- AustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

Rights Issue and Shortfall

Winsome Commences Drilling Campaign at Flagship Lithium Project

Western Australian-based lithium exploration and development company Winsome Resources (ASX:WR1; “Winsome” or “the Company”) is pleased to advise drilling has commenced at its flagship Cancet property in the James Bay region of Quebec, Canada.

The drilling campaign is expected to take three to four weeks and will include around 20 holes to a combined depth of approximately 2,000m. It will build on two previous drilling campaigns conducted at the Cancet property in 2017.The project will include infill and "twinning" of existing holes to increase QAQC level of drilling data. The potential outcome will confirm the previous high-grade intersections, increase the Company's understanding of the pegmatite orebody and provide quality data for resource calculation in the future. The project will also test several new targets near the pegmatites which were recently identified using new interpretations of magnetic data over the area. Winsome’s Perth-based Managing Director Chris Evans has been onsite at Cancet over the past ten days with Canadian General Manager Carl Caumartin conducting site preparation. Mr Evans said: “The commencement of drilling at Cancet is a significant milestone for the Company and means we are one step closer to our intention of declaring a maiden resource. This is the culmination of 12 months of work since the Winsome Resources spin-out and listing process began in March 2021 and represents the new Company’s first ‘ín-ground’ exploration work. “The drill program will focus on infill drilling to increase our knowledge of the ore body, as well as extension drilling with a view to extending the known mineralisation to the east, north and west. “Planning is also underway for our spring and summer exploration programs, which will commence once ground conditions permit. This will be a combination of on the ground field exploration, taking rock and soil samples, trenching and drilling. “The programs will be based on targets identified by the magnetic survey already conducted and an upcoming geophysical gravity survey that will be completed in April 2022.”

Click here for the full ASX release

This article includes content from Winsome Resources, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Winsome Further Expands Lithium Exploration Footprint in Quebec

Perth-based lithium exploration and development company Winsome Resources (ASX:WR1; “Winsome” or “the Company”) is pleased to advise it has partnered with geology specialist Mr Glenn Griesbach and with local prospector Mr Marc de Keyser.

Highlights:

- Exclusive option agreement executed for Winsome to acquire and explore a further 259 claims, totalling 149 km2 in the highly sought after greater Decelles region of Quebec, Canada

- Option agreement expands Winsome’s lithium exploration footprint in Quebec, enlarging Company’s recently acquired Decelles claim area by nearly 40%

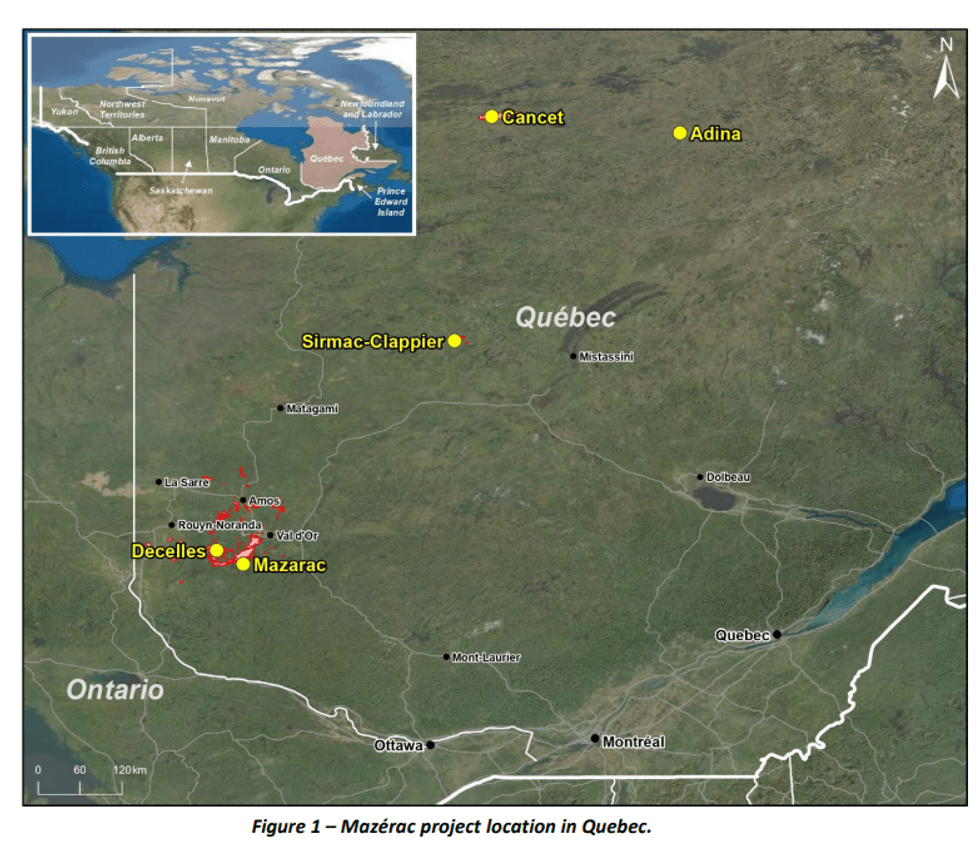

- This expanded area, known as Mazérac, is located around the Decelles Reservoir, about 50km southwest of Val-d’Or and easily accessible by a network of forestry roads

- The region has seen much recent staking and prospecting activity, including highgrade spodumene discoveries by Vision Lithium at their nearby Cadillac property1

- Enlarged property holding is highly complementary to Company’s 100% owned, existing projects in the James Bay region – Cancet, Adina and Sirmac-Clapier

The Company has entered into an exclusive option agreement to acquire 258 claims from Mr Glenn Griesbach and one claim from Mr de Keyser, totalling 149km2 in the prospective Mazérac region of Quebec, Canada. This is within the greater Decelles area, where the Company also acquired new property in January 20222 .

Mazérac is located close to the mining centres of Val-d’Or and Rouyn-Noranda, approximately 600km from Montreal. The Company has signed an exclusive option agreement to explore and subsequently acquire the claims over a 24-month period.

Mr Griesbach is a Canadian-certified geologist with more than 40 years of mineral exploration experience across Canada, Africa, China, and Southeast Asia. Mr de Keyser is a seasoned local prospector of First Nation heritage, with a strong understanding of the Mazérac region.

By entering into this agreement, the Company further expands its land holding in Quebec, exploring a new area of the province known for granitic and pegmatitic outcrops. The area is located close to infrastructure and the major mining centres immediately adjacent to recent lithium discoveries1 (see Figure 1 map)

Managing Director Chris Evans said:

“We are delighted to have entered into the option agreement for a further 259 claims at Mazérac in the Decelles region. There has been a considerable amount of recent lithium focused activity in the surrounding region, with several public and private companies making successful discoveries.

“By acquiring this project, we significantly increase the Company’s prospective lithium landholding in Quebec and continue towards achieving our vision of supplying high grade lithium products into the North American battery supply chain.”

Transaction details

Winsome has entered into an exclusive option agreement to acquire 259 claims from Mr Griesbach under the following broad terms:

- An upfront fee of AUD$75,000, paid in WR1 shares

- AUD $250,000 paid in three tranches of WR1 shares, based on the five-day VWAP from last week’s trading (AUS $0.47). This will equate to:

- 177,000 WR1 shares issued now

- 177,000 WR1 shares issued on 3 May 2023

- 177,000 WR1 shares issued on 3 May 2024

- A 2% Net Smelter Royalty (NSR) over the properties which can be reduced to 1% at any time for a consideration of AUD $1,000,000

Once the final payment of 175,000 WR1 shares is made on 3 May 2024, the 259 claims will transfer to Winsome’s Canadian subsidiary.

The Company also has the ability to accelerate the acquisition at any point within the next 24 months and have the claims transferred immediately by issuing all shares due to Mr Griesbach.

As a separate transaction, the Company paid Mr de Keyser CAD $20,000 to acquire outright the ‘Nippy Hill’ claim which is contiguous to the other Mazérac claims described above.

Click here for the full ASX Release

This article includes content from Winsome Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Top 8 Canadian Lithium Stocks of 2024

After a tumultuous 2023 that saw prices for lithium carbonate shed 80 percent from its January start value, Q1 2024 was much less volatile. Starting the year at US$13,377.44 per ton, lithium carbonate prices ended the three-month period in the US$14,874,31 price range, representing an 11 percent increase.

Strong electric vehicle sales numbers in January helped sustain lithium prices through January and February. Prices began to climb higher at the end of the month and through March when values reached a quarterly high of US$16,109 per metric ton (MT). The rally was attributed to news out of China that noted that lithium demand for batteries and energy storage was locked in an “irreversible” growth trend.

"If lithium prices can stabilize between 80,000 and 150,000 yuan, leaving upstream and downstream (companies) along the industry chain certain profit, it might be the best development environment for the whole industry," Li Liangbin, chairman at Ganfeng Lithium (OTC Pink:GNENF,HKEX:SZSE:002460) told Reuters. That currently converts to about US$11,050 to US$20,725.

Against that backdrop several Canada-listed lithium companies saw share price growth during the first quarter of the year. This list was created on April 10, 2024, using TradingView‘s stock screener, and all data was current at that time. Only companies with market caps above C$10 million for TSX and TSXV and above C$5 million for CSE are included.

TSX and TSXV lithium stocks

1. Century Lithium (TSXV:LCE)

Year-to-date gain: 78 percent; market cap: C$131.49 million; current share price C$0.89

US-focused Century Lithium is currently advancing its Clayton Valley lithium project in West-central Nevada. The company is also engaged in the pilot testing phase at its lithium extraction facility in Amargosa Valley, Nevada, which will process material from the lithium-bearing claystone deposit.

Shares of Century Lithium began the year trading at C$0.48 range and rose to a quarterly high of C$0.80 on March 27.

While the company made no announcements during Q1, some of the positive price momentum likely resulted from two press releases from December 2023. The first provided an update on the company’s ongoing feasibility study for the Clayton Valley project.

“This comprehensive study covers all areas of the lithium extraction process from shallow surface mining of lithium-bearing clay to on-site production of battery-grade lithium carbonate,” it read. “Target production for the study follows that of the project’s earlier Pre-Feasibility Study, which was based on a mill feed of 15,000 tonnes per day and average annual output of 27,000 tonnes per year of lithium carbonate equivalent.”

The second December announcement provided an overview of work at the extraction facility. During test work at the pilot plant the company achieved increased lithium grades with an average grade of 7.5 grams/liter lithium.

“This increase in concentration was attributed to the integration of Koch Technology Solutions Li-ProTM equipment into the direct lithium extraction (DLE) area,” the company said

2. Lithium Chile (TSXV:LITH)

Year-to-date gain: 50.94 percent; market cap: C$164.97 million; current share price: C$0.80

South America-focused Lithium Chile owns several lithium land packages in Chile and Argentina. Presently, the explorer is working to delineate the deposit at its Salar de Arizaro property in Argentina.

Following price volatility in January and early February, shares of Lithium Chile made a 32 percent climb between January 1, 2024, and the end of February.

On February 28, Lithium Chile released “favorable” results from a new drill hole on the northeastern side of the Salar de Arizaro claim.

Hole ARDDH-08 was drilled to a depth of 606 meters, encountering a brine-rich, sandy formation at 200 meters. Samples were sent to Alex Stewart Laboratory in Jujuy, Argentina, revealing lithium grades of 180 mg/l at 50 meters and 690 mg/l at 200 meters, the statement read.

In early March, Lithium Chile penned a farm-In agreement with European mining company Eramet (EPA:ERA). The agreement aims to expedite exploration efforts on four Chilean properties-- Llamara, Aguilar, Rio Salado, and Aquas Caliente-- with a total land area exceeding 40,000 hectares

3. Power Metals (TSXV:PWM)

Year-to-date gain: 24 percent; market cap: C$55.22 million; current share price: C$0.35

Exploration company Power Metals holds a portfolio of diversified assets in Ontario and Quebec, Canada.

In late February, Power Metals commenced a winter drill program at its Case Lake property in northeastern Ontario. The program was designed to expand and define lithium/cesium/tantalum (LCT) mineralization, building on previous work which revealed high-grade lithium and cesium mineralization.

Company shares traded flatly for most of Q1 locked in the C$0.27 range. Prices began to rise in mid-March and hit a three-month high of C$0.43 on March 31.

The 59 percent uptick coincided with news that Power Metals was

acquiring the 7,000-hectare Pelletier project, consisting of 337 mineral claims in northeast Ontario.

According to the company, the project features lithium/cesium/tantalum (LCT) potential, with peraluminous S-type pegmatitic granites intruding into metasedimentary and amphibolite formations.

4. Q2 Metals (TSXV:QTWO)

Year-to-date gain: 24 percent; market cap: C$27.71 million; current share price: C$0.31

Mineral exploration firm Q2 Metals is actively exploring its flagship Mia lithium property in the Eeyou Istchee James Bay Territory of Quebec, Canada. The property contains the Mia Trend, spanning over 10 kilometers.

Included in the Q2 portfolio is the Stellar lithium property, comprising 77 claims and located six kilometers north of the Mia property.

Company shares were trading below C$0.20 for most of January and February. On February 27, the price rose rapidly climbing from C$0.19 on February 26 to C$0.45 to end the month.

The growth corresponds with the company announcement that a winter drill property was complete.

“The winter drill program at the Mia Property has confirmed the spodumene mineralized pegmatite at the western end of the Mia Trend,” said Neil McCallum Q2 Metals VP Exploration. “The drilling has successfully evaluated a large portion of the Mia Trend that had been explored at the surface.”

Days later Q2 reported the acquisition of the 11,374-hectare Cisco lithium property also located in the Eeyou Istchee James Bay region.

The upward trend continued, and shares reached a Q1 high of C$0.51 on March 4, 2024.

5. Volt Lithium (TSXV:VLT)

Year-to-date gain: 23.91 percent; market cap: C$37.14 million; current share price: C$0.28

Volt is a lithium development and technology company aiming to become a premier North American lithium producer utilizing its unique technology to extract lithium from oilfield brine.

In late January Volt made its first announcement of 2024, highlighting the company’s success producing 99.5 percent battery-grade lithium carbonate. The achievement was made at the company’s demonstration plant in Calgary, Alberta.

Commenting on the milestone, company CEO, Alex Wylie expressed his excitement.

“The Volt team continues to advance our DLE capabilities at our demonstration plant and showcased our ability to transform oilfield brine into a commercially saleable grade of lithium carbonate," he said. “Bringing the full-cycle process in-house greatly reduces the cost to produce lithium carbonate, which is expected to enhance margins and position Volt as a low-cost operator.”

The cost savings were reiterated in late February when the company announced a 64 percent reduction in full-cycle DLE operating costs at the Calgary-based demonstration plant.

Shares marked a Q1 high of C$0.27 on March 12.

CSE lithium stocks

1. Foremost Lithium (CSE:FAT)

Year-to-date gain: 18.69 percent; market cap: C$19.17 million; current share price: C$4

Foremost Lithium is an exploration company with hard rock lithium properties in Snow Lake, Manitoba, and Lac Simard South, Quebec. Included in the company’s portfolio is the Winston gold/silver property in New Mexico, US.

In January, Foremost received its third C$300,000 grant from the Manitoba Mineral Development Fund. The monies have been earmarked for continued exploration and drill work at the Snow Lake property.

Throughout the first quarter Foremost released several updates including, receiving a multi-year work permit for the Jean Lake lithium/gold project in Manitoba, the start of a drill program at the Zoro lithium property in the Snow Lake region and the of filing an application for C$10 million from Canada’s Critical Mineral Infrastructure fund.

Shares of the company hit a Q1 high of C$4.51 in late February when the company released some promising intercepts from the Zoro property drill program.

“The presence of spodumene and the length of pegmatite encountered in multiple holes, highlighted by over 32-meters of spodumene-bearing pegmatite hit in one hole, are very positive in terms of the potential for our maiden resource to now grow in significant scale,” Jason Barnard, president and CEO of Foremost Lithium, said in a February 27 statement.

“As drilling progresses, the focus will continue to build resource to the south of Dyke 1, a promising new uncharted area, which has confirmed spodumene pegmatite as drilling progresses.”

2. Quantum Battery Metals (CSE:QBAT)

Year-to-date gain: 5.56 percent; market cap: C$6.9 million; current share price: C$0.19

Mineral exploration company Quantum Battery Metals is focused on identifying lithium and cobalt deposits in Canada.

In mid-January the company announced it was actively looking to “acquire additional properties to expand on its portfolio to help address the world's shortage in technology metals.”

The statement continued: “There is an increasing demand for metals as the world is transitioning to a low-carbon economy and global conflicts continue to arise that require massive amounts of metals for producing batteries, clean energy technologies, and national defense applications.”

Subsequently, Quantum reported submitting a letter of intent to acquire the Copper Coffer property in Newfoundland, Canada.

Company shares reached a first quarter high of C$0.20 on March 17, and ended the three-month session in the same range.

Don’t forget to follow us @INN_Resource for real-time news updates!

Securities Disclosure: I, Georgia Williams, hold no direct investment interest in any company mentioned in this article.

Top 4 ASX Lithium Stocks of 2024

In contrast to the volatility of 2023, Q1 2024 saw a more stable lithium market. Prices for lithium carbonate started the period at US$13,377.44 per tonne and finished at US$14,874.31, marking an 11 percent increase.

Strong electric vehicle sales in January helped support prices for the important battery metal, which continued to rise through February and March, reaching a quarterly high of US$16,109. This rally was fueled by reports from China indicating a sustained growth trend in lithium demand for batteries and energy storage technology.

Here the Investing News Network looks at the top four ASX-listed lithium companies by year-to-date gains. The list below was generated using TradingView’s stock screener on April 10, 2024, and includes companies that had market caps above AU$10 million at that time. Read on to learn more about their activities over the past year.

1. Prospect Resources (ASX:PSC)

Year-to-date gain: 46.07 percent; market cap: AU$40.31 million; current share price: AU$0.13

Africa-focused exploration company Prospect Resources holds a diversified portfolio of assets located in Zimbabwe, Zambia and Namibia. Its lithium properties — Omarur and Step Aside — are in Namibia and Zimbabwe, respectively.

Shares of Prospect were locked below AU$0.08 from January to mid-March, before rising to a Q1 high of AU$0.09 on March 25. The move occurred shortly after Prospect acquired a 60 percent residual interest in the Omarur property from Osino Resources (TSXV:OSI,OTCQX:OSIF) for US$75,000, taking Prospect’s stake to 100 percent.

Earlier in the quarter, Prospect announced the start of Phase 2 drilling at Omarur. The company said the program will consist of 70 rotary air blast and reverse-circulation drill holes across 4,250 metres.

2. Ioneer (ASX:INR)

Year-to-date gain: 33.33 percent; market cap: AU$432.96 million; current share price: AU$0.20

Emerging producer Ioneer owns the Rhyolite Ridge lithium-boron project in Nevada, US. According to the company, the project is considered the “sole lithium-boron deposit in North America.”

As part of the permitting process for Rhoylite Ridge, Ioneer completed and submitted an administrative draft environmental impact statement to the US Bureau of Land Management (BLM) in mid-January.

After slipping to a first quarter low of AU$0.10 on January 25, shares of Ioneer spent February and March slowly climbing, reaching a quarterly high of AU$0.17 on March 25. News that the BLM has reached a final decision continued to add tailwinds at the beginning of the second quarter; the results of the review are expected in mid-April.

3. Pan Asia Metals (ASX:PAM)

Year-to-date gain: 28 percent; market cap: AU$26.85 million; current share price: AU$0.16

ASX-listed Pan Asia Metals is a mineral exploration company with a diverse portfolio of projects in Southeast Asia, particularly Thailand. Specialising in critical metals such as lithium, tantalum and rare earth elements, the company is also actively engaged in exploration activities in South America.

Shares of Pan Asia Metals rose to a Q1 high of AU$0.21 during the first week of January. The spike came when the company entered into three binding option agreements to secure ownership of the Dolores North, Dolores South, Pozon and Pink project areas, which together comprise the Tama Atacama lithium brine project in Chile; it also agreed to acquire the Ramatidas project area. In total, these assets span about 120,000 hectares.

“The Tama Atacama lithium project has the potential to be one of the largest lithium brine projects in the global peer group. Surface assays for lithium are extremely high and the project has enviable strategic positioning, with all infrastructure requirements satisfied,” said Pan Asia Metals Managing Director Paul Lock.

Shares subsequently shed some of the positivity, spending the rest of the quarter rangebound below AU$0.17.

4. Mineral Resources (ASX:MIN)

Year-to-date gain: 2.45 percent; market cap: AU$13.81 billion; current share price: AU$71.61

Diversified miner Mineral Resources holds a portfolio of assets in Australia, including lithium and iron ore projects.

Following a share price slump early in the year's first quarter, the company began to rebound in mid-January. On February 21, shares rose to AU$67.69 following the release of Mineral Resources' latest financial results.

The half-year reporting period, which ended on December 31, 2023, saw the company's lithium operations perform well, benefiting from higher lithium prices and increased production volumes.

Shares marked a Q1 high of AU$70.98 at the end of March, when Mineral Resources announced plans to develop a lithium-processing hub in Western Australia's Goldfields region. It aims to capitalise on lithium-ion battery demand.

Plans for the hub include the construction of a lithium hydroxide and carbonate plant, as well as associated infrastructure to support the production of battery-grade lithium chemicals.

FAQs for investing in lithium

What is lithium?

Lithium is the lightest metal on the periodic table, and it is used in a wide variety of applications, including lithium-ion batteries, pharmaceuticals and industrial applications like glass and steel.

How do lithium-ion batteries work?

Rechargeable lithium-ion batteries work by using the flow of lithium ions in the battery's cell to power a device.

A lithium-ion battery has one or more cells, depending on the amount of energy storage it is capable of, and each cell has a positive electrode and negative electrode with an electrolyte separating them. When the battery is in use, lithium ions flow from the negative electrode to the positive electrode, running out of power once all have transferred. When the battery is charging, ions flow the opposite way.

Where is lithium mined?

Lithium is mined from two types of deposits, hard rock and evaporated brines. Most of the world's lithium production comes out of Australia, which hosts the Greenbushes hard-rock lithium mine. The next-largest producing country is Chile, which like Argentina and Bolivia is located in South America's Lithium Triangle. Lithium in this famed area comes from evaporated brines, including the Salar de Atacama. Lithium can also be found in sedimentary deposits, but currently none are producing.

Where is lithium found in Australia?

Australia is the world’s top producer of lithium, and the country’s lithium mines are all located in Western Australia except for one, which is Core Lithium’s (ASX:CXO,OTC Pink:CXOXF) Finniss mine in the Northern Territory. Western Australia accounts for around half of global lithium production, and the state is looking to become a hub for critical elements.

Who owns lithium mines in Australia?

Several companies own lithium mines in Australia, including some of the biggest ASX lithium stocks. In addition to the entities discussed above, others include: Pilbara Minerals (ASX:PLS,OTC Pink:PILBF) with its Pilgangoora operations; Arcadium Lithium with the Mount Cattlin mine; Jiangxi Ganfeng Lithium (HKEX:0358), which owns the Mount Marion mine alongside Mineral Resources (ASX:MIN,OTC Pink:MALRF); and Tianqi Lithium (SZSE:002466), which is a partial owner of Greenbushes via its stake in operator Talison Lithium.

Who is Australia’s largest lithium producer?

Australia’s largest lithium producer is Albemarle, which has interests in both the Greenbushes and Wodgina hard-rock lithium mines. Greenbushes is the world’s largest lithium mine, and Albemarle holds 49 percent ownership of operator Talison Lithium’s parent company. Albermarle also has 60 percent ownership of Mineral Resources’ Wodgina mine, and owns the Kemerton lithium production facility as part of a 60/40 joint venture with Mineral Resources.

Don’t forget to follow us @INN_Australia for real-time updates!

Securities Disclosure: I, Georgia Williams, currently hold no direct investment interest in any company mentioned in this article.

Galan Lithium Limited (ASX: GLN) – Trading Halt

Description

The securities of Galan Lithium Limited (‘GLN’) will be placed in trading halt at the request of GLN, pending it releasing an announcement. Unless ASX decides otherwise, the securities will remain in trading halt until the earlier of the commencement of normal trading on Wednesday, 17 April 2024 or when the announcement is released to the market.

ASX Compliance

Click here for the full ASX Release

This article includes content from Galan Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

RecycLiCo Grants Stock Options

RecycLiCo Battery Materials Inc. (“RecycLiCo” or the “Company”), TSX.V: AMY, OTCQB: AMYZF, FSE: ID4, has granted an aggregate of 3,000,000 stock options to Kurt Lageschulte, director pursuant to the Company's omnibus equity incentive plan. The stock options have an exercise price of $0.16 per share and an expiry date of April 12, 2029.

About RecycLiCo

RecycLiCo Battery Materials Inc. is a battery materials company specializing in sustainable lithium-ion battery recycling and materials production. RecycLiCo has developed advanced technologies that efficiently recover battery-grade materials from lithium-ion batteries, addressing the global demand for environmentally friendly solutions in energy storage. With minimal processing steps and up to 99% extraction of lithium, cobalt, nickel, and manganese, the patented, closed-loop hydrometallurgical process turns lithium-ion battery waste into battery-grade cathode precursor, lithium hydroxide, and lithium carbonate for direct integration into the re-manufacturing of new lithium-ion batteries.

For more information, please contact:

Teresa Piorun

Senior Corporate Secretary

Telephone: 778-574-4444

Email: InvestorServices@RecycLiCo.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. This news release may contain "forward-looking statements", which are statements about the future based on current expectations or beliefs. For this purpose, statements of historical fact may be deemed to be forward-looking statements. Forward–looking statements by their nature involve risks and uncertainties, and there can be no assurance that such statements will prove to be accurate or true. Investors should not place undue reliance on forward-looking statements. The Company does not undertake any obligation to update forward-looking statements except as required by law.

AM Resources Identifies 26 New Pegmatites for a Total of 187 Pegmatites on its 1,500 km² Land Package in Austria

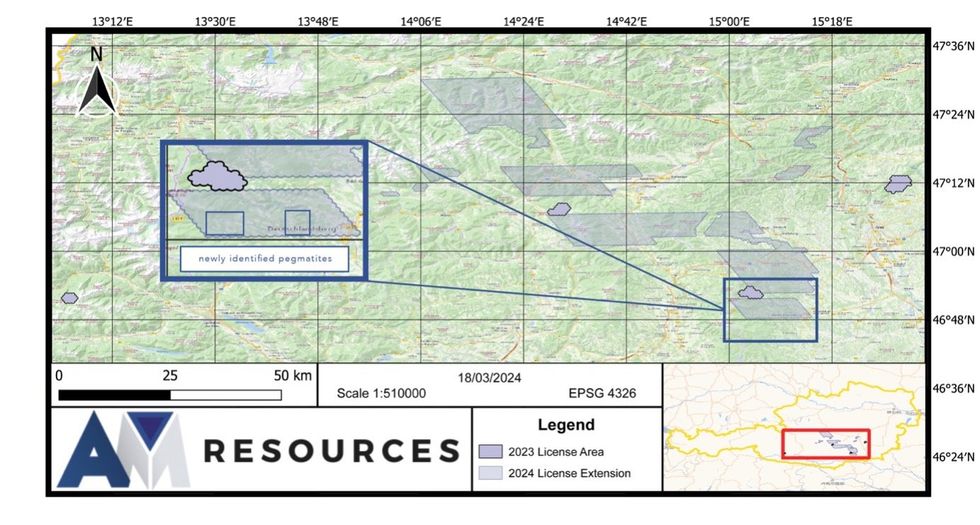

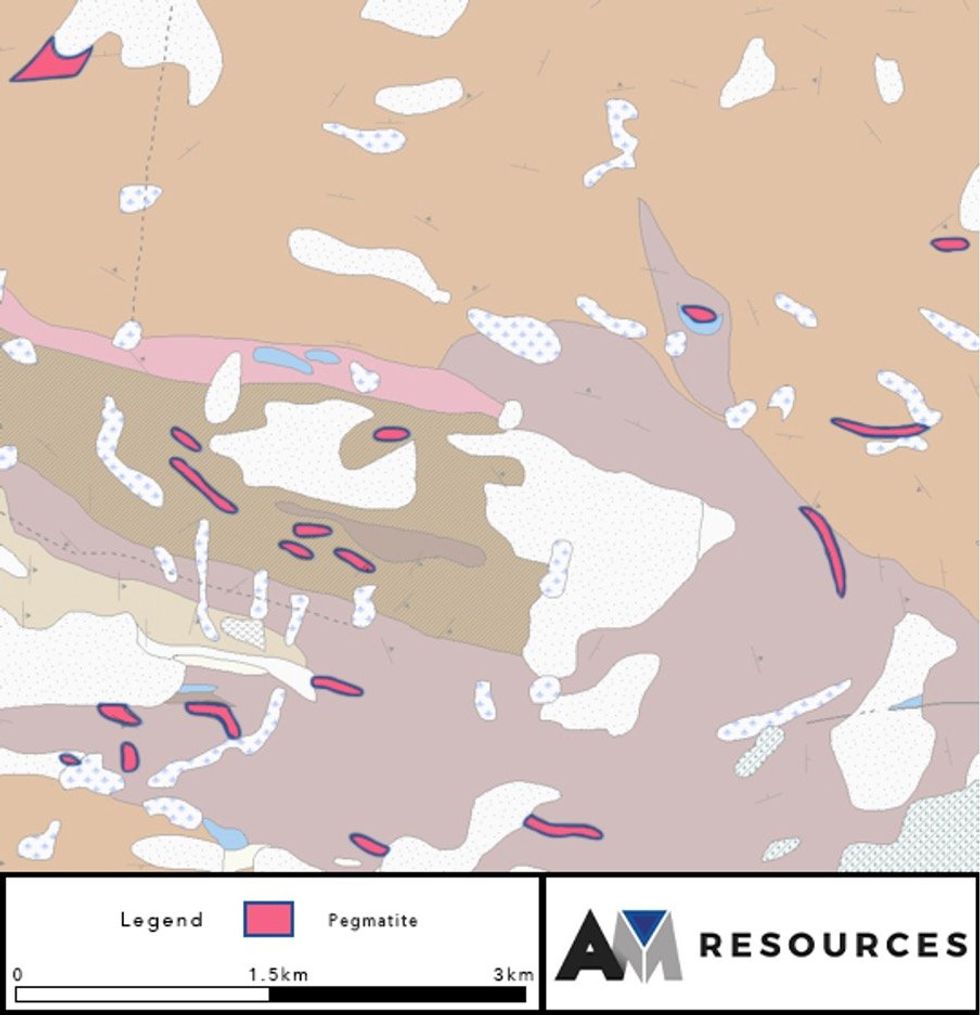

AM Resources Corporation (“AM Resources” or the “Company”) (TSXV: AMR) (Frankfurt: 76A), a dynamic junior mining company focused on the exploration and development of high-potential pegmatite lithium deposits, is pleased to announce the discovery of 26 new pegmatites as a result of its ongoing compilation of government databases since it acquired its 1,500 km2 land package (see press release dated March 21, 2024). AM Resources has now identified a total of 187 pegmatites, consolidating its strategic position in one of Austria’s most prospective lithium areas.

- Recently announced 1,500 km2 land package gives AM Resources control over a large area of the Austrian Pegmatite Belt.

- Ongoing compilation of government data resulted in the discovery of 26 additional pegmatites across two groups, with sizes ranging from 102 metres to 887 metres.

- Many pegmatites are strategically located within mica schists, indicating favorable conditions for lithium-bearing minerals.

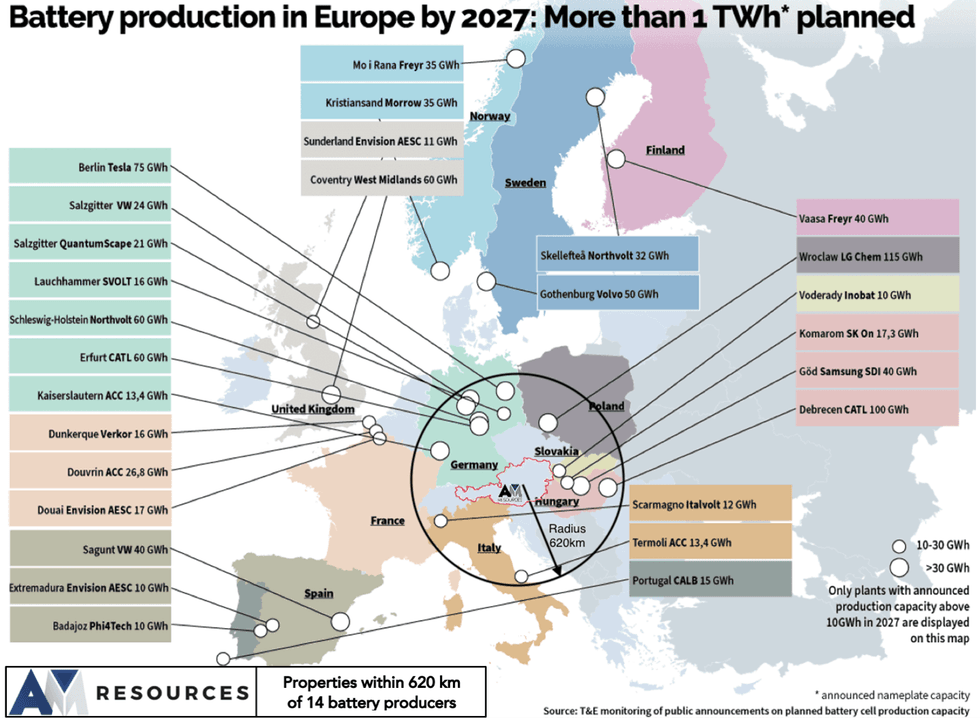

- Latest discoveries continue to reinforce AM Resources' position in the Austrian Pegmatite Belt, located within proximity to European battery manufacturers.

AM Resources’ 1,500 km2 land package

First Group

The Company has identified 8 large pegmatites with lengths varying between 329 metres and 887 metres, with the most extensive pegmatite measuring an impressive 281 metres in width.

Second Group

An additional 18 pegmatites ranging from 102 metres to 560 metres in length were discovered, with the thickest pegmatite reaching 195 metres in width. This group's diversity in size and shape adds to the prospectivity of AM Resources’ holdings. Many of these pegmatites are located within mica schists, a geological setting favorable for the presence of lithium-bearing minerals.

David Grondin, CEO of AM Resources commented: “Since the acquisition, we've been compiling the data available to us in preparation for our upcoming exploration program scheduled for June. We are very pleased with the number and size of the pegmatites found so far. Once we finish compiling the data, we'll have a better picture of the work that needs to be done to fully evaluate the lithium potential of our properties.”

Location, Location, Location

Qualified Person

Technical information related in this news release has been reviewed and verified by Jean Lafleur, P. Geo., of PJLEXPL Inc., a registered geologist with the Ordre des Géologues du Québec (OGQ #833) and is a qualified person (QP) as defined by NI 43-101. Mr. Lafleur is independent from the Company and has reviewed and approved the disclosure of the AM Resources geological information.

About AM Resources

AM Resources Corporation (TSXV: AMR) is a dynamic junior mining company focused on the exploration and development of high-potential pegmatite deposits. With a strategic portfolio of assets and a commitment to responsible resource development, the Company is dedicated to creating long-term value for its stakeholders while adhering to the highest standards of corporate governance and sustainability.

Forward-Looking Statements

This news release contains forward-looking statements. Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of AM Resources to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects”, “estimates”, “intends”, “anticipates” or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Since forward-looking statements and information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. Readers are cautioned that the foregoing list of factors is not exhaustive. The forward-looking statements contained in this news release are made as of the date of this release and, accordingly, are subject to change after such date. AM Resources does not assume any obligation to update or revise any forward-looking statements, whether written or oral, that may be made from time to time by us or on our behalf, except as required by applicable law.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information:

David Grondin

AM Resources Corporation

President and Chief Executive Officer

1-514-583-3490

Notification of Expiry of Options (EUROA) and Announcement of Options Offer

As announced on 25 March 2024, European Lithium Limited (ASX: EUR, FRA:PF8, OTC: EULIF) (European Lithium or the Company) has listed options on issue exercisable at $0.075 each that are due to expire on Friday, 19 April 2024 (EUROA Options). Optionholders may exercise their options by way of payment, which must be received no later than 5:00pm (WST) on Friday 19 April 2024 (Expiry Date). All EUROA Options that are not exercised by the Expiry Date will expire with no value and no further entitlement will exist.

Official quotation of the EUROA Options on the ASX will cease at the close of trading on 15 April 2024.

For more information, please refer to the announcement dated 25 March 2024 available on the Company’s ASX Platform.

Options

Offer The Company is pleased to announce that it intends to conduct an offer to all registered holders of EUROA Options on 12 April 2024 (Record Date) with a registered address in Australia and New Zealand (Registered Holders) whereby Registered Holders can apply for one (1) option (New Option) for every one (1) EUROA Option held on the Record Date at an issue price of $0.005 with an exercise price of $0.08 per option, expiring on 14 November 2025 (Options Offer). The Company intends to apply for quotation of the New Options. The New Options will be issued pursuant to the Company’s available Listing Rule 7.1 placement capacity.

The Directors of the Company intend to apply for their full allocation under the Options Offer (a total of 21,750,000 New Options) as follows:

(a) Tony Sage – 10,000,000 New Options;

(b) Malcolm Day – 10,000,000 New Options; and

(c) Michael Carter – 1,750,000 New Options,

(together, the Participation) subject to shareholder approval sought at the Company’s upcoming general meeting which is expected to be held in June 2024 (General Meeting).

To the extent that the Options Offer is not fully subscribed by Registered Holders, the Directors of the Company have each agreed to underwrite the Options Offer in equal proportions (up to an amount of 41,680,491 New Options each). Any issue of New Options pursuant to the Directors’ underwriting will be in addition to the Participation and also subject to shareholder approval to be sought at the General Meeting.

Click here for the full ASX Release

This article includes content from European Lithium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Latest News

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.