- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Strong Upside From Updated Scoping Study - Devon Pit

Matsa Resources Limited (“Matsa”, “Company”) is pleased to advise the receipt the results of an updated Scoping Study conducted by Linden Gold Alliance Limited (“Linden”) on the Devon Pit which is the subject of a joint venture agreement between Matsa and Linden.

HIGHLIGHTS

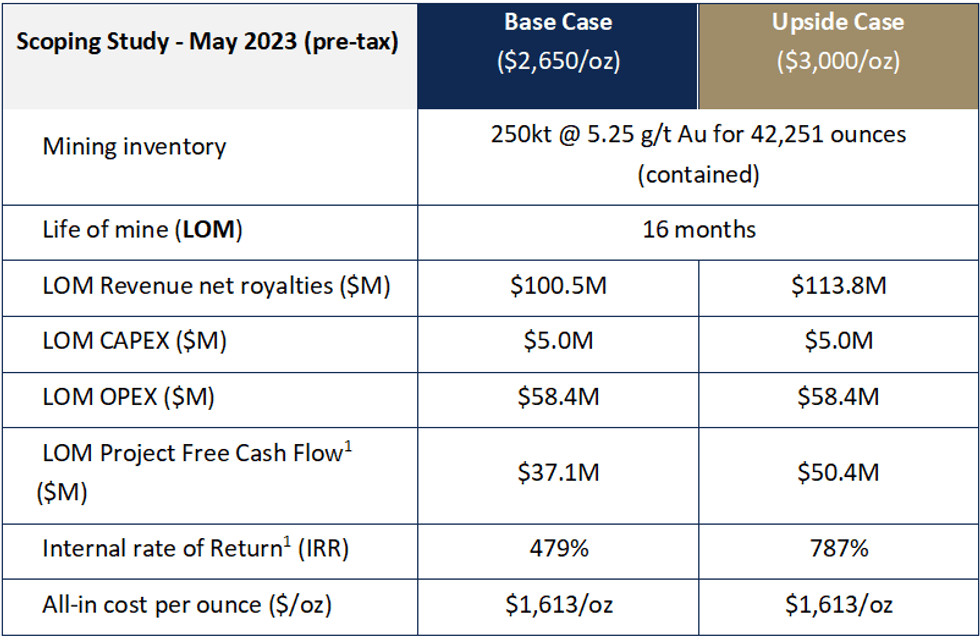

- The Devon Joint Venture has completed an updated Scoping Study on the potential restart of mining at the Devon Pit has delivered excellent results including:

- Project cash flow surplus (pre-tax) up to A$50.4m over 16 months (at A$3,000/oz)

- Production of 250kt at 5.25g/t Au for a recovered ~39koz (93% recovery)

- All-in cash costs of A$1,613/oz gold

- Pre-tax project IRR of +470%

- Mining of ore commences from surface

- Progressing to Definitive Feasibility Study (DFS) expected to be finalised by 31 August 2023, with proof of funding by 30 September 2023 and FID expected late 2023

The Scoping Study demonstrates a strong financial outcome with potential to mine the Devon Pit over a 16-month mine life generating cash flows up to $50.4M with a pre-tax project IRR of +470%.

At an all-in cost of A$1,613/oz, the Scoping Study indicates potential profit margins per ounce of +A$1,380/oz (based on current spot prices).

Matsa Executive Chairman Mr Paul Poli commented:

“It is pleasing that the updated Scoping Study for the Devon Pit conducted by Linden illustrates delivery of strong margins for the Devon JV and improves on the April 2021 study conducted by Matsa. Encouragingly, the grades reported in the updated study of +5g/t compare favourably with the excellent historical grades reported by GME Resources in 2015 and 2016. Matsa now looks forward to the Devon JV progressing the DFS, due for completion by 31 August 2023.”

Click here for the full ASX Release

This article includes content from Matsa Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Falco Resources: Canadian Explorer in the Rouyn-Noranda Mining Camp

Falco Resources (TSXV:FPC) focuses on developing gold and base metal projects in the Rouyn-Noranda region of Quebec, an established mining camp with a long history of exploration and development. The camp has historically produced 19 million ounces (Moz) of gold and 2.9 billion pounds (Blbs) of copper, and yet it is still under-explored for gold.

Falcon’s principal property, Horne 5 project, holds 67,000 acres or nearly 67 percent of the total area of the entire mining camp and is located under the former Horne mine which produced 11.6 Moz of gold and 2.5 Blbs of copper. The 2021 feasibility study on the Horne 5 project suggests strong project economics with a total mine life of 15 years, after-tax NPV at 5 percent of US$761 million, and a payback period of 4.8 years, assuming gold prices at $1,600/oz. At the current gold prices of over $2,300/oz, the project economics will be even better.

Falco Resources operating license and indemnity agreement (OLIA) with Glencore Canada will enable Falco to utilize a portion of Glencore's lands. The agreement entails establishing a technical committee comprising two representatives from Glencore and two from Falco, tasked with safeguarding the uninterrupted operations of Glencore’s Horne copper smelter. Additionally, a parallel strategic committee will be formed. Glencore will nominate one representative to join Falco's board of directors.

The successful completion of the OLIA, coupled with life-of-mine copper-zinc concentrate offtake agreements with Glencore, positions Falco to advance its Horne 5 project towards construction. The company is advancing with the permitting and financing processes for the project.

Company Highlights

- Falco Resources is a Canadian explorer of base and precious metals focused on developing its mineral properties in the Rouyn-Noranda region in Quebec, Canada.

- The company holds 67,000 acres of mining claims in the Rouyn-Noranda mining camp, accounting for nearly 67 percent of the entire mining camp.

- Rouyn-Noranda has a long history of mining and exploration. The area has established infrastructure and has been host to 50 former producers, including 20 base metal mines and 30 gold mines.

- Falco’s principal asset is the Horne 5 project which is a gold project with significant base metal by-products. It is located under the former Horne Mine which produced 11.6 Moz of gold and 2.5 billion pounds of copper.

- The Horne 5 is a world-class deposit containing 7.6 Moz gold equivalent in measured and indicated resources and 1.7 Moz gold equivalent in inferred resources.

- The Horne 5 project represents a robust, high-margin, 15-year underground mining project with attractive economics. The 2021 feasibility study indicates after-tax NPV at 5 percent of US$761 million and after-tax IRR of 18.9 percent.

- The operating lease and indemnity agreement (OLIA) with Glencore coupled with EIA admissibility receipt from the government body positions Falco to advance its Horne 5 project towards construction.

This Falco Resources profile is part of a paid investor education campaign.*

Click here to connect with Falco Resources (TSXV:FPC) to receive an Investor Presentation

Antilles Gold Takes Up Second $1.0 Million Convertible Note

Antilles Gold Limited (“Antilles Gold” or the “Company”) (ASX: AAU, OTCQB: ANTMF) advises that it has exercised its option to take up a second A$1.0M Convertible Note from Patras Capital Pte Ltd on the same commercial terms as the first A$1.0M Convertible Note which was issued on 8 March 2024.

The basic terms of the second Convertible Note are as follows;

Principal Amount | A$1,000,000 |

Maturity Date | 30 April2026 |

Interest | NIL |

Discount to Principal Amount | A$100,000 (in lieu of interest) |

Early Repayment | At the Company’s option at 110%of any outstanding balance of the Convertible Note within the first year after issue, and 115% in the second |

Conversion | TheNote holder may convert all or partof any outstanding amount of the Convertible Note at a conversion price equal to: i)$0.04 per share; or ii)A 10% discount to the numericaverage of the lowest 5 daily VWAP’s in the 15 trading days prior to conversion which can not be less than $0.015 per share |

Security | 40,000,000 AAU shareson the issueof the Convertible Note which can be applied to any conversion. |

Law & Jurisdiction | Queensland |

Antilles Gold has sufficient placement capacity under Listing Rule 7.1, or 7.1A for the second Convertible Note.

The Company has issued 27,000,000 AAU shares at $0.02 each to Patras Capital as Security Shares for the second Convertible Note from existing capacity under Listing Rule 7.1A.

The balance of the Security Shares (13,000,000) will be issued in due course.

The majority of the funds raised will be applied to subscribing for shares in the Cuban joint venture company, Minera La Victoria, for it to continue pre-development activities for the Nueva Sabana gold-copper mine.

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

March 2024 Quarterly Report

Astral Resources NL (ASX: AAR)(Astral or the Company) is pleased to report on its activities during the quarter ended 31 March 2024 (the Quarter).

HIGHLIGHTS

Mandilla Gold Project – near Kalgoorlie, WA

- Assays results reported for the final three holes of the six-hole/1,832 metre Theia diamond drilling (DD) program completed during November 1.

- The Theia DD program was targeting extensional and in-fill mineralisation at the Theia deposit.

- Planning underway for further drilling programs and commencement of Mandilla Pre-Feasibility Study.

Feysville Gold Project – near Kalgoorlie, WA

- Assay results reported for the three-hole/495 metre DD program completed at the Kamperman prospect during the previous Quarter 2.

- A total of 4,924 metres of drilling completed during the Quarter, inclusive of:

- oA 67-hole/2,248 metre regional air-core (AC) Program on prospecting licences P26/4351-4353;

- oA three-hole/217 metre slimline reverse circulation (RC) program at the Kamperman Prospect; and

- oA 19-hole/2,459 metre RC program at the Kamperman Prospect.

- Assay results from the AC Program and slimline RC Program reported during the Quarter 3.

- Assay results from the Kamperman RC Program reported during and subsequent to the end of the Quarter 4, 5.

Corporate

- Cash of approximately $0.62 million as at 31 March 2024.

- Mr Mark Connelly elected Chair following the resignation of Mr Leigh Warnick as Director.

- Share placement of 140 million shares at $0.05 per share to raise $7 million (before costs) announced on 28 March 2024 (Placement), with funds received after Quarter’s end.

- Directors of the Company subscribed for an additional 2.1 million shares at $0.05 per share, subject to the approval of shareholders at a meeting to be held on 20 May 2024 (Director Participation Shares).

- Astral is now well-funded to pursue its various exploration programs and commence the Mandilla Pre-Feasibility Study.

MANDILLA GOLD PROJECT

The Mandilla Gold Project (Mandilla) is situated in the northern Widgiemooltha greenstone belt, approximately 70 kilometres south of the significant mining centre of Kalgoorlie, Western Australia (Figure 1).

Mandilla is covered by existing Mining Leases which are not subject to any third-party royalties other than the standard WA Government gold royalty.

The Mandilla Gold Project includes the Theia, Iris, Eos and Hestia deposits.

Gold mineralisation at Theia and Iris is comprised of structurally controlled quartz vein arrays and hydrothermal alteration close to the western margin of the Emu Rocks Granite and locally in contact with sediments of the Spargoville Group.

Click here for the full ASX Release

This article includes content from Astral Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Antilles Gold Limited (ASX: AAU) – Trading Halt

Description

The securities of Antilles Gold Limited (‘AAU’) will be placed in trading halt at the request of AAU, pending it releasing an announcement. Unless ASX decides otherwise, the securities will remain in trading halt until the earlier of the commencement of normal trading on Tuesday, 30 April 2024 or when the announcement is released to the market.

Issued by

ASX Compliance

Click here for the full ASX Release

This article includes content from Antilles Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

James Henry Anderson: Gold Facing Tectonic Shift, US$2,400 Will Look Cheap

James Henry Anderson, senior market analyst at precious metals dealer SD Bullion, shared his thoughts on gold and silver, including what factors are moving the metals right now and where they could go in 2024.

In his view, the precious metals sector is undergoing a tectonic shift with far-reaching impacts. "Ultimately I think US$2,400 (per ounce gold) is going to be looked back in time as being cheap," he said.

Watch the interview above for more of Anderson's thoughts on gold and silver.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Top 5 Junior Gold Stocks on the TSXV in 2024

2024 has been a storybook year for gold. Coming off a record-setting December 2023, markets were range bound as they awaited important interest rate decisions from the US Federal Reserve.

As March started, messaging from the central bank became clearer. The Fed was confident it was done raising rates and cuts could be expected in 2024. Gold took off, setting the quarter’s high of US$2,264.52 per ounce on March 31, with momentum continuing to set an all-time high of US$2,426.56 per ounce on April 12.

Despite gold’s solid performance at the end of 2023 and continued high prices in 2024, it didn’t translate to gold stocks. They saw little movement through the first 10 weeks of the year. It wasn’t until after gold’s dramatic breakout that some of the major gold stocks saw some upward momentum.

How have these gains affected small cap gold stocks on the TSXV? These are the biggest movers through the start of the year. Data for this article was retrieved on April 2, 2024, using TradingView's stock screener, and only companies with market capitalizations greater than C$10 million are included.

1. Contact Gold (TSXV:C)

Year-to-date gain: 200 percent; market cap: C$10.57 million; current share price: C$0.03

Contact Gold is a gold exploration company that is working to create a district-scale gold property in Nevada, US.

Its Pony Creek project consists of a 43.8 square kilometer land package that has hosted exploration since the 1980s. Since acquiring the property in 2016, Contact has conducted more than 25,000 meters of drilling across 118 holes, identifying five zones of gold mineralization. The company released a maiden resource estimate for the asset in January 2022, reporting 433,000 inferred ounces of gold from 25.72 million metric tons (MT) of ore with an average grade of 0.52 grams per MT (g/t).

Contact’s Green Springs property lies along the southern end of Nevada’s Cortez Trend and consists of a 19.5 square kilometers land package that hosts three past-producing open-pit mines that produced 74,000 ounces of gold in the late 1980s. In December 2022, Centerra Gold (TSX:CG,NYSE:CGAU) entered into a US$10 million earn-in agreement to potentially gain a 70 percent stake in Green Springs over a four year period.

Shares of Contact have been trending up since the February 26 news that Orla Mining (TSX:OLA,NYSE:ORLA) will acquire all of the company's issued and outstanding common shares through a definitive arrangement agreement. The deal will allow Orla to consolidate the Railroad-Pinion district in Nevada by combining Contact’s Pony Creek property with Orla’s adjacent South Railroad project.

Shares of Contact gold reached a quarterly high of C$0.03 on March 6.

2. Falco Resources (TSXV:FPC)

Year-to-date gain: 192.31 percent; market cap: C$103.2 million; current share price: C$0.36

Falco Resources is a gold exploration and development company operating within the Abitibi Greenstone Belt in Québec, Canada. Its flagship asset is the Horne 5 project, which consists of 67,000 hectares of land in the Noranda Mining Camp and includes 13 historic gold and base metals mining sites.

A March 2021 feasibility study update for Horne 5 would see an average annual production of more than 220,000 ounces of gold with a mine life of over 15 years. This would generate a C$761 million after-tax net present value with an 18.9 percent rate of return and an average all-in-sustaining cost of $587 per ounce.

Shares of Falco saw gains early in the year following a news release on January 24, when the company announced it had executed an operating license and indemnity agreement with Glencore (LSE:GLEN:OTC Pink:GLCNF). Under the terms of the deal, Falco will gain access to a portion of lands that it will use to advance Horne 5.

The deal will also establish a technical committee to ensure that operations at Horne 5 do not interfere with Glencore's Horne smelter. Additionally, Glencore will gain the right to require remediation, suspension or risk mitigation in order to protect its Horne smelter. Glencore will also have the right to a seat on Falco’s board of directors.

The most recent news from the Horne 5 project came on March 27, when Falco confirmed the admissibility of an environmental impact assessment from the Ministry of the Environment, the Fight Against Climate Change, Wildlife and Parks. Falco can now move forward to the public hearing process for the asset.

The share price for Falco reached a quarterly high of C$0.37 on March 28.

3. PPX Mining (TSXV:PPX)

Year-to-date gain: 150 percent; market cap: C$33.71 million; current share price: C$0.05

PPX Mining is a precious metals company that is focused on its Igor project, which contains the operating Callanquitas underground mine, located in the Otuzco province of Northern Peru.

In a prefeasibility study for Igor, which was amended in January 2022, the company indicates that the 1,300 hectare site previously hosted small-scale mining operations and hosts a 50 MT per day gold-processing plant from the 1980s. PPX is currently working to upscale processing at the site through the construction of a 350 MT per day carbon-in-leach and flotation plant that will be used to process oxide and sulfide ore from Callanquitas.

An updated resource estimate for Callanquitas released by the company this past January shows measured and indicated amounts as oxides of 81,090 ounces of gold and 2.9 million ounces of silver. The inferred resource as sulfides stands at 34,450 gold equivalent ounces at 4.63 g/t gold equivalent.

Shares of PPX saw gains following news on March 12 that the firm has signed a letter of intent with Silver Crown Royalties for US$2.5 million in funding in exchange for a 15 percent silver royalty from Igor. Under the terms of the arrangement, which can be expanded, the royalty is currently set to expire upon the delivery of 250,000 ounces of silver, or after five years, whichever comes later. This funding will be put toward a new processing plant.

The company followed with additional funding news on April 18, when it closed a C$1.35 million private placement with proceeds earmarked to finance further exploration at Igor.

PPX shares reached a quarterly high of C$0.60 on March 13.

4. Sun Peak Metals (TSXV:PEAK)

Year-to-date gain: 135.71 percent; market cap: C$42.68 billion; current share price: C$0.495

Sun Peak Metals is a gold exploration company operating in the Arabian Nubian Shield in Ethiopia. Its flagship Shire project consists of six exploration licenses covering an area of 1,450 square kilometers in the northern part of the country. Early work by Sun Peak has revealed approximately two dozen gold and copper targets at the site.

Work on the project was stymied in November 2020 as war broke out between the Ethiopian government and the Tigray People’s Liberation Front. Operations at Shire remained suspended until February 7, when the company announced that a force majeure put in place to protect workers during the conflict had been lifted on three licenses. The company said it expects the restrictions on the remaining three licenses to be lifted at a later date.

The company’s most recent announcement came on April 4, when it commenced drilling at Shire. Sun Peak has 6,000 to 7,000 meters planned for 2024 and will focus on the Hamlo prospect

Sun Peak's share price hit a high of C$0.54 for the quarter on March 12.

5. Bluestone Resources (TSXV:BSR)

Year-to-date gain: 134.78 percent; market cap: C$75.8 million; current share price: C$0.54

Bluestone Resources is a gold exploration and development company operating out of Guatemala. Its flagship property is the Cerro Blanco gold project, located near the town of Asunción Mita 160 kilometers from Guatemala City.

In a resource estimate from July 2021, the company reported measured and indicated amounts of 3,089,000 ounces of gold and 13,445,000 ounces of silver at the site. Bluestone is also developing the Mita geothermal project, which will provide power for the mine when it is complete.

Shares of Bluestone soared early in the year following an announcement on January 18, when the company said that an amendment to its environmental permit for Cerro Blanco was approved by the Guatemalan government. The initial application for the site was for the development of an underground mine, but in November 2021 Bluestone applied for an amendment to switch to surface mining. The company said the change will increase the size of the project's layout, but the fundamental elements will remain unchanged.

Shares of Bluestone reached a quarterly high of C$0.59 on January 18.

Don’t forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.