- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Tchaga Deep Extensional Drilling Delivers High-grade Gold at Napié

Mako Gold Limited (“Mako” or “the Company”; ASX:MKG) is pleased to advise that it has received assay results from the final 10 diamond drill (DD) holes at the Tchaga Prospect, within the Company’s flagship Napié Project in Côte d’Ivoire. Tchaga is located on a +23km soil anomaly and coincident 30km-long Napié Fault (Figure 3).

DD DRILLING HIGHIGHTS POTENTIAL TO GROW RESOURCE AT DEPTH

Significant mineralisation was intersected in all 10 holes drilled at Tchaga, with deep high-grade results returned such as 19.6m at 4.36g/t Au in NARC621DD, and 4.5m at 6.92g/t Au which includes 1m at 29.46g/t Au in NARC512DD (Figure 1).

The Company is highly encouraged by the results from deeper DD as this will extend the mineralised zones at depth which should increase the size of the upcoming maiden MRE. In addition, this highlights the potential for extending the resource post the maiden MRE with further drilling at depth (Figure 2).

Intervals above 0.5g/t Au cut-off are reported in Appendix 1. A map of the Tchaga drill hole locations is shown in Appendix 2.

Select significant results from previous drilling at Tchaga1 include:

- 41m at 4.51g/t Au from 17m in NARC216

- 32m at 7.1g/t Au from 13m in NARC184

- 13m at 20.82g/t Au from 32m in NARC145

- 36m at 3.09g/t Au from 43m in NARC107DD

- 28m at 4.86g/t Au from 83m in NARC057

- 26m at 4.34g/t Au from surface in NARC214

- 25m at 3.43g/t Au from 53m in NARC017

- 14m at 5.46g/t Au from surface in NARC124

- 18m at 3.25g/t Au from 39m in NARC080

- 23m at 2.46g/t Au from 15m in NARC084

- 17m at 2.43g/t Au from 86m in NARC055

- 38m at 1.64g/t Au from 5m in NARC180

- 7.7m at 11.65g/t Au from 169m in NARC058DD

- 4m at 14.26g/t Au from 33m in NARC185

- 2m at 24.06g/t Au from 112m in NARC542

- 26m at 1.01g/t Au from 92m in NARC467DD; and

- 5.8m at 6.96g/t Au from 135m; including 1m at 34.62g/t Au from 137m

Click here for the full ASX release

This article includes content from Mako Gold, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here

Mineral Resource Update – Mt Boppy Gold Project

Sonic drilling program delivers significant increase in Resource confidence to support gold production at Mt Boppy

Manuka Resources Limited (ASX: MKR) (“Manuka” or the “Company”) is pleased to release an updated Mineral Resources Estimate for Mt Boppy. The Resource update supports Manuka’s strategy to install a purpose-built gold processing plant at Mt Boppy and recommence on-site gold production from Q4 2024.

Highlights:

- The results of a recently completed Sonic Drilling Program over the Main Waste Rock Dump and Dry Tailings have successfully delivered an updated Mineral Resource Estimate for Mt Boppy.

- The updated Resource comprises 4.28Mt at 1.19g/t Au for 163koz of contained gold. Importantly, the updated Resource has seen an 100% increase in the portion of contained gold ounces classified as Indicated.

- The Mt Boppy Measured and Indicated Resource categories now comprises 82% of total Resource Estimate.

- A high-grade component of the Resource comprising 1.8Mt at 1.74g/t containing 102koz Au has been identified as a basis for future mine planning.

- The results support Manuka’s strategy to install on-site processing plant at Mt Boppy and provides confidence in the development of a mine plan that will underpin the recommencement of gold doré production.

Dennis Karp, Manuka’s Executive Chairman, commented:

“The Sonic Drilling Program was critical precursor to the recommencement of the processing of rock dumps and dry tailings at Mt Boppy. The results of this program have been extremely positive allowing us to significantly improve the confidence of our Mt Boppy Resource.

Consequently, Manuka is confident in its strategy to progress the establishment a fit-for- purpose on-site gold processing plant at Mt Boppy in the coming months and in turn free up our Wonawinta process plant, most recently used to process Mt Boppy ore, for future silver production from the existing Wonawinta Silver mine.

The bullish gold and silver markets, combined with the fact that Manuka has two granted mining licenses - both fully permitted for on-site processing - and existing processing infrastructure, translate to a very exciting time for the Company.”

Mt Boppy Resource Statement Summary

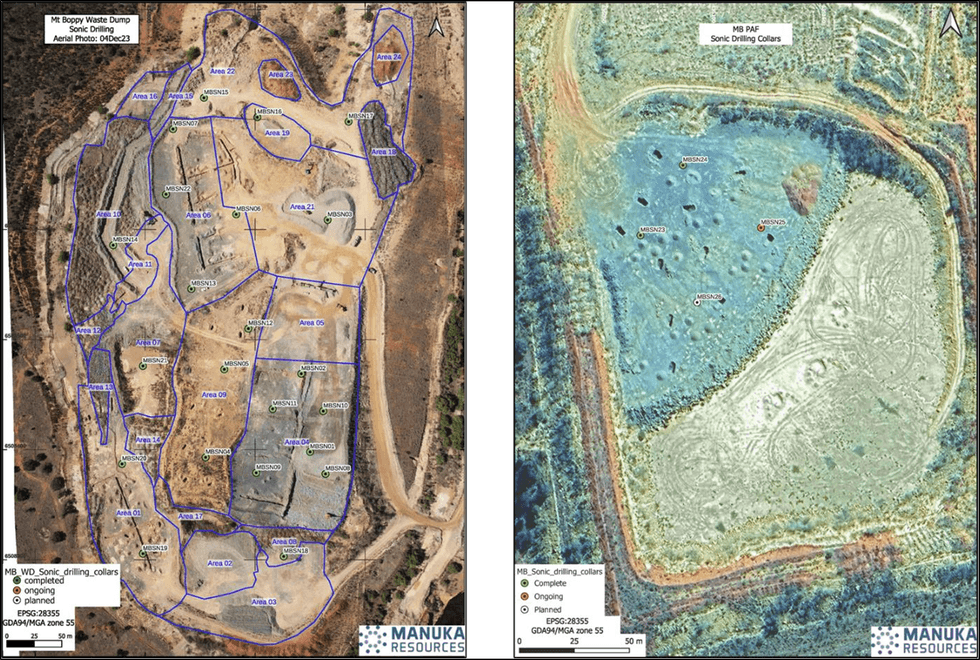

The Mineral Resource Estimate at Mt Boppy has been updated subsequent to the completion of a 26 borehole 506m sonic drilling evaluation programme over the Mt Boppy Rock Dumps and Dry Tailings completed in December 2023 (Figure 1).

The updated Resource comprises 4.28Mt at 1.19g/t Au for 163koz of contained gold of which 82% is contained in the Measured and Indicated categories (Table 1). Importantly, the Resource update sees the ounces classified as Indicated increase by 100% over the previous estimate.

The Resource for Mt Boppy comprises (Table 2):

Rock dumps and tailings depositories, with gold grades derived from recent Sonic drilling to bedrock, and fire assay head grades of +90, -90+20, +10-20, and -10mm size fractions, each weighed to ascertain mass % distribution. The rock dump and tailings Resources are reported at a cutoff of 0.25g/t Au total 3.9Mt tonnes at a grade of 0.89g/t Au for 110,628oz Au.

In-situ hard rock Resources including:

- a Mt Boppy open cut pit shell that reaches a depth of 215m below surface at the southern end of the Mt Boppy deposit. Material within the current pit design is reported at a 1.6g/t Au cut off and material below the pit design is reported to a 3.0g/t Au cut off

- the Boppy South mineral zone based on a grade shell modelled at a 1.6g/t cut off. This prospect still requires final drilling and evaluation before assessing the viability of establishing a small opencast mine.

The incremental change to the overall Mt Boppy Resource relates to updates to Rock dumps and Tailings depositories. The combined Mt Boppy Open Cut and Boppy South Resource of 282kt at a grade of 4.95 g/t Au for 44,820 ounces gold remain unchanged from that previously reported (ASX Release 25 August 2023) and all material assumptions continue to apply.

Click here for the full ASX Release

This article includes content from Manuka Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Maiden Drill Programme to Commence at the Arkun Project, WA

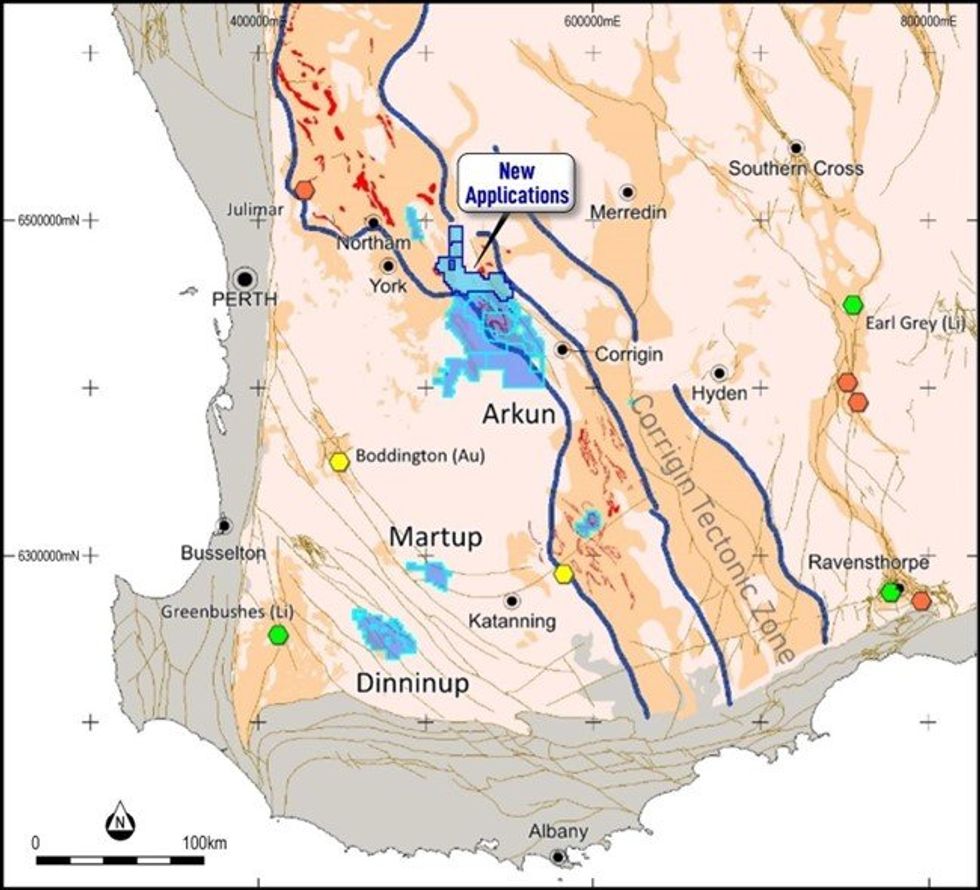

An aircore drill programme will commence this week at Impact Minerals Limited's (ASX:IPT) Hyperion REE prospect, which is part of the 100% owned Arkun Project, located 150km east of Perth in the emerging mineral province of southwest Western Australia ( Figure 1).

- Drilling to commence this week at the Hyperion Rare Earth Element (REE) Prospect to test a large Rare Earth Element soil geochemistry anomaly.

- The soil anomaly covers at least a 3 km2 area at greater than 1,000 ppm Total Rare Earth Oxide (TREO + Y) with peak values up to 5,880 ppm (0.59%) TREO+Y and Nd+Pr of up to 21%.

- The soil anomaly is hosted in weathered granite and is prospective for a large clay-hosted REE deposit.

- All necessary statutory approvals, Program of Works (POW) and land access permissions received.

- Aircore/ slimline RC rig has been secured and is currently mobilising to site

The drill programme, comprising approximately 40 holes for 2000 metres will test the significant REE soil geochemistry anomaly identified at Hyperion, where results of up to 5,880 parts per million (ppm) Total Rare Earth Element Oxides and Yttrium (TREO +Y) were reported previously (ASX Release 4th January 2024). These are some of the highest TREO-in-soil results reported recently in Western Australia. Other REE soil geochemistry anomalies have been identified at Swordfish and Horseshoe (Figure 2 and ASX Releases January 4th 2024 and June 1st 2023).

Impact Minerals’ Managing Director, Dr Mike Jones, said, “The discovery of the Hyperion REE Prospect was a significant breakthrough in exploring the Arkun Project, and we are eager to drill test the anomaly to assess the depth extent of the weathered clay that may host the REE mineralisation. The key to an economic discovery is to evaluate how easily the REEs can be extracted through simple acid leaching of clays and, so we will be sending samples for preliminary test work as quickly as possible. Given this is the first-ever drill programme at Arkun, and that several other significant REE anomalies remain to be tested at Arkun, for example Swordfish and Horseshoe, the extraction characteristics will have an important bearing on any future resource definition drilling”.

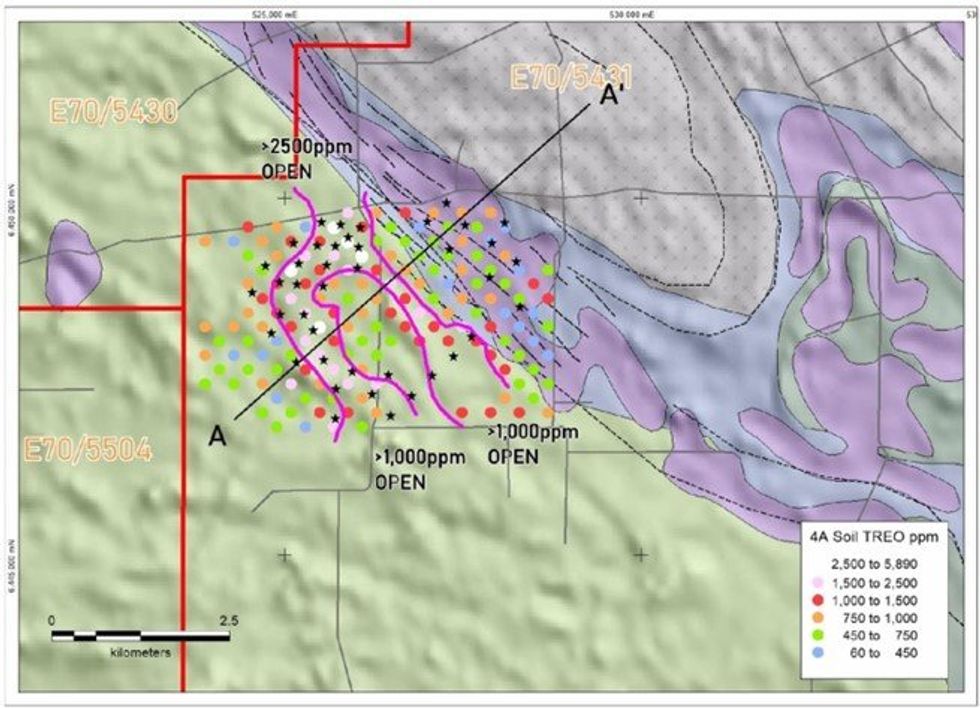

Hyperion Prospect

The soil geochemistry results have defined an area of more than 3 km2 at greater than 1,000 ppm TREO+Y at Hyperion (Figure 2). Five samples returned greater than 2,500 ppm TREO+Y with a peak value of 5,880 ppm (0.58%) TREO+Y, amongst some of the highest tenor REE soil values reported in Western Australia ASX Release January 4th 2024).

Within the anomaly, two broad northwest-southeast trending zones of more than 1,500 ppm TREO+Y-in- soils extend for 2.5 km along-trend and are open in both directions (Figure 2).

The anomaly has an average neodymium plus praseodymium percentage of about 20%, typical of most regolith-hosted mineralisation in the region with Heavy REE contents of between 54 ppm and 200 ppm within the >1,000 ppm parts of the anomaly (ASX Release January 4th 2024). This is encouraging for discovering the more economically compelling Heavy Rare Earths close to the surface.

The Hyperion anomaly is underlain by a well-preserved laterite (weathering) profile developed on very weathered granite bedrock, the likely source of the REE.

By coincidence, Impact's previous airborne electromagnetic (EM) survey covers part of the Hyperion anomaly (Section Line A-A’, Figure 3. ASX Release 18th September 2023). Geophysical modelling of this data shows a possible vertical thickness of up to 60 metres of conductive clays across much of the Hyperion anomaly, suggesting a significant volume of clay that may host REE mineralisation is present close to the surface (Figure 3). In addition, the regional magnetic data indicates the underlying granite may cover an area of about 170 km2, suggesting there is significant scope to increase the size of Hyperion with further soil surveys.

Click here for the full ASX Release

This article includes content from Impact Minerals, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

New High-Grade Discovery – “Pepper” Prospect: 17.52m @ 15.86g/t Gold Incl. 9.22m @ 27.89g/t

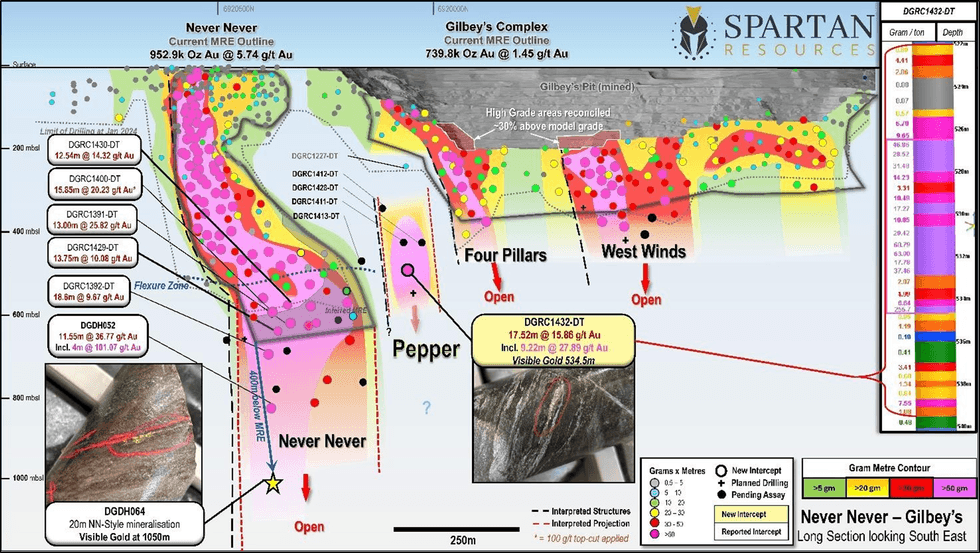

Drilling immediately south of the Never Never Gold Deposit intersects a new high-grade lode with Never Never-style mineralisation and grades

Spartan Resources Limited (“Spartan” or “Company”) (ASX: SPR) is pleased to advise that it has discovered a new high-grade gold lode immediately south of the 952koz Never Never Gold Deposit at its 100%-owned Dalgaranga Gold Project (“DGP”) in the Murchison region of Western Australia.

Highlights:

“Pepper” Gold Prospect – new discovery

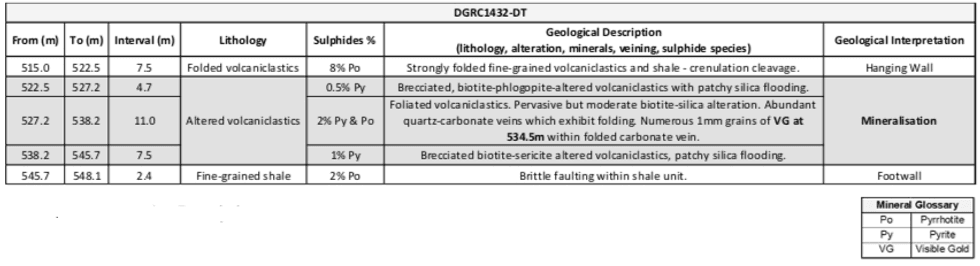

- 17.52m @ 15.86g/t gold from 522.0m, including 9.22m @ 27.89g/t (DGRC1432-DT):

- Intercept located approximately 90.0m south and along-strike of the nearest intercept (<0.5g/t gold) defining the southern extent of the 952koz Never Never Gold Deposit.

- Three additional diamond drill-holes have also intersected various widths of logged mineralisation up-dip of DGRC1432-DT, confirming the discovery (assays pending).

- Further drilling to define this new high-priority target is currently underway.

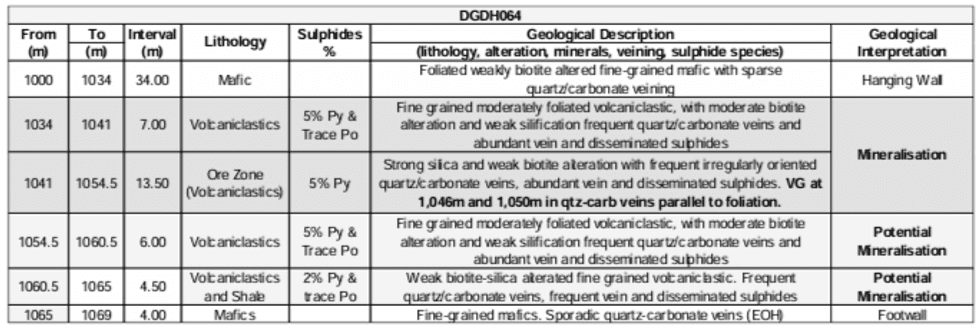

Please Note: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations. Assays for DGDH064 are expected in April 2024.

The new lode, named the Pepper Gold Prospect, sits approximately 90 metres south of the previous southernmost intercept at Never Never and all current conceptual underground development designs for future underground drilling and potential extraction of high-grade Never Never gold mineralisation pass by the new high-grade Pepper discovery position.

Importantly, the discovery intercept, 17.52m @ 15.86g/t gold including 9.22m @ 27.89g/t Au, comprises typical Never Never-style mineralisation with similar grades and mineralogical characteristics.

Please Note: Visual estimates of mineral abundance should never be considered a proxy or substitute for laboratory analyses where concentrations or grades are the factor of principal economic interest. Visual estimates also potentially provide no information regarding impurities or deleterious physical properties relevant to valuations.

Management Comment

Spartan Managing Director and Chief Executive Officer, Simon Lawson, said: “The discovery of the new high-grade Pepper Gold Prospect, located directly between Never Never and Four Pillars, is yet another game-changer for the Dalgaranga Gold Project.

“The core from the discovery hole DGRC1432-DT shows the same thick, heavily-altered volcaniclastic host-rock, orientation and mineralisation style as Never Never and the gold grades are consistent across the entire intercept and of an impressive tenor, to this point only seen elsewhere at Never Never.

“Importantly, the Pepper discovery sits along-strike and in the same volcaniclastic sequence as Never Never but appears to be in a separate steeply north-west plunging fold shoot of its own.

“Think of fold shoots as linear folds like those on a corrugated iron roofing sheet. The sheet represents the north-striking steeply west-dipping volcaniclastic rock package at Dalgaranga. East-west shears regularly cross-cut the sheet, creating corrugations or fold shoots. The troughs of the folds host steeply- plunging high-grade gold mineralisation while the ridges between host lower-grade gold mineralisation.

“The high-grade Never Never Gold Deposit sits in one of these large corrugation troughs and the new high-grade Pepper discovery appears to be located in an adjacent fold trough with a ridge of lower grade mineralisation in between.

“We have also drilled a number of follow-up holes up-dip from DGRC1432-DT which have intersected the same style of mineralisation and we look forward to those assays.

“The Pepper Gold Prospect sits immediately adjacent to Never Never in an extremely favourable position given that any future exploration drill drive and/or mining access scenarios will likely come from the Gilbey’s Open Pit as a start point and pass right by Pepper on the way to Never Never.

“The potential to add further high-grade ounces in close proximity to planned future infrastructure through discoveries like this is central to our strategy and investment proposition – and demonstrates clearly why we think there is so much more upside in what is turning out to be a truly remarkable gold system at Dalgaranga!”

Click here for the full ASX Release

This article includes content from Spartan Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Don Hansen: Gold, Silver Price Potential Not Just Hype, History Backs Up Gains

Private investor Don Hansen has honed his resource sector investment approach for more than 20 years, and he shared his latest research in a conversation with the Investing News Network.

Among other topics, he discusses the relationship between the gold price and US money supply from 1970 to the present, showing how they diverged in previous bull markets and explaining what this historic precedent can tell investors.

"The interesting thing is that most of gains in these bull markets is in the last two or three years. And I think we are at the beginning of that period, which is why I think there's so much potential for gold and silver investors," he explained.

Hansen encouraged investors to add gold to their portfolios, and has spoken previously about how to build a portfolio of gold and silver stocks. To watch those interviews, click the links below:

- Gold and Silver Stock Analysis with Expert Don Hansen

- Gold and Silver Stock Leverage with Expert Don Hansen

- Gold and Silver Portfolio Building with Expert Don Hansen

- Gold and Silver Stock Evaluation with Expert Don Hansen

- US Debt and Currency Collapse with Expert Don Hansen

- Gold vs. US Dollar Outlook with Expert Don Hansen

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Charlotte McLeod, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Gold Price Update: Q1 2024 in Review

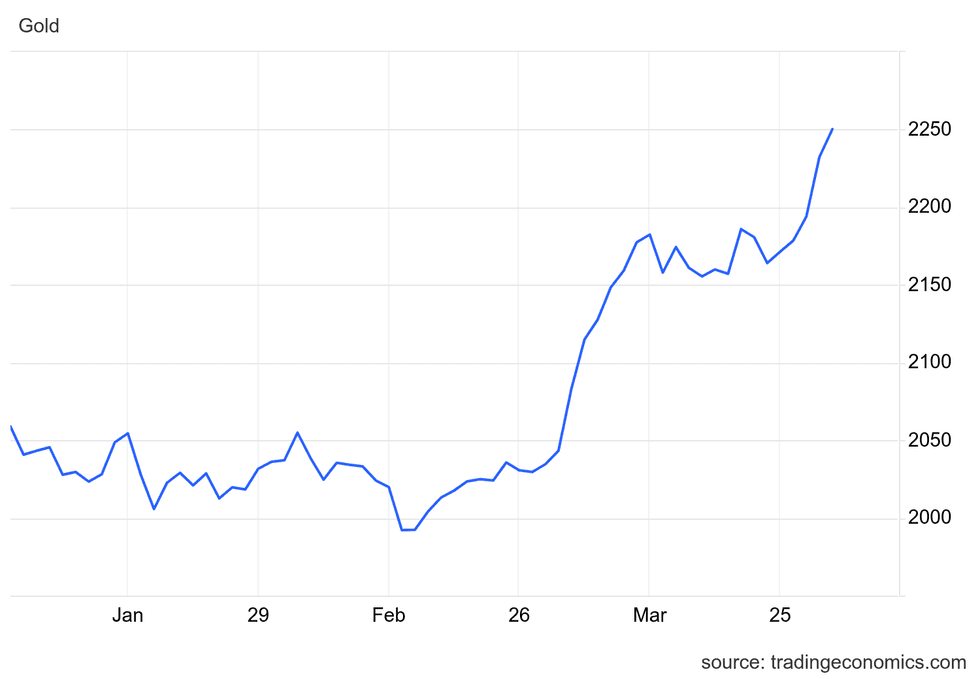

The gold price hit record levels in the first three months of 2024. Opening the period on January 2 at US$2,041.20 per ounce, the yellow metal was coming off previous highs set in December 2023.

Gold remained rangebound for the first two months of the year, staying above the US$2,000 level until it briefly broke through support in the middle of February, falling to its quarterly low of US$1,991.98 on February 13.

Following this low, gold began a slow climb toward the start of March, ultimately soaring to a quarterly high of US$2,251.37 on March 31. Gold has continued to move since then, briefly passing US$2,400 on April 12.

Central bank buying offsets ETF outflows

The first eight weeks of the year saw key gold market trends extend from 2023.

According to data from the World Gold Council (WGC), gold exchange-traded funds (ETFs) continued to see outflows in January and February, posting declines of 50.9 metric tons (MT) and 49.1 MT, respectively.

Joe Cavatoni, North American market strategist at the WGC, told the Investing News Network (INN) in an email that western gold ETFs marked three years of outflows in Q1, but this was offset by modest gains from Asian funds.

“One area of note in the ETF landscape is the Asian region. The Asian-domiciled ETFs, while smaller than the US and European markets, are positive in terms of net flows year-to-date (were positive in 2023 as well). This amplifies the importance of looking into the detail as it relates to gold investment to get a complete picture,” he said.

Despite overall outflows in ETFs, gold found support from continued central bank buying, with Chinese coffers seeing the largest gains, adding 10 MT of gold in January and an additional 12 MT in February. Reserve holdings for the People's Bank of China have grown for 16 consecutive months and have reached a total of 2,257 MT.

Other notable central bank buyers during the first two months of the year included Turkey, which added 16 MT of gold, Kazakhstan which purchased 12 MT, and India, which increased its reserves by 13 MT.

Lobo Tiggre, CEO of IndependentSpeculator.com, suggested to INN that other players may also be getting involved.

“With ETFs still seeing outflows, I think there’s a new buyer in the market, one that’s also interested in physical gold, not paper substitutes. This could be sovereign funds joining central banks, other institutions or other deep-pocketed players who don’t really care that much about the price, deciding that the time has come to hedge with gold,” he said.

On a different note, WGC data for the first month of the year indicates that Chinese wholesale gold demand jumped to 271 MT in January, the strongest ever for that month. While some gold is likely earmarked for jewelry markets, where demand remains high despite the elevated gold price, there was also increased demand for bars and coins.

Chinese investors have turned to the yellow metal as a safe haven against falling real estate and stock prices. In total, stocks in the country have lost nearly US$5 trillion in value over the past three years.

Purchases from Chinese investors continued into February as price stability helped take an additional 127 MT from Shanghai Gold Exchange stockpiles; that's above the month's 10 year average of 118 MT. Even though buying has been strong through the first couple months of 2024, the wholesale and investment markets are moving into what is traditionally a slow part of the year, which along with record high gold prices may put a damper on purchases.

Gold price hits record amid global uncertainty

Where the first two months of the year brought steadiness for the gold price, March was punctuated by strong gains and record highs. The precious metal started the month strong on the back of the solidifying belief that the US Federal Reserve would begin cutting rates as early as June; this helped drive buyers back into the gold market.

By the middle of March, gold had set record highs and was pushing against resistance at the US$2,200 mark.

Gold price, Q1 2024.

Chart via Trading Economics.

Investor sentiment was reaffirmed later in the month when the Fed met from March 19 to 20. With inflation coming in hotter than expected for February, the central bank held its benchmark rate at 5.25 to 5.5 percent. However, it also noted that it maintained the belief that it would make three rate cuts before the end of 2024.

This bullish sentiment helped stem western gold ETF outflows, with North America seeing inflows of 4.8 MT in March. The global pullback came to 13.6 MT, with largest losses coming from the UK, where a weak pound limited purchasing power, and traders sold off holdings to take profits as gold hit record high prices. European losses came to 22 MT.

More broadly, Cavatoni sees conditions setting up for broader global interest in gold.

“As central banks continue to be significant buyers and geopolitical risks and global uncertainties drive investors towards the perceived safety of gold, the current environment underscores gold’s importance as a strategic asset for portfolio diversification and risk mitigation. Therefore, while there may have been a perception of western disinterest in gold, recent developments indicate a sustained and broad-based demand for the precious metal,” Cavatoni said.

Gold price momentum yet to boost stocks

Gold stocks started to gain some momentum in March, but have been slow to take off.

Tiggre attributed this lag to a misreading by investors who had expected the gold price to retreat from all-time highs.

“It’s my view that the 'smart money' in the west thought gold had spiked and its next big move would be down, so gold stocks were 'leading' gold lower. However, it’s increasingly clear that that call was wrong, and I expect to see the stocks outperform this year when those who got it wrong realize their mistake,” he said.

While upward movement is slow among gold stocks, there have been some strong gains among producers. On the TSX, Serabi Gold (TSX:SBI,OTCQX:SRBIF), Mineros (TSX:MSA,OTC Pink:MNSAF) and Galiano Gold (TSX:GAU,NYSEAMERICAN:GAU) led the way during the first quarter with gains over 60 percent.

The upward momentum from gold's high price has yet to translate for junior companies, but David Erfle, founder and editor of Junior Miner Junky, noted in a March interview with INN at Prospectors & Developers Association of Canada convention that the sector is undervalued and overdue for a reversion.

"I've never seen this much of a disconnect before while the gold price is breaking out," he said. "I've seen ... this much of a severe deficit twice before, when the gold price was threatening to break down to a much lower level."

The last two times this happened, there were huge moves for juniors within six months of the start of the reversion.

What's next for gold in 2024?

While the second quarter of the year is just beginning, the yellow metal has already made some major gains. Gold continues to make moves and has even traded above US$2,400 for the first time ever.

The new highs coincided with increasing tensions in the Middle East and fallout from an Israeli attack on international aid workers in Gaza on April 1. The start of April has also seen an escalation in the war between Russia and Ukraine, with renewed strikes on Kyiv and other targets outside Donetsk.

While gold is traditionally viewed as a safe haven during times of geopolitical tension, Tiggre said the ongoing nature of these conflicts has caused an evolution of sorts for investors. “Unless one of these conflicts spreads, I don’t think either will have much impact on gold. They are part of the new normal background level of political radiation,” he said.

For Tiggre, a key point to watch is continued buying of gold from outside of the sphere of influence, where he thinks there is a push to move away from the US dollar. He also expects a recession, which he believes will move gold higher.

“I’m still in the 'hard landing' camp. If I’m right about that, I expect gold to go even higher once that becomes evident,” he explained. Tiggre's comments came as US consumer price index data for the month of March showed a 0.4 percent gain month-on-month, coming in 0.1 percent higher than expected. These higher numbers should be considered by investors as they could cause the Fed to re-evaluate its policy and adjust its rate-cutting schedule.

For his part, Cavatoni believes continued uncertainty around geopolitical events and the macroeconomic landscape may be a tipping point for western investors. “Will those Fed rate cuts be enough to move investors back into the gold? We believe this will serve as a catalyst to bring back the western investor, even at these high prices,” he said.

If gold continues to rise in Q2, it could prove a critical time for the yellow metal and gold stocks. Producers are likely to move first, followed by companies with advanced-stage projects and lastly juniors. However, it's important for investors to remember with rate cuts uncertain, the momentum in the market now could just as easily shift into decline.

Don't forget to follow us @INN_Resource for real-time updates!

Securities Disclosure: I, Dean Belder, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Affiliate Disclosure: The Investing News Network may earn commission from qualifying purchases or actions made through the links or advertisements on this page.

What Makes a World-class Gold Deposit? (Updated 2024)

The world holds several hundred active gold mines, but not all are created equal.

The world’s largest gold operation by production is Barrick Gold (TSX:ABX,NYSE:GOLD) and Newmont's (TSX:NGT,NYSE:NEM) Nevada Gold Mines joint venture in the US. An important source of gold, the mining complex is comprised of 10 underground mines and 12 surface mines, including the famous Cortez and Goldstrike mines.

Apart from size, what makes a world-class gold deposit? Various characteristics must be considered when determining the status of a gold deposit, including deposit type, average grade and mining and processing costs. Read on to learn more about those three factors and how they can be used to identify world-class gold deposits.

What makes a world-class gold deposit?

1. Look for lode

Gold deposits are formed by a wide range of geological processes, and according to the US Geological Survey, they generally fall into two categories: lode deposits and placer deposits. Gold can be found in these deposits in a variety of forms, including nuggets, fine grains, flakes and microscopic particles. The metal is usually found alloyed to silver as electrum or with mercury as an amalgam.

Lode deposits are considered primary gold deposits because they are bedrock deposits that have not been moved. They come in a range of shapes and sizes — indeed, the US Geological Survey notes that they can “form tabular cross-cutting vein deposits but also take the forms of breccia zones, irregular replacement bodies, pipes, stock-works and other shapes.”

Placer deposits are secondary deposits, and they are created when lode deposits are eroded and the gold in them is redeposited. Often alluvial processes are responsible for forming these deposits — running water will erode a lode deposit, and then the gold will fall from suspension as the water slows, creating placer deposits in places like the inside bends of rivers and creeks.

In the past, placer deposits were important sources of gold, but today few economically important placer deposits remain in the world. The top gold deposits are now lode deposits.

2. Consider grade

Grade refers to the proportion of gold contained in ore and is represented in grams per metric ton (g/t). Generally, companies want to find deposits with higher grades as they contain more gold and will usually be more economically sound.

According to the World Gold Council, larger and better-quality underground mines contain around 8 to 10 g/t gold, while marginal underground mines average around 4 to 6 g/t gold. Open-pit mines usually range from 1 to 4 g/t gold, but can still be valuable.

3. Understand mining and processing costs

While grade is important, even a high-grade gold deposit can be uneconomic if extracting the gold it contains is too expensive.

Placer gold deposits are generally easier and cheaper to extract gold from, but as mentioned, few economic placer gold deposits remain today — those in existence are mostly low grade and are not large enough to be viable. It is harder to extract gold from lode deposits as either open-pit or underground mining operations must be constructed, but as technology continues to advance, companies are becoming better able to streamline operations and cut costs.

One increasingly important factor weighing on mining costs is that gold production is becoming more reliant on smaller operations rather than individual large-scale mines. This shift has raised development and operating costs in the gold industry as a whole.

In addition to extraction costs, it is important to look at the processing costs a deposit will incur. The type of processing used generally depends on a deposit’s grade, and there are pros and cons to each type. For instance, the US Geological Survey explains that heap leaching and vat leaching are “relatively low-cost processes” that have made it economic to mine lower-grade deposits.

However, these processing methods “extract somewhat less of the contained gold than the cyanide-extraction methods used for higher grade ore.” Ultimately, companies must choose the best method for their deposit while keeping costs as low as possible — world-class deposits will be those where large amounts of gold can be mined and processed at a relatively low cost.

What are some examples of world-class gold deposits?

Along with the Nevada Gold Mines complex in the US, other examples of world-class gold deposits include:

- Freeport-McMoRan’s (NYSE:FCX) Grasberg mine in Indonesia

- Peru’s Yanacocha mine, operated by Newmont

- The Boddington mine in Australia, operated by Newmont

- The Muruntau mine, owned and operated by the government of Uzbekistan; it ranked as the world's second largest gold-producing mine in 2021

- The Olimpiada mine in Russia, operated by UK-based Polyus Gold (MCX:PLZL)

- The Lihir mine, located on Lihir Island in Papua New Guinea, owned and operated by Newmont

- The Kibali mine, a joint venture between Barrick, AngloGold Ashanti (NYSE:AU) and the Democratic Republic of Congo’s state miner Sokimo

- Cadia Hill, an open-pit mine owned by Newmont within the Cadia Valley in Australia

- The Canadian Malartic mine, a Quebec-based operation owned and operated by Agnico Eagle Mines (TSX:AEM,NYSE:AEM)

This is an updated version of an article originally published by the Investing News Network in 2010.

Don’t forget to follow us @INN_Resource for real-time news updates.

Securities Disclosure: I, Melissa Pistilli, hold no direct investment interest in any company mentioned in this article.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.