- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

Fireweed Metals

Cyclone Metals

Lancaster Resources

Element79 Gold Corp.

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

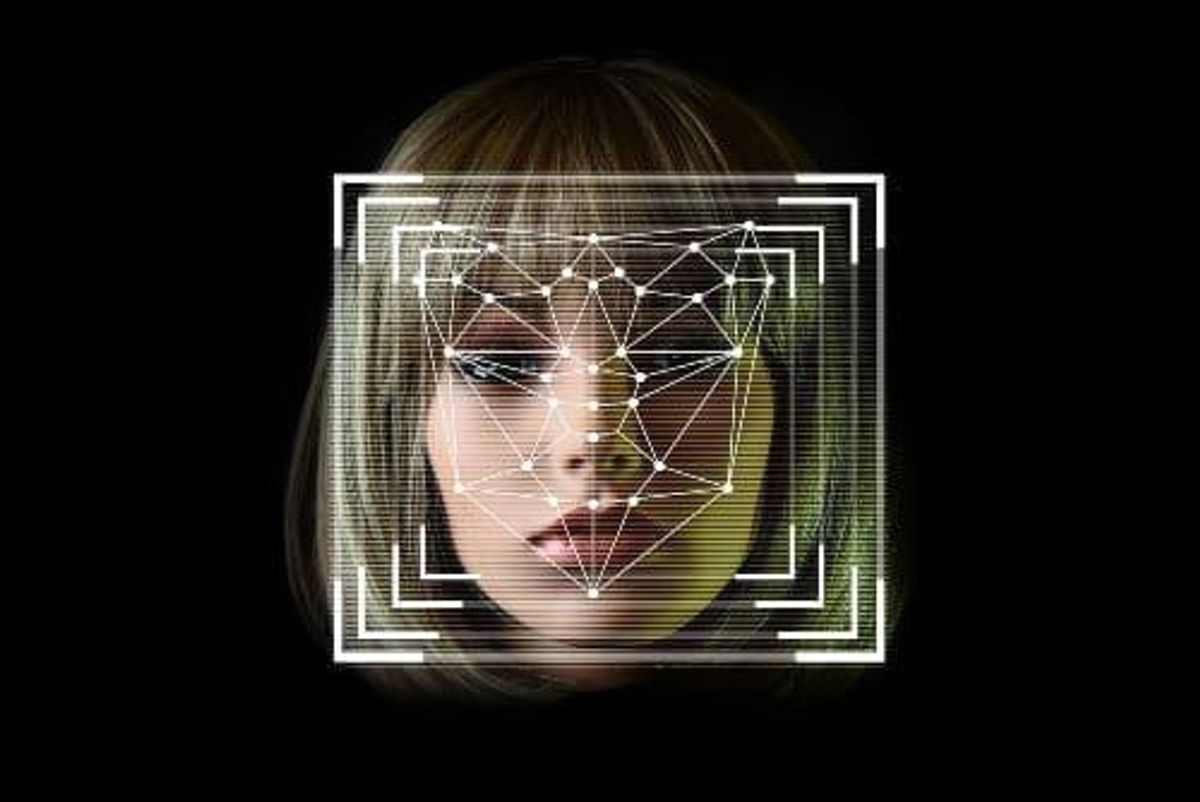

Veridium Using Biometrics to Combat Outdated Security Systems

By using biometrics for authentication, companies can create security systems that are based on unique identifiers.

Thanks to a pivotal year for the cybersecurity space — defined by a flurry of major online breaches that affected millions of users globally — an expert believes the need for increased security measures will continue into 2020.

For some, these increased security efforts could mean the end of one of online security’s oldest institutions: the password. At least that’s what James Stickland, CEO of Veridium, argues for.

Stickland has said the password concept is an “outdated, costly method of authentication” that often leaves users susceptible to digital attack.

Veridium is a biometric authentication company providing businesses with biology-based identification solutions to protect employee and company data.

In using biometrics — the distinctive, measurable characteristics identify one person from another — for authentication, companies can create security systems that are based on unique identifiers.

According to Stickland, compromised passwords made up 61 percent of data breaches in 2019 and with the expansion of the 5G network, said to be up 100 times faster than the existing cellular network, the speed of data theft is likely to surge in 2020.

In Stickland’s view, the potential adoption of biometrics could usher in a new standard in the cybersecurity space as breach attempts are expected to become more frequent and sophisticated, easing the weight off of the already established and overburdened password ecosystem.

Stickland spoke to the Investing News Network (INN) about the catalysts that could lead to the password’s demise as well as other trends he believes will shift the focus onto biometric cybersecurity.

The following interview has been edited for clarity and brevity. Continue reading for more of what Stickland told INN.

INN: Do you think that companies today are taking note of the increased challenges in protecting consumers from the emerging threats?

JS: I think they’re not fully prepared, if I’m brutally honest. If I’m investing in companies that are publicly traded or privately held, I want to understand the security posture of the institution I’m working with. If I’m downloading an application, I should care about the security posture and the security standards that are being adopted.

When we see market caps being affected by breaches in data by institutions, I now really care as an investor. And I care because we’re putting the data of our customers and the data of our employees at risk. And that really is one of the key fundamentals of the reason why companies can be successful.

I think that yes, people are talking about security. I think it’s active in every board agenda and every conversation and dialogue. But the challenge is I’m not sure if it’s necessarily as heightened as it could be or if we’re prepared for future-based security challenges that we will see through 2020 and beyond.

INN: Are there any particular industries you think would most benefit from a biometric security system or a two-point authentic authentication system?

JS: Financial services is highly regulated and has incredibly sensitive data. They are absolutely at the leading edge of removing the … password ecosystem that exists today and replacing it with biometrics, which we attest is the strongest form of authentication because its a representation of who you are, rather than what you know and what you have.

INN: Can you talk a little bit about how the gig economy kind of has its own set of challenges?

JS: The gig economy is at the forefront of driving huge consumption and continued adoption of the application ecosystem. And in doing that, we’re sadly giving away a lot of access to our own personal data.

Imagine the average user has, let’s say, 50 or 100 different applications on their device — they’re interacting with 50 or 100 different service providers. All the accessing and all the requesting of things like your email address, your home address, your credit details, all that content becomes ever present in a cloud environment.

What (Veridium’s) driving is a real focus and a real agenda around managing your life and more effectively using biometrics to secure the access to your identity, so that we can take away the weak points.

INN: James, you have explained the uses of physical biometrics, which relate to benchmark characteristics such as your fingerprint or retina, but can you explain more about behavioral biometrics and their role for security measures moving forward in 2020?

JS: You think about our interaction with our data, our interaction with our devices physically. We have an opportunity with technology now to start to build up a true heartbeat in a data sense or a true heuristic of you as an individual.

The way that you hold your device, the gait of your walk, the pressure and the frequency of your interaction with different data types, your GPS location. We’re sending signals, physical and data, and we’re building these footprints all the time. And now we have an opportunity to really utilize those points and start to build a map of you.

In authentication, the desire always is not to create an abrasive interaction with the end user because it drives people out of checking out carts, or accessing content and it drives a poor experience.

We believe in a combination of authentication measures (involving) behavior plus explicit authentication measures, which gives us, for the very first time, really strong and really effective authentication capabilities.

There’ll always be a need, in my opinion, for biometric authentication in the explicit fashion, faces, fingerprints, irises, whatever it might be. And that will be dependent on risk, or it’ll be dependent on value or the sensitivity of a transaction. But I think there’s an opportunity to really add everything on … by using behavioral biometrics, whether these are data or physical attributes.

Don’t forget to follow us @INN_Technology for real-time news updates!

Securities Disclosure: I, Danielle Edwards, hold no direct investment interest in any company mentioned in this article.

Editorial Disclosure: The Investing News Network does not guarantee the accuracy or thoroughness of the information reported in the interviews it conducts. The opinions expressed in these interviews do not reflect the opinions of the Investing News Network and do not constitute investment advice. All readers are encouraged to perform their own due diligence.

Outlook Reports

Featured Cyber Security Investing Stocks

Browse Companies

MARKETS

COMMODITIES

| Commodities | |||

|---|---|---|---|

| Gold | 2344.53 | +0.88 | |

| Silver | 27.94 | +0.01 | |

| Copper | 4.32 | +0.06 | |

| Oil | 85.45 | -0.14 | |

| Heating Oil | 2.68 | +0.02 | |

| Natural Gas | 1.77 | +0.01 | |

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.