- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Magnis Energy Technologies Limited (“Magnis” or the “Company”) is pleased to announce that Imperium3 Townsville (“iM3TSV”) has made major progress on the feasibility study it is undertaking for a 15 GWh lithium-ion cell manufacturing facility in Townsville, Queensland.

• Significant progress made on feasibility study with positive initial findings

• Preliminary Process Information compiled by Ausenco from Global Vendors

• GHD develops site plan and building drawings

• Engagement with local businesses

• Infrastructure Development with private and public entities

Magnis Energy Technologies Limited (ASX:MNS)(“Magnis” or the “Company”) is pleased to announce that Imperium3 Townsville (“iM3TSV”) has made major progress on the feasibility study it is undertaking for a 15 GWh lithium-ion cell manufacturing facility in Townsville, Queensland. Magnis has a one third ownership in iM3TSV. The initial findings support the rapid development in both the business case and technical solution for this project.

Townsville Location

The study to date is confirming the suitability of Townsville in large-scale manufacturing because of:

• Market proximity to rapidly growing Asian economies where electrification of transport and renewable energy are emerging as disruptors in global markets;

• Logistics with easy access to Townsville Port and local availability of battery materials and precursors such as lithium and manganese;

• The right people to execute with a supportive government and project team with unrivalled expertise in lithium-ion battery (LIB) innovation, business development and project delivery;

• Townsville’s plans to be a leading city of the future with an ambition to become the centre of high technology manufacturing with an emphasis on sustainability.

Business Case

The business case for the 15 GWh LIB manufacturing facility at Townsville continues to positively evolve across the following key areas:

• Strong Battery Market Fundamentals. Electrification of mobility and the transition to renewables continued unabated in 2018. Global growth in electric vehicle sales was over 50% above that for 2017 with 2019 forecast to deliver even greater growth as automotive manufacturers broaden their EV offering across their fleet;

• Growing Government Support. The average cost of energy generated by renewable solar and wind projects fell below the average cost of existing alternatives in 20181. This has encouraged public support for climate action in many jurisdictions around the world through lower power prices, new policies incentivising electromobility, renewables and LIB storage;

• Local Business Engagement. iM3 TSV is also investigating and identifying future participation of local businesses in both the construction and operating phases of the project. iM3’s scoping study established local content opportunities to be in the order of A$300 million across a range of items including labour, power, fuel, security and logistics;

• Global Partnering. iM3 TSV is continuing to establish global partnerships with component suppliers, industry specialists and tertiary education organisations (international and national). Testing and qualification of battery input materials involving over 30 well known global suppliers has occurred over the past 12 months in iM3’s facility located in upstate New York;

• Downstream Co-Location Opportunities. Opportunities representing an additional potential economic gain to the local economy in the order of US$750M to US$1.5B annually; and

• Cost Competitiveness. iM3 is engaging with each level of government to seek to create supportive policy, targeted incentivisation and collaboration for future R&D initiatives.

The economic and strategic benefits of the project include

• Creating approximately 750 jobs in a high technology manufacture;

• Promoting sustainable industries in North Australia;

• Supporting Townsville through the current local economic downturn;

• Realising higher value from Australia’s resource endowment; and

• Transitioning Australia to low carbon economy and associated industries.

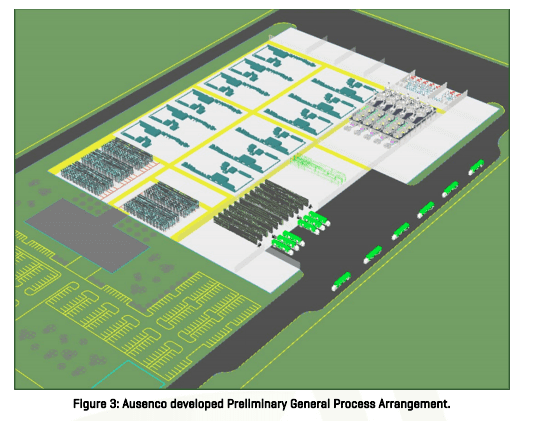

Technical Solution

Creating Australia’s first Giga-scale LIB manufacturing facility has required bringing together the technical expertise of global equipment vendors with local engineering specialists. In particular, Ausenco, which is based in Brisbane is overseeing process development and the GHD office in Townsville is overseeing site development and building design.

Imperium3 Chairman Dr Shailesh Upreti said: “We would like to thank the Queensland State Government and Townsville City Council for the continuous support provided towards our project in Townsville.”

“In recent times we have been approached by members from both major parties federally and prominent business leaders in our community who are interested in assisting and being involved in the project which is very encouraging.”

Notes:

- https://reneweconomy.com.au/australias-plunging-wind-solar-storage-costs-stun-fossil-fuel-industry-60383/

For further information, please contact:

Marc Vogts

Managing Director

Ph: +61 2 8397 9888

www.magnis.com.au

Click here to connect with Magnis Energy Technologies (ASX:MNS) for an Investor Presentation.

Source: drive.google.com

Outlook Reports

Featured Australia Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2385.44 | +17.78 | |

| Silver | 28.48 | +0.26 | |

| Copper | 4.44 | +0.07 | |

| Oil | 82.19 | -0.50 | |

| Heating Oil | 2.54 | -0.04 | |

| Natural Gas | 1.76 | +0.04 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.