- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Galan Lithium

Trident Royalties PLC

International Graphite

Carbon Done Right

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Townsville Battery Manufacturing Plant Feasibility Study Submitted to Queensland Government

Magnis Energy is pleased to announce that Imperium3 Townsville has finalised the feasibility study for a lithium-ion battery cell manufacturing facility

Magnis Energy Technologies Limited (“Magnis” or the “Company) (ASX:MNS) is pleased to announce that Imperium3 Townsville [“iM3TSV”] has finalised the feasibility study [the “Study] for an 18 GWh lithium-ion battery cell manufacturing facility in Townsville, Queensland. Magnis owns one third of iM3TSV.

As announced on 5 June 2018, formal agreements to fast track the Townsville battery plant project were signed with the feasibility study to commence shortly after [ASX Release, 5 June 2018]. The project also received a $3.1 million grant from the Queensland Government [ASX Release, 27 August 2018].

Feasibility Study Outcomes

The feasibility study was primarily performed to develop the detailed engineering plan for the project and to establish financial viability to support subsequent investment decision and project funding.

A significant outcome of the study was to phase the project over 3 stages of 6 GWhs each, for a total

nominal capacity of 18 GWh. This not only reduces the upfront capital expenditure to a more manageable A$1.12B for the first stage, but also allows for project expansion to occur in line with developments in technology and the market.

Site

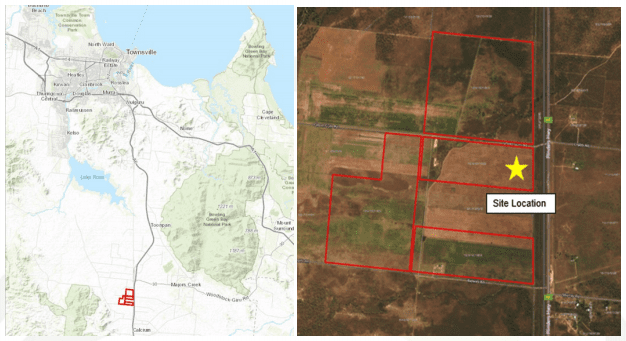

The site is part of Lansdown Station approximately L-10km south of the Townsville CBD with a total property area of 357 hectares [Figures 1 and 2]. It offers flat terrain and is predominantly vacant land with limited natural vegetation. Situated on the western side of the Flinders Highway, bounded to the north by Ghost Gum Road and south by Bidwilli Road, forming part of a new industrial estate planned by Townsville City Council which has a total area of approximately 2,070 hectares. Environmental assessments of the site including flora and fauna, stormwater, hydrology and flooding, geotechnical and cultural heritage found no major impediments to develop the plant at this site. Major infrastructure and utilities such as roads, electricity and gas are in close proximity to the site.

Figures 1 and 2: Site Location

Battery

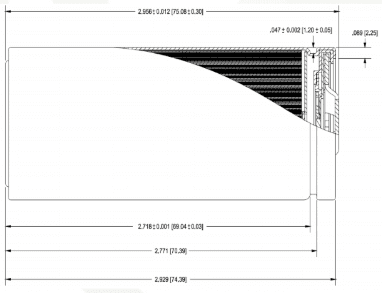

iM3TSV has selected a cylindrical 32700 form factor for our battery cells as it is better suited to high volume manufacture and offers improvements in performance and cost whilst still maintaining flexibility in the range of applications for its use.

Figure 3 : Battery dimensions of a 32700 form factor

ENABLING FUTURE ENERGY

Manufacturing Process

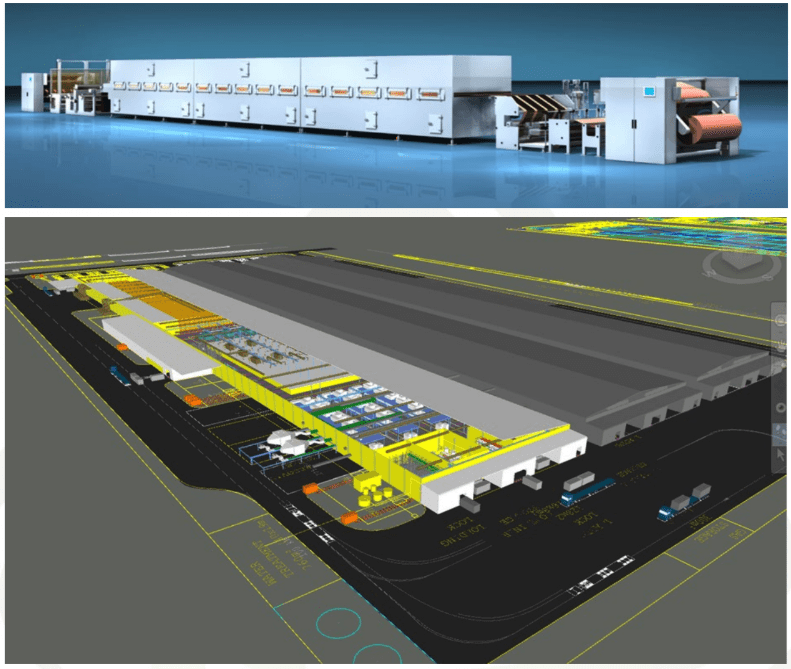

iM3TSV’s manufacturing process was developed with our strategic partners and leading vendors of manufacturing equipment including Durr Megtec and Siemens. Incorporating the latest advancements in battery cell production to increase overall efficiencies and production yields. Ausenco was responsible for combining the individual vendor packages into a fully integrated production process.

Figures 4, 5 and 6: LIB Manufacturing Plant Views of equipment and buildings

Labour

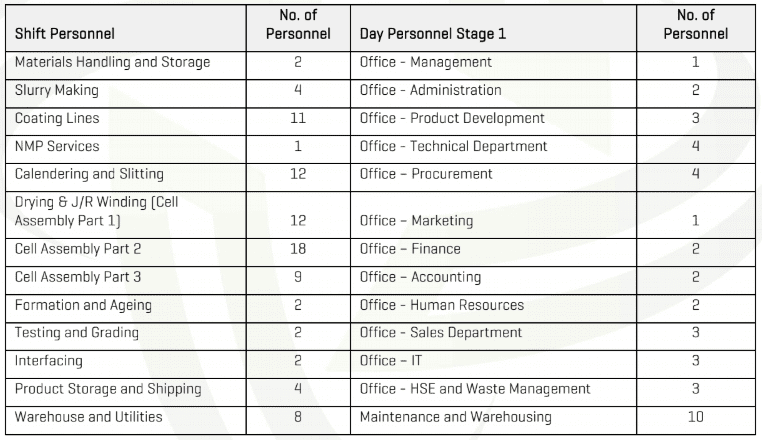

There will be approximately 1150 jobs at full operation [3 stages of 6GWhs] including 90 office staff, detailed below.

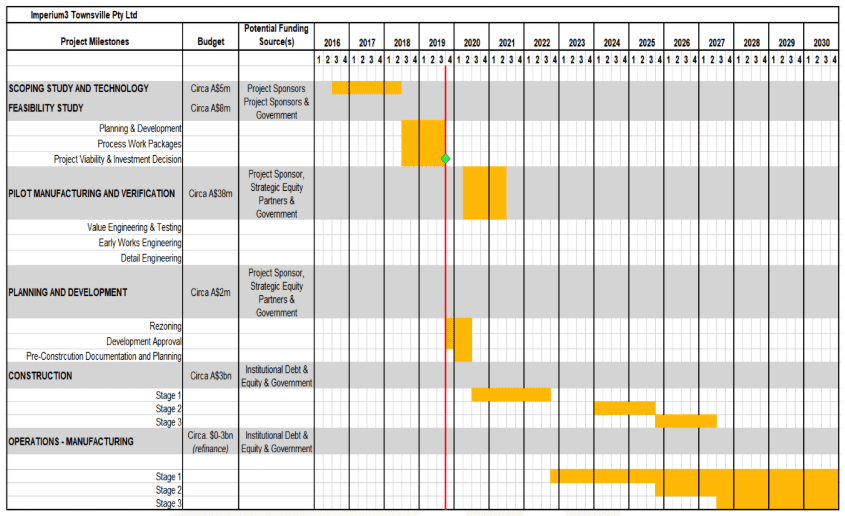

Execution Schedule

The implementation schedule for the first stage 6 GWh production is shown below.

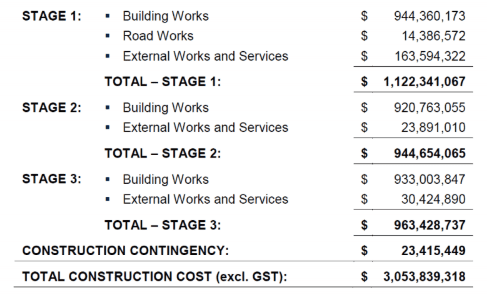

Capital Cost

iM3TSV’s staged approach to developing the project has significant benefits for funding and product development. Townsville based quantity surveyors Rider Levett Bucknall [RLB] completed an independent review of capital expenditures for each stage as shown below.

The cost for stage 1 is slightly higher than stages 2 and 3, due to the need for iM3TSV to contribute to the cost of extending some trunk infrastructure services to the site.

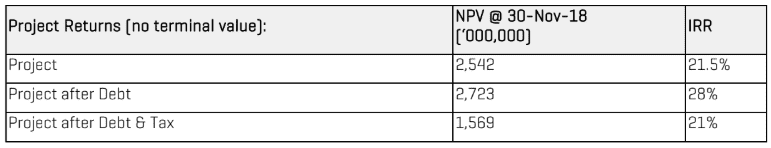

Financial Analysis

Project revenues and operating costs were compiled using conservative inputs which were used to create a robust financial model for the project. This model enables detailed analysis and scenario testing including product chemistries, production parameters and financing options. The table below shows the key financial metrics of a conservative base case assuming no financial incentives from government and iM3TSV achieving an 80% production yield with standard production configuration.

iM3TSV has recently appointed National Australia Bank [‘NAB] as its financial advisor to assist in developing a project funding strategy.

Next Steps

The next phase of the project is now underway with the key milestones being::

- Development Approvals. Over the coming months a development application will be completed and submitted to Townsville City Council for formal consideration;

- Project Funding. iM3TSV’s project funding strategy will be executed with advice from NAB who are the exclusive financial advisor to the project; and

- Testing and Market Development. iM3TSV will commence battery cell production testing in a commercial setting at equipment vendor facilities. iM3 battery cells will be provided to customers for independent evaluation and qualification as a precursor to procuring offtake

iM3TSV has consulted with local businesses, community groups and State and local government including:

- Townsville City Council in pre-development application meetings;

- Edify Energy towards supply of low-cost, renewable power to our facility;

- Port of Townsville to develop our transport and logistics solutions;

- James Cook University for collaboration on future education and training, innovation and research facilitation; and

- RLB quantity surveyors to ensure rigorous cost controls and maximising the amount of local procurement in the project.

Click here to connect with Magnis Energy Technologies (ASX:MNS) for an Investor Presentation.

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2308.78 | -24.61 | |

| Silver | 26.96 | -0.35 | |

| Copper | 4.45 | -0.05 | |

| Oil | 82.13 | +0.23 | |

| Heating Oil | 2.57 | 0.00 | |

| Natural Gas | 1.79 | 0.00 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.