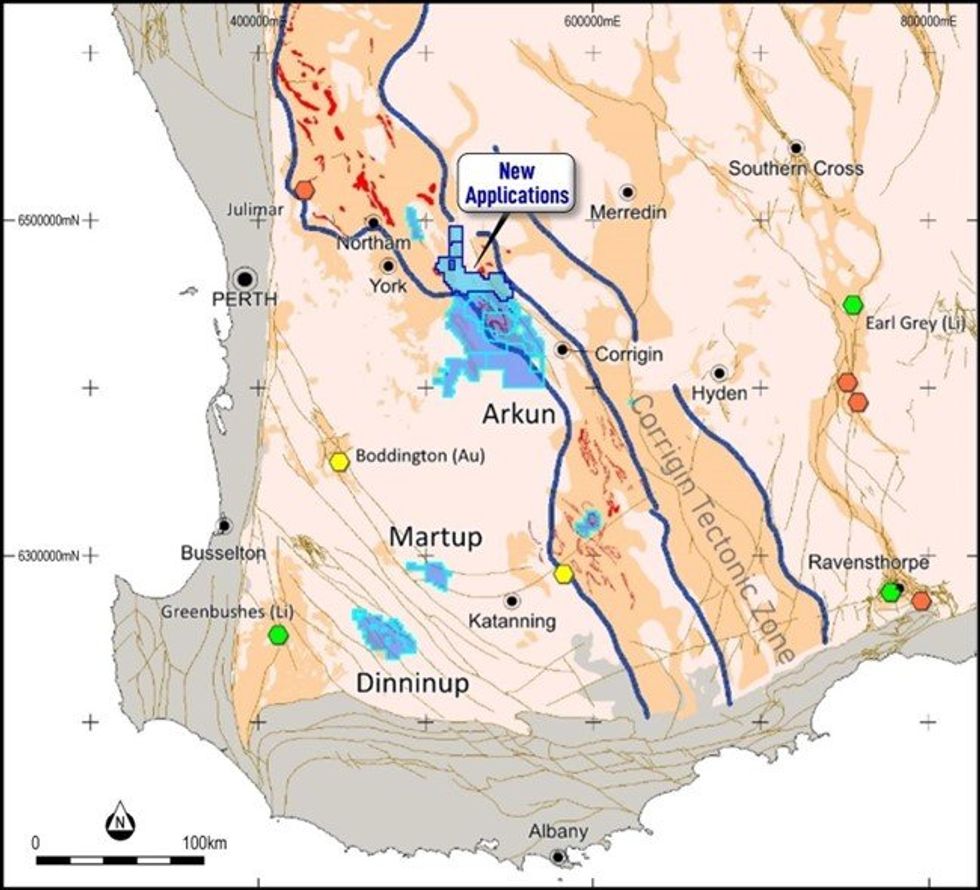

Figure 1. Location and regional geological setting of Impact’s Arkun and other projects in the emerging mineral province of southwest Western Australia. Also shown are recent additions to the Arkun project (ASX Release March 14th 2024). Significant nickel deposits are shown in orange, lithium deposits in green and gold deposits in yellow.

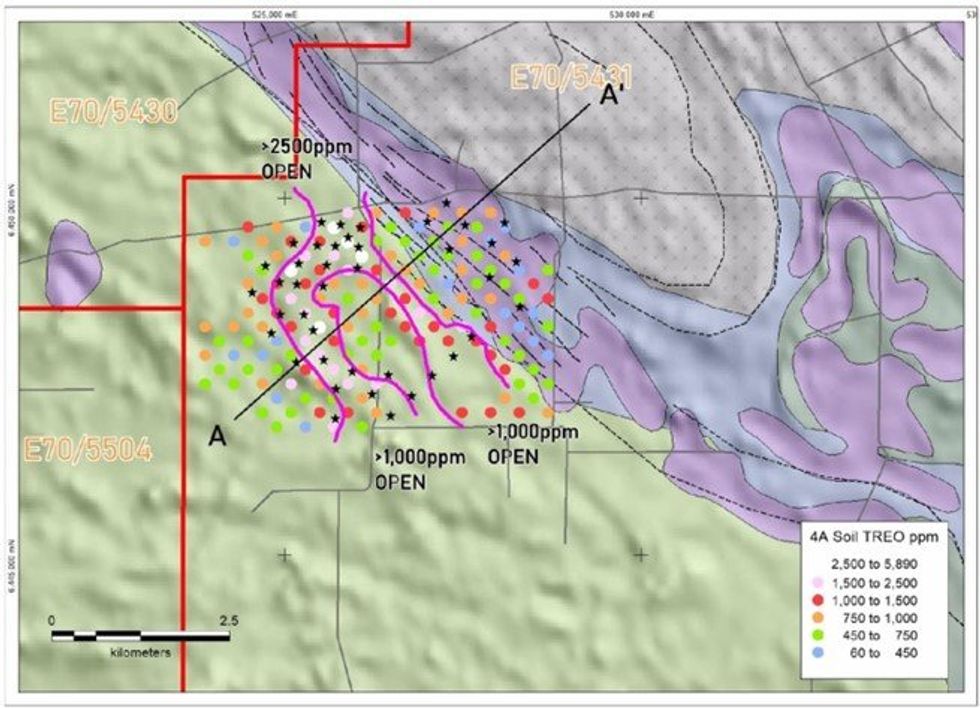

Figure 1. Location and regional geological setting of Impact’s Arkun and other projects in the emerging mineral province of southwest Western Australia. Also shown are recent additions to the Arkun project (ASX Release March 14th 2024). Significant nickel deposits are shown in orange, lithium deposits in green and gold deposits in yellow. Figure 2. Hyperion REE Prospect: TREO+Y results and location of planned drill collars noted by black stars

Figure 2. Hyperion REE Prospect: TREO+Y results and location of planned drill collars noted by black stars

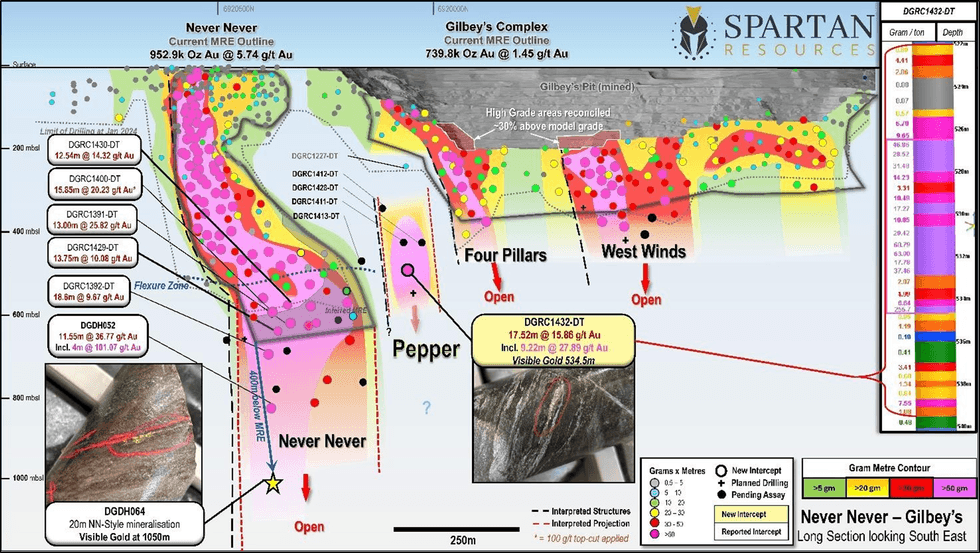

Figure 1: Long Section of the Never Never Gold Deposit, Four Pillars and West Winds Gold Prospects looking East. New high-grade Pepper Gold Prospect with discovery hole DGRC1432 shown in pink. Note: consistency of gold grades in DGRC1432 (inset) and three additional drill-holes with logged mineralised intercepts above DGRC1432 defining the emerging Pepper Gold Prospect (assays pending).

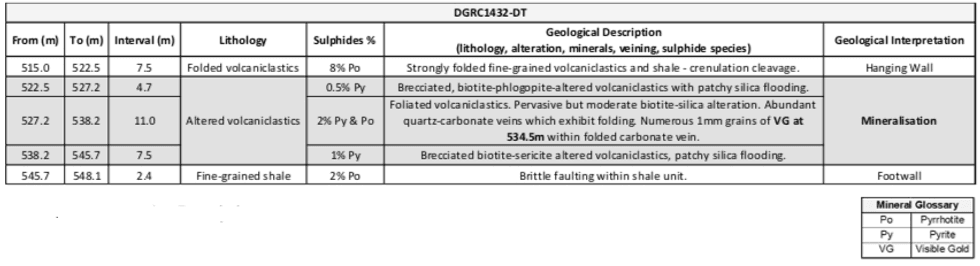

Figure 1: Long Section of the Never Never Gold Deposit, Four Pillars and West Winds Gold Prospects looking East. New high-grade Pepper Gold Prospect with discovery hole DGRC1432 shown in pink. Note: consistency of gold grades in DGRC1432 (inset) and three additional drill-holes with logged mineralised intercepts above DGRC1432 defining the emerging Pepper Gold Prospect (assays pending). Table 1: Mineralisation Description – DGRC1432 – Pepper Gold Prospect discovery intercept

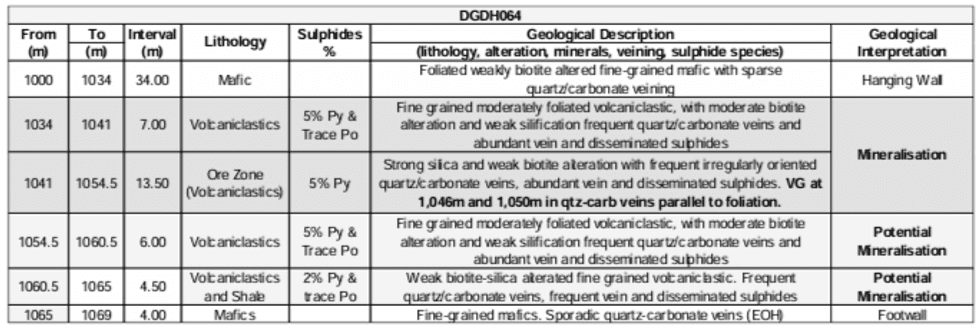

Table 1: Mineralisation Description – DGRC1432 – Pepper Gold Prospect discovery intercept Table 2: Mineralisation Description – DGDH064 – Visible Gold at 1,050m from Never Never in Fig.1 (previously reported)

Table 2: Mineralisation Description – DGDH064 – Visible Gold at 1,050m from Never Never in Fig.1 (previously reported)