Tempus Resources Ltd (“Tempus” or the “Company”) (ASX:TMR)(TSXV:TMRR) is pleased to announce that it has received firm commitments to complete a non-brokered private placement raising gross proceeds of approximately A$1.9 million through the issue of 12,465,425 ordinary shares in the Company at an average price equivalent to A$0.153 per share (the “Placement”). The Placement was strongly supported by North American and Australian institutional and sophisticated investors

Commenting on the Placement, President and Chief Executive Officer, Jason Bahnsen, said: “We plan to resume drilling at our high-grade Canadian Elizabeth Gold Project within the coming 6-8 weeks and the Placement will enable us to extend works there. Given the great results from last year, it’s very exciting to be getting back on the ground at Elizabeth with an enlarged drilling program.“

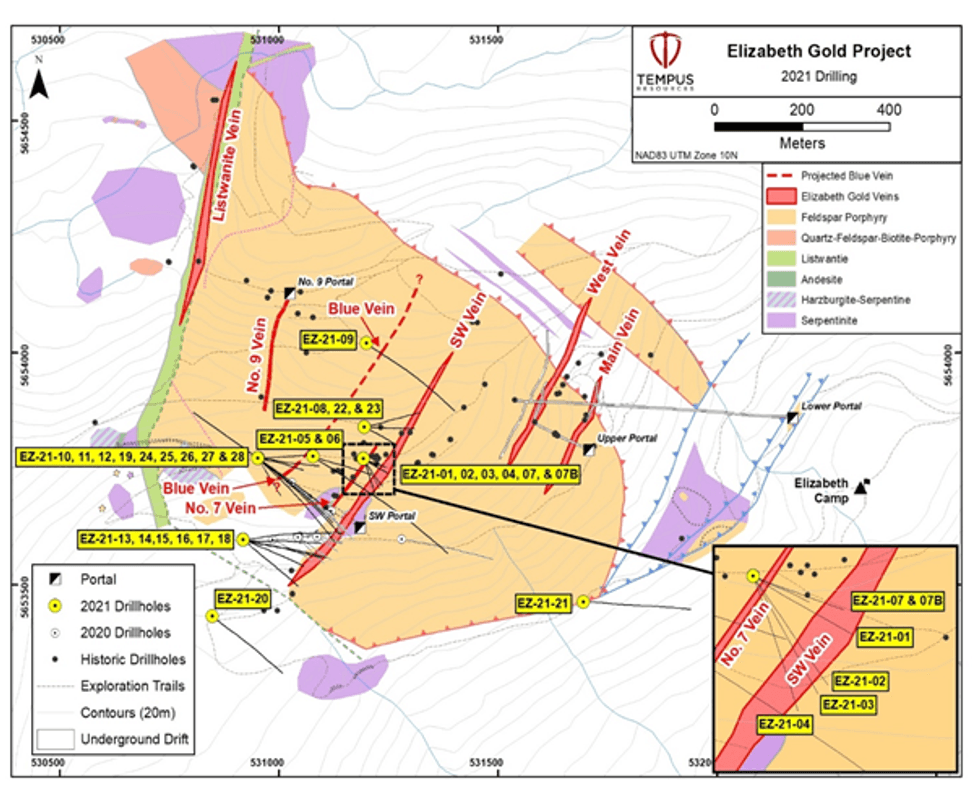

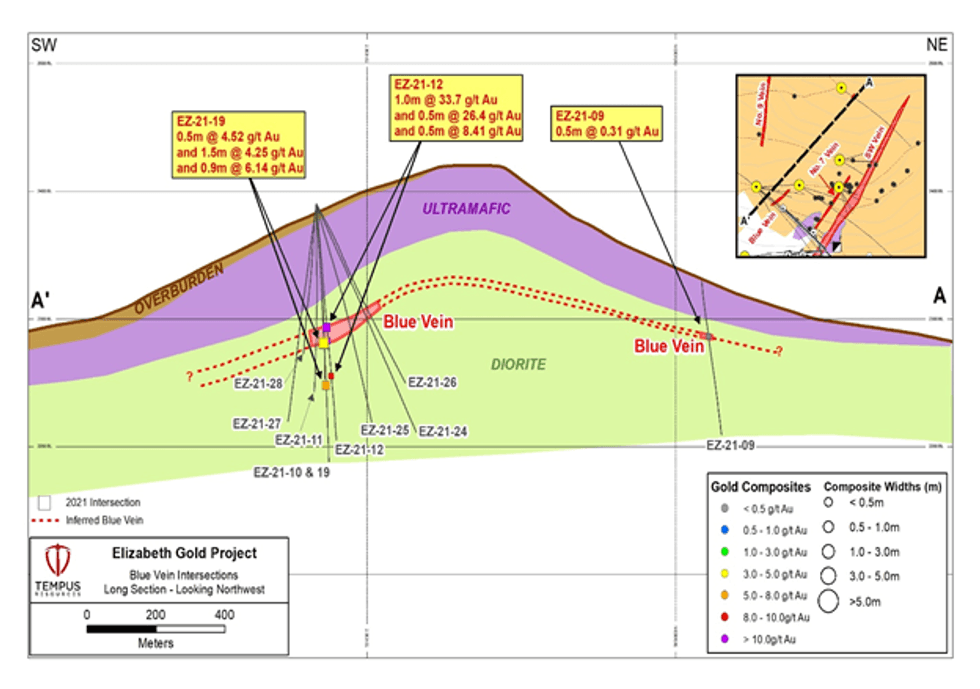

The Company began drilling at Elizabeth in November 2020 and completed 11 holes for 2,006 metres before suspending operations for the season in late-December. Assays returned bonanza grade gold intercepts including:

- Drill-hole EZ-20-06: 5.0m at 61.3g/t gold from 116.5m, including 1.5m at 186.0g/t gold from 118.0m; and

- Drill-hole EZ-20-10: 3.2m at 28.1g/t gold from 184.0m, including 0.5m at 178.0g/t gold from 184.5m

The 2021 exploration program at Elizabeth is fully permitted and on schedule to commence by the end of Q2 2021. Tempus currently plans 7,500 metres of drilling to expand the known high-grade gold mineralisation by testing the down plunge and along strike extensions of the currently delineated vein zones.

The Placement will be completed utilising the Company’s available capacity under Listing Rules 7.1 and 7.1A. It includes two tranches: Tranche 1, which consists of 6,400,000 shares to be issued as “Canadian flow-through shares” at C$0.155 per share; and Tranche 2, which consists of 6,065,425 shares at a price of A$0.145 per share.

The shares issued as “Canadian flow-through shares” qualify as such under the Income Tax Act (Canada), which provides tax credits for investors in qualifying mining and exploration activities. The proceeds of these will be exclusively used to incur eligible Canadian exploration expenses that are “flow-through mining expenditures” (as such terms are defined in the Income Tax Act (Canada)), related to exploration of the Company’s Blackdome-Elizabeth Gold Project in British Columbia, Canada. The Tranche 1 shares are subject to TSX Venture Exchange (“TSXV“) approval and will be subject to a standard Canadian 4 month plus 1 day hold period. Proceeds of Tranche 2 will be available for expenditure on the Company’s Ecuador projects and for general corporate purposes. Shares issued under Tranche 2 will not carry any holding restrictions.

Aesir Corporate Pty Ltd is the Company’s Corporate Adviser. The Placement is non-brokered and the Company has agreed to pay: A$114,608 in advisory / finders fees; plus 2,500,000 unlisted compensation options, with an exercise price of A$0.20 per share for a period of 3 years from the date of issue.

This announcement has been authorised by the Board of Directors of Tempus Resources Ltd.

Competent Persons Statement

Information in this report relating to Exploration Results is based on information reviewed by Mr. Kevin Piepgrass, who is a Member of the Association of Professional Engineers and Geoscientists of the province of BC (APEGBC), which is a recognised Professional Organisation (RPO), and an employee of Tempus Resources. Mr. Piepgrass has sufficient experience which is relevant to the style of mineralisation and type of deposit under consideration and to the activity which he is undertaking to qualify as a Competent Person as defined by the 2012 Edition of the Australasian Code for reporting of Exploration Results, Mineral Resources and Ore Reserves, and as a Qualified Person for the purposes of NI43-101. Mr. Piepgrass has reviewed and verified the disclosure in this news release as accurate and consents to the inclusion of the data in the form and context in which it appears.

For further information:

Tempus Resources LTD

Melanie Ross – Director/Company Secretary Phone: +61 8 6188 8181

About Tempus Resources Ltd

Tempus Resources Ltd (“Tempus”) is a growth orientated gold exploration company listed on ASX (“TMR”) and TSX.V (“TMRR”) stock exchanges. Tempus is actively exploring projects located in Canada and Ecuador. The flagship project for Tempus is the Blackdome-Elizabeth Project, a high grade gold past producing project located in Southern British Columbia. Tempus is currently midway through a drill program at Blackdome-Elizabeth that will form the basis of an updated NI43-101/JORC resource estimate. The second key group of projects for Tempus are the Rio Zarza and Valle del Tigre projects located in south east Ecuador. The Rio Zarza project is located adjacent to Lundin Gold’s Fruta del Norte project. The Valle del Tigre project is currently subject to a sampling program to develop anomalies identified through geophysical work.

Forward-Looking Information and Statements

This press release contains certain “forward-looking information” within the meaning of applicable Canadian securities legislation. Such forward-looking information and forward-looking statements are not representative of historical facts or information or current condition, but instead represent only the Company’s beliefs regarding future events, plans or objectives, many of which, by their nature, are inherently uncertain and outside of Tempus’s control. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as ”plans”, ”expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, ”anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or may contain statements that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “will continue”, ”will occur” or “will be achieved”. The forward-looking information and forward-looking statements contained herein may include, but are not limited to, the ability of Tempus to successfully achieve business objectives, and expectations for other economic, business, and/or competitive factors. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of Tempus to control or predict, that may cause Tempus’ actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein and the other risks and uncertainties disclosed under the heading “Risk and Uncertainties” in the Company’s Management’s Discussion & Analysis for the quarter and six months ended December 31, 2020 dated February 16, 2021 filed on SEDAR. Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statements prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated or expected. Although Tempus believes that the assumptions and factors used in preparing, and the expectations contained in, the forward-looking information and statements are reasonable, undue reliance should not be placed on such information and statements, and no assurance or guarantee can be given that such forward-looking information and statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information and statements. The forward-looking information and forward-looking statements contained in this press release are made as of the date of this press release, and Tempus does not undertake to update any forward-looking information and/or forward-looking statements that are contained or referenced herein, except in accordance with applicable securities laws. All subsequent written and oral forward-looking information and statements attributable to Tempus or persons acting on its behalf are expressly qualified in its entirety by this notice.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Tempus Resources Ltd

View source version on accesswire.com:

https://www.accesswire.com/641914/Tempus-Raises-A19M-to-Extend-Drilling

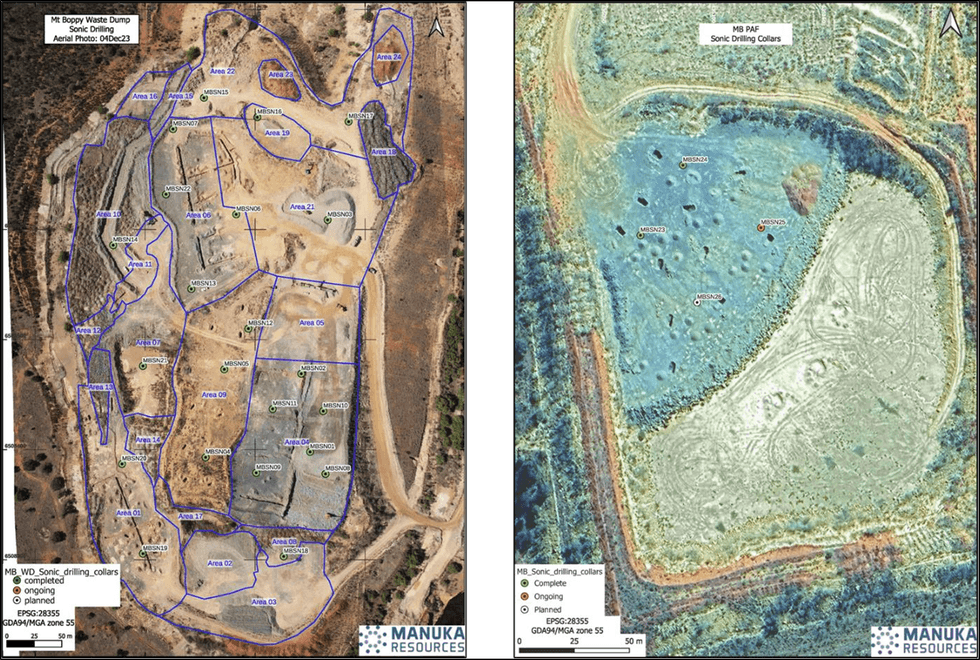

Figure 1: Location Sonic drilling collars over Mt Boppy Rock Dump (left) and TSF3 PAF (right)

Figure 1: Location Sonic drilling collars over Mt Boppy Rock Dump (left) and TSF3 PAF (right)

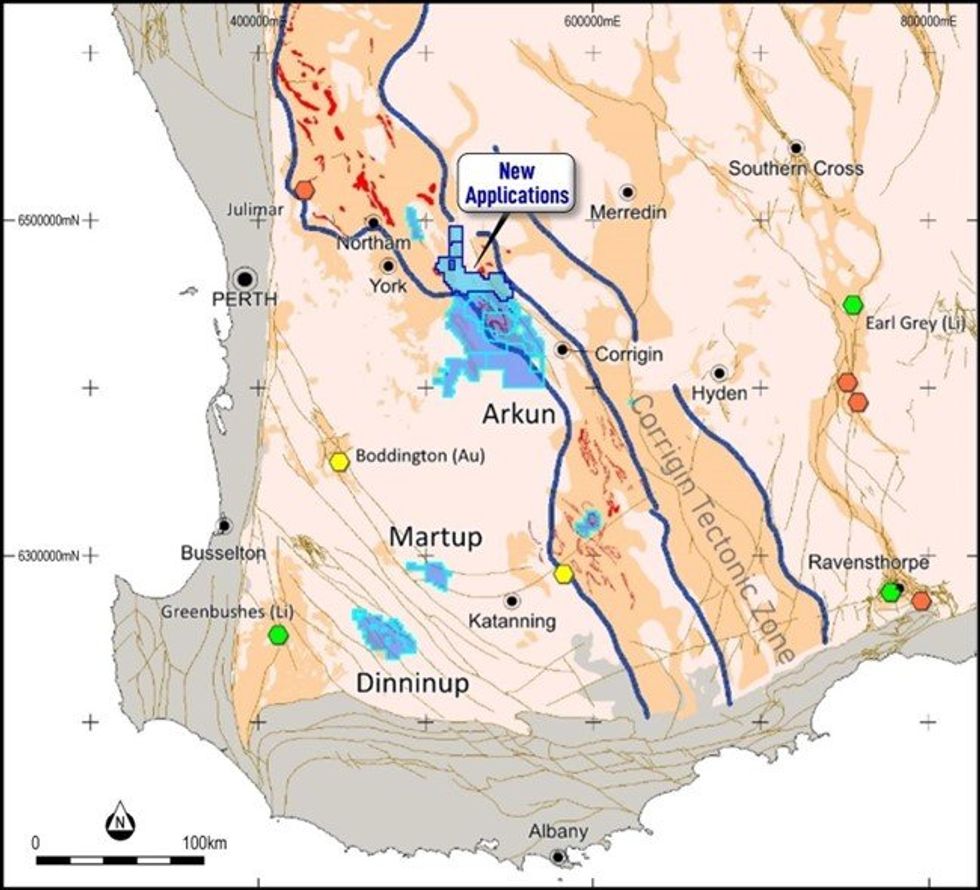

Figure 1. Location and regional geological setting of Impact’s Arkun and other projects in the emerging mineral province of southwest Western Australia. Also shown are recent additions to the Arkun project (ASX Release March 14th 2024). Significant nickel deposits are shown in orange, lithium deposits in green and gold deposits in yellow.

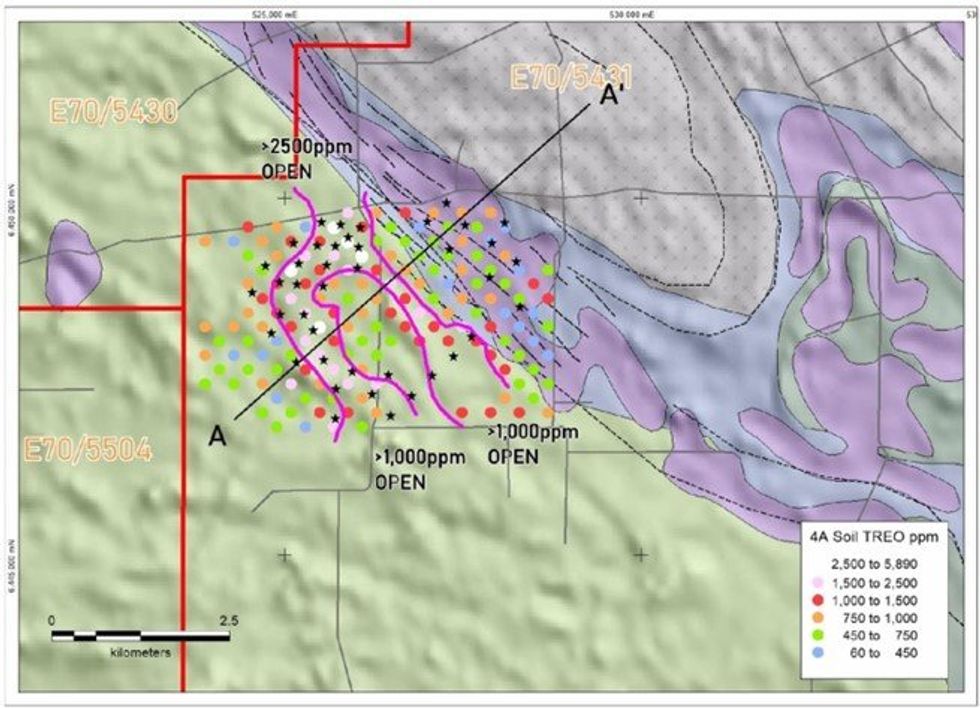

Figure 1. Location and regional geological setting of Impact’s Arkun and other projects in the emerging mineral province of southwest Western Australia. Also shown are recent additions to the Arkun project (ASX Release March 14th 2024). Significant nickel deposits are shown in orange, lithium deposits in green and gold deposits in yellow. Figure 2. Hyperion REE Prospect: TREO+Y results and location of planned drill collars noted by black stars

Figure 2. Hyperion REE Prospect: TREO+Y results and location of planned drill collars noted by black stars

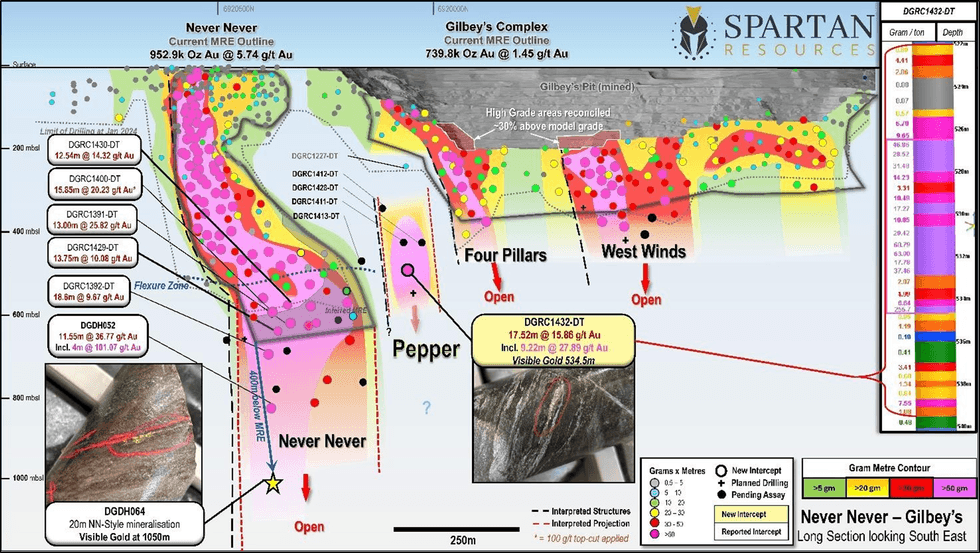

Figure 1: Long Section of the Never Never Gold Deposit, Four Pillars and West Winds Gold Prospects looking East. New high-grade Pepper Gold Prospect with discovery hole DGRC1432 shown in pink. Note: consistency of gold grades in DGRC1432 (inset) and three additional drill-holes with logged mineralised intercepts above DGRC1432 defining the emerging Pepper Gold Prospect (assays pending).

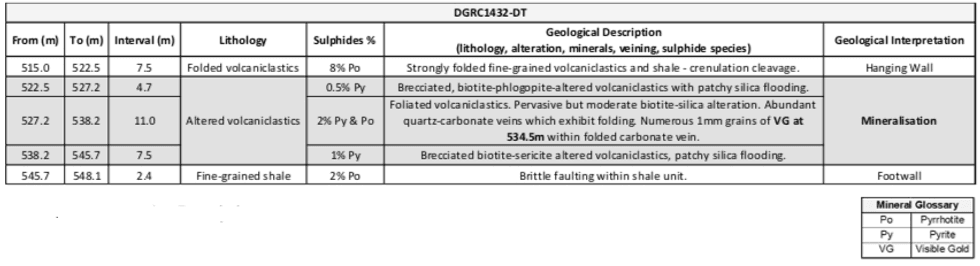

Figure 1: Long Section of the Never Never Gold Deposit, Four Pillars and West Winds Gold Prospects looking East. New high-grade Pepper Gold Prospect with discovery hole DGRC1432 shown in pink. Note: consistency of gold grades in DGRC1432 (inset) and three additional drill-holes with logged mineralised intercepts above DGRC1432 defining the emerging Pepper Gold Prospect (assays pending). Table 1: Mineralisation Description – DGRC1432 – Pepper Gold Prospect discovery intercept

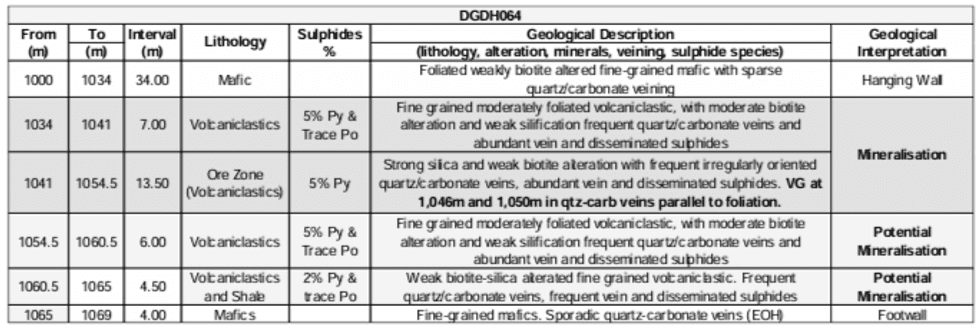

Table 1: Mineralisation Description – DGRC1432 – Pepper Gold Prospect discovery intercept Table 2: Mineralisation Description – DGDH064 – Visible Gold at 1,050m from Never Never in Fig.1 (previously reported)

Table 2: Mineralisation Description – DGDH064 – Visible Gold at 1,050m from Never Never in Fig.1 (previously reported)